Yes, the past decade of 2000s didn't treat investors well. If you invested in the DJIA, you lost 9% for the decade. A S&P 500 investor lost 24%. And a NASDAQ investor lost 44%, thanks to the fact that we started the decade at the height of the dot com bubble.

Yes, the past decade of 2000s didn't treat investors well. If you invested in the DJIA, you lost 9% for the decade. A S&P 500 investor lost 24%. And a NASDAQ investor lost 44%, thanks to the fact that we started the decade at the height of the dot com bubble.

All the above figures are absolute, un-annualized returns. That is, your original 10,000 dollar investment will end up at approximately $9,100, $7,600, and $5,600 respectively.

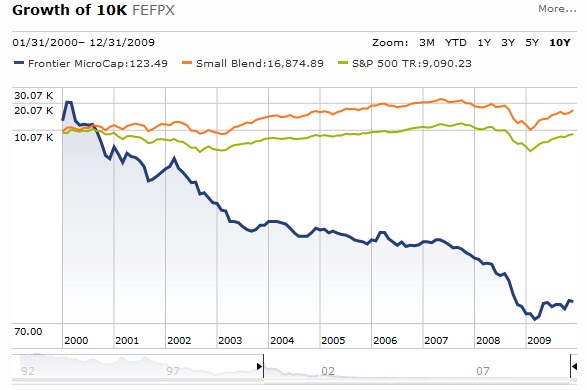

But how about losing at an annualized rate of 37% a year for 10 years?

That's what Frontier MicroCap (FEFPX) has managed to treat its investors. If your crystal ball had guided you to the fund back in 2000, every $10,000 of your original investment have become, well, 98 cents.

The fund, which almost doubled its investor money in the first few months of the decade just before the dot com crash, fell all the way down since then.

With a remaining total asset of only $53,559 (yes, in dollars, not in thousands), the fund chose to close shop. The NAV of the fund is $0.04 per share for its 1.5M shares before it ceased trading.

How did it happen? A look at its last annual report will shed some light on the downward trajectory of this fund that managed to lose almost every single dollar of fund investor's money:

1) The fund invested in a bunch of penny shares. Of course this is a "MicroCap" fund so that's what it is supposed to do. But any micro-cap investor should know this segment of the market is probably the most risky.

2) The fund applies some leverage. As of September 30, 2009, the fund has a leverage of about 1.5x.

3) And when its asset base dwindled, the multitude of expenses that are needed to keep a fund running became intolerable. In the last 12 months, the fund has an astonishing annualized expense ratio of 72%. Advisory fees, transfer agent fees, audit fees, legal fees, custodian fees, trustee fees, registration, printing and mailing, insurance and other miscellaneous fees added up to a total of $41,049 even though the fund advisors waived advisory fee of $844 as an insignificant gesture.

After studying the annual report, I think the fund probably already passed the point of no return five years ago when the expense ratio was 15% in 2005, and the ratio grew up every year since that. It is therefore the greed of the many involved parties that kept it running until the last moment.

The lesson: it is probably very difficult to identify a fund that will win you big in the next decade, but it is not that difficult to identify one that will cost you big. Key traits of a loser: niche and risky segment, small asset base, leverage, and greedy management.