One of the commentators to my last monthly portfolio update rightfully pointed out that I'm not using the right benchmark to measure my portfolio performance. Given that I'm positioning my portfolio for a sizable exposure to international equity, it is unfair to use S&P 500 as the benchmark. To fix this, I'm going to construct a meaningful benchmark for my portfolio.

As I explained in my "Reengineering My Portfolio Management" series, excluding my employee stock option account, I'm planning my portfolio for the following allocation:

• 50% Domestic Equity

• 35% International Equity

• 15% Cash & Equivalent

To map to this allocation, my benchmark portfolio will include the following components:

• 50% in Vanguard Total Markets ETF (VTI)

• 35% in iShares MSCI EAFE Index (EFA)

• 15% in Cash

To calculate the benchmark, I'm using the monthly close price of both ETFs plus any dividend payout to map out the growth in both equity positions. I'm also assigning a 5% APY for the cash position in the benchmark portfolio.

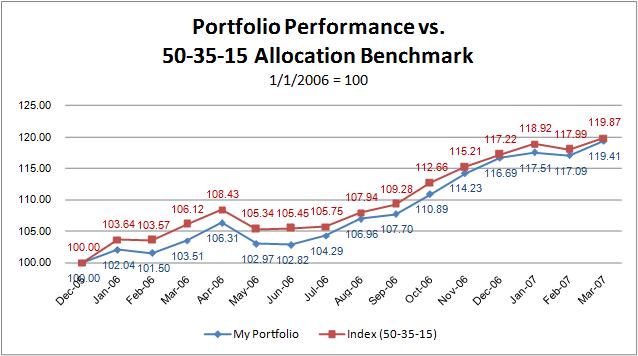

To compare the return of my benchmark portfolio vs my own semi-actively-managed portfolio, I calculate an index with the baseline of 100 on January 1, 2006.

Here is how my portfolio performed against the benchmark:

There are several take-aways. First, my portfolio tracked closely to the benchmark after 15 months. In fact, my portfolio lost to the index in the first half of 2006 by almost 3 percentage points, but recovered almost everything in the following 9 months.

More importantly, throughout this 15-month period, on average a quarter of my portfolio was in cash. (Did I mention too much cash is my headache?) Therefore, case can be made that my portfolio generated (almost) the same return with lower volatility.

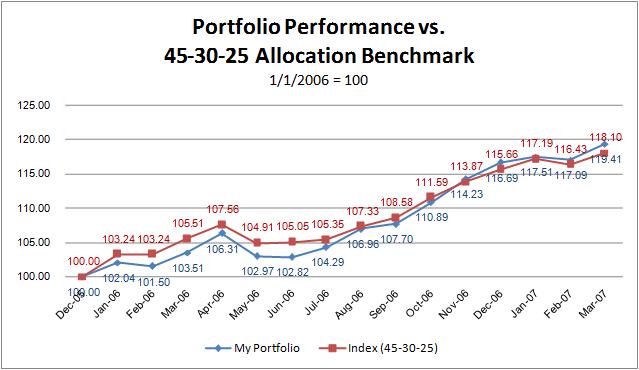

If I compare my portfolio's return to a similarly allocated model portfolio (45% in domestic equity, 30% in international equity and 25% in cash), my portfolio actually returned more than 1.3% during the period.

Anyway, 15 months is too short a timespan to draw a conclusion on the performance. The purpose of this exercise is to construct a benchmark index to compare my portfolio's performance against. You can count on me to report my score vs the benchmark in future monthly portfolio updates.