The pending roll-over of my 401(k) plan assets to traditional IRA truly allows me to examine my mutual fund strategy holistically. As I mentioned in my earlier posts, my primary objective in mutual fund investing is to build my foreign equity positions, and some domestic equity positions that complement my large-cap stock picks.

The selection of mutual funds in my portfolio should be drastically different from that of individual stocks. For me, every stock pick is no more than an excursion even though on average I hold onto a position for a few years. But mutual funds are closer to marriage. In fact, I expect to hold on to every mutual fund position for at least a decade without selling. Therefore, the importance of careful selection is paramount. (What about some occasional rebalancing? With the monthly cash infusion in five figures, rebalance will be done by just buying more of the under-represented asset class, instead of conversion between asset classes.)

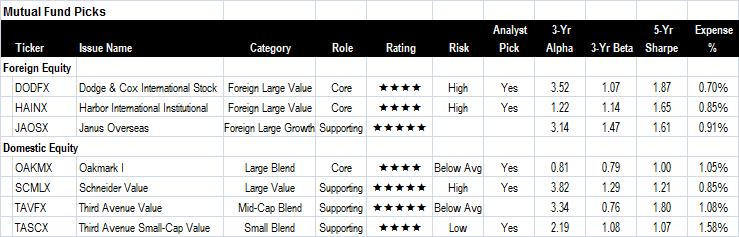

In the lookout for top-rate mutual funds, I started at each personal finance magazine's annual mutual fund recommendation issue, then researched each fund more at Morningstar. (I did put my Premium subscription at Morningstar to good use.) Here are the fund I came up with:

Here is what Morningstar says of each fund:

Dodge & Cox International Stock (DODFX)

This fund's performance has been excellent. Over the trailing five-year period through Dec. 15, 2006, it has posted a 21.1% annualized return that beats roughly 85% of its foreign large-value rivals. The fund has had another strong year in 2006; it is well into the category's top half and ahead of the MSCI EAFE Index, with a 26.2% gain so far.

Past performance itself isn't enough, but this one has much more going for it. It's only five years old, but it relies on the same strategy and many of the same members of a skilled and experienced group of investment professionals as other Dodge & Cox funds with much longer records of success. This fund's patience is also an attraction: With a turnover rate of only 6% in 2004 and 7% in 2005, it really does invest for the long term, and its affordability is another reason to favor this offering.

Harbor International Instl (HAINX)

This fund has numerous characteristics that make it a standout among foreign options: a skillful, hugely experienced stock-picker at the helm, supported by a strong team (in fact, we're increasingly confident they can pick up the mantle if and when septuagenarian lead manager Hakan Castegren decides to retire); a consistent strategy sporting low turnover; and moderate expenses. The result has been an outstanding track record: The fund's trailing 10-year average annual return of 12.4% through Nov. 30, 2006, ranks within the top 10% of the foreign large-value category.

Janus Overseas (JAOSX)

There is no one way to view risk. When considering common measures such as standard deviation of returns or the amount of the portfolio dedicated to emerging markets, for example, this fund looks quite risky. It has kept 40% or so of its portfolio in emerging-markets stocks ever since manager Brent Lynn became lead manager in 2003.

However, we think it's more important to consider how the fund's strategy is suited to capital preservation and does not lose money for shareholders. After all, losing money is far more painful than a poor relative return--if the fund is gaining value. This fund will certainly lose money at times, but we think Lynn's approach is well suited to grow capital over long time periods. That's because Lynn has proven an ability to latch on early to quickly growing companies. In addition, he keeps a long-term focus, pays attention to valuation, and diversifies the fund's sector and industry exposure.

Oakmark I (OAKMX)

This fund joined the large-blend category at the beginning of December 2006. It isn't unusual for funds run by truly bottom-up managers like this fund's bosses to move around our style box.

And those who have been watching the fund's buying habits shouldn't be surprised by these moves. Its comanagers have spied value in beaten-down growth areas, including media, pharmaceutical, and select technology stocks. Despite the fact that many stocks in these areas have shown steady earnings growth throughout the past half decade, they have been shunned by investors. The fund has suffered for holding some of these stocks, but as we've mentioned in the past, we think that this emphasis on higher-quality stocks will ultimately be rewarded

Overall, we think this fund has what it takes to succeed. Its willingness to stand out on a limb gives it quite a bit of appeal. Furthermore, experienced managers, reasonable fees, and good stewardship are all marks in its favor.

Schneider Value (SCMLX)

Manager Arnie Schneider's ability to recognize when specific companies or entire industries are operating well below normal earnings levels is unmatched. However, the current market environment makes his job much more difficult; earnings for many firms and most industries are nearing historical highs, not lows. So the universe of battered underperformers has shrunk.

Schneider's approach has been hugely successful, but the fund does harbor risks investors need to be comfortable with. Its deep value style will not always strike the market's fancy and may cause it to lag when high-quality companies or growth stocks lead the way over battered ones. But we don't see that as a risk for patient long-term investors. This is a stellar choice.

Third Avenue Value (TAVFX)

Whitman's ability to identify and invest in the distressed debt of companies on the cheap is a key part of the fund's strategy. Although individually not big pieces of the portfolio, such investments can have a big impact.

Despite such hits and misses, volatility at the fund has traditionally been modest relative to its peers. The fund's enormous stake in financial stocks, especially holdings with real estate exposure comprising about 25% of fund assets, would also appear to court risk. But Whitman's tried-and-true bottom-up security selection, which emphasizes "safe and cheap," and a long investment horizon have overcome most obstacles.

Although this go-anywhere value maven may not appeal to style purists, Whitman has proven himself to be an exceptional manager capable of delivering outsized returns.

Third Avenue Small-Cap Value (TASCX)

Despite the recent setback, this remains one of our favorite small-cap funds. Jensen is part of the topnotch deep-value team at Third Avenue that has a knack for rooting out bargains.

This small-blend Analyst Pick has proven its mettle. We think it will be better able to handle all that cash now that it's closed, and continue to serve shareholders well over the long haul.

So here is my little romance so far with some of these funds: I bought into Dodge & Cox International Stock (DODFX) in November 2005 (after I got tons of cash from selling my house), and again in December 2005, January 2006 and May 2006. So far the annualized return is over 25%. Of course 2006 is a good year for foreign equity funds in general, but I'm still happy about the over $26,000 return it contributed to our net worth so far. With over $120,000 invested in DODFX, it is the single largest holding in my portfolio at this moment.

I first tested water on Third Avenue Value (TAVFX) in August 2005, and added more in November 2005, January 2006, March 2006 and May 2006. The annualized return of 16.5% so far isn't bad. I have $43,000 invested in this fund, making it my second largest holding.

For Third Avenue Small-Cap Value (TASCX), I only made one purchase in January 2006 to diversify into the small-caps. The fund's performance is mediocre so far (with annualized return of 12.3% but lagging its peers). I still have full confidence on the renowned value investing shop of Third Avenue, though.

For all these three funds, I have never sold a dime so far. But will I increase my positions? Probably not until I can crunch the numbers and see how I can leverage the other star funds in my portfolio.

Next: Tax considerations for the portfolio.