SUMMARY

SUMMARY

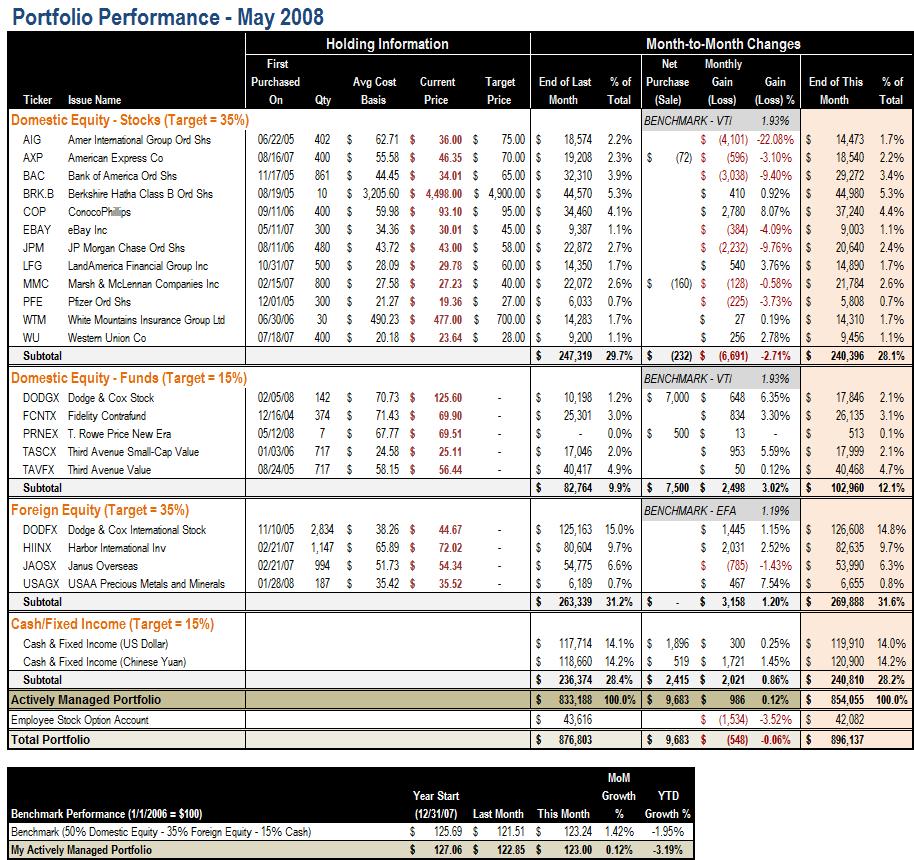

May is a pretty stable month for my portfolio in terms of absolute gains -- my stable of mutual funds, stocks and cash inched higher 0.12%. But on a relatively basis, my portfolio lagged the benchmark by 1.3% in this month. Certainly not a good month for relative performance!

TRANSACTIONS

I made a further $7,000 commitment to Dodge & Cox's domestic stock offering (DODGX). Also, I started a new (yet admittedly tiny $500) position at T. Rowe Price New Era (PRNEX), as an effort to beef up my energy exposure. I have enrolled in

NEXT STEPS

My individual stock positions have been lagged the market for a few months in a row now -- the huge concentration on financial stocks has been proven untimely, but at this price level, it can be argued that opportunities and risks are relatively balanced. Anyway, I'm intentionally controlling the relative share of my individual stock exposure now -- individual stock positions now represents only 28% of my portfolio, vs. 34% at the end of 2007.

With another series of reports on worsening housing market, it doesn't look like I need to eagerly commit more money to the market now. I do plan to sit in the side line of the equity market, and move more money to China for some currency bets.