SUMMARY

SUMMARY

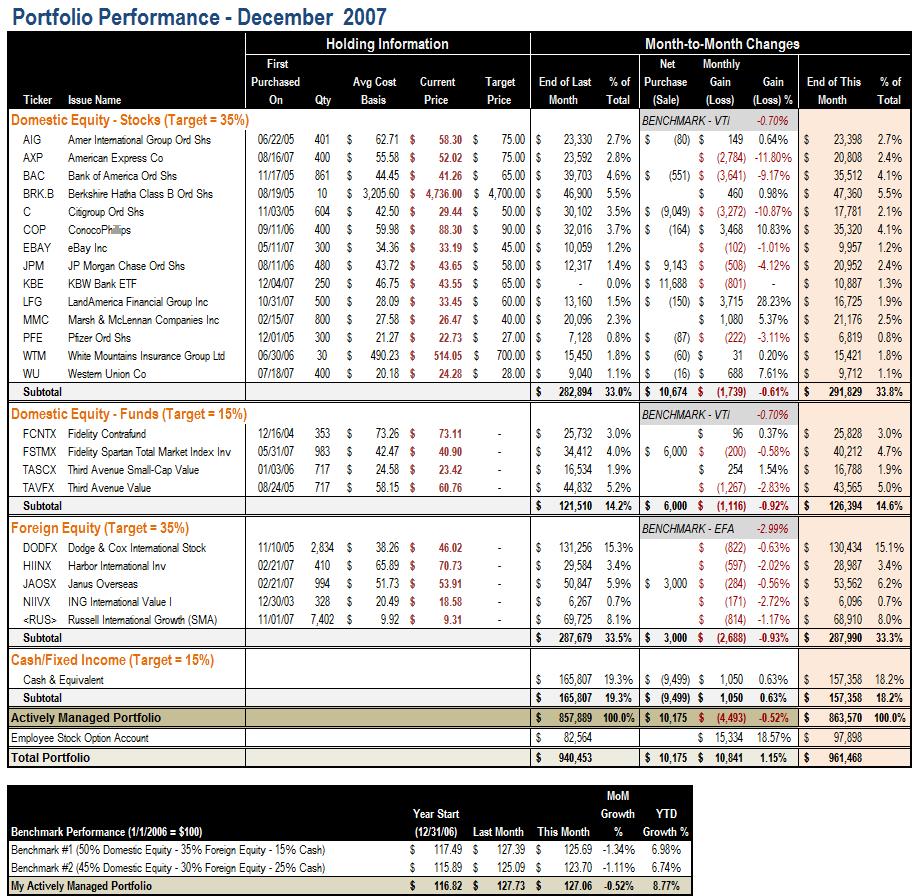

After another choppy ride in December, the domestic market retreated 0.7% and the foreign market MSCI EAFE index lost almost 3%. My benchmark index, which is composed of 50% domestic equity, 35% foreign equity and 15% cash, suffered 1.34%.

Speaking of my portfolio, although I took some (more) beatings in my large bank and credit card company holdings, my other financial stocks and energy holding came to the rescue. Also, my hand-picked foreign equity funds are performing extremely well compared to the index. All together, my portfolio only took a small haircut of 0.52% in December, which is much better than the 1.34% loss of the index.

Although extremely volatile in the latter half, 2007 is still a good year for investors committed to the market. For the year of 2007, my portfolio recorded a gain of 8.77%, besting my benchmark's 6.98% gain by a good margin.

TRANSACTIONS

The year-end distribution of all mutual funds make bookkeeping a nasty job in December. Other than that, I made a few adjustments to the portfolio:

1) To book some tax loss before the end of the year, I swapped some losing Citigroup (C) shares to JP Morgan (JPM).

2) Believing the market is still undervalued in the ongoing bearish mood, I continued to add some more exposure to the market, including more to FSTMX (domestic equity), JAOSX (foreign equity) and KBE (financial stock sector ETF).

Other than that, I'm gradually moving some cash balance to China to play the Dollar/Yuan carry trade, and hence you can see a higher-than-normal return on my cash account -- that includes some currency gains.

NEXT STEPS

1) I intend to complete a more thorough analysis of my 2007 performance by asset class (domestic equity vs foreign equity) and by vehicle (mutual fund vs individual stocks).

2) I will then take the learning and start thinking about my 2008 asset allocation and investment strategy.