SUMMARY

SUMMARY

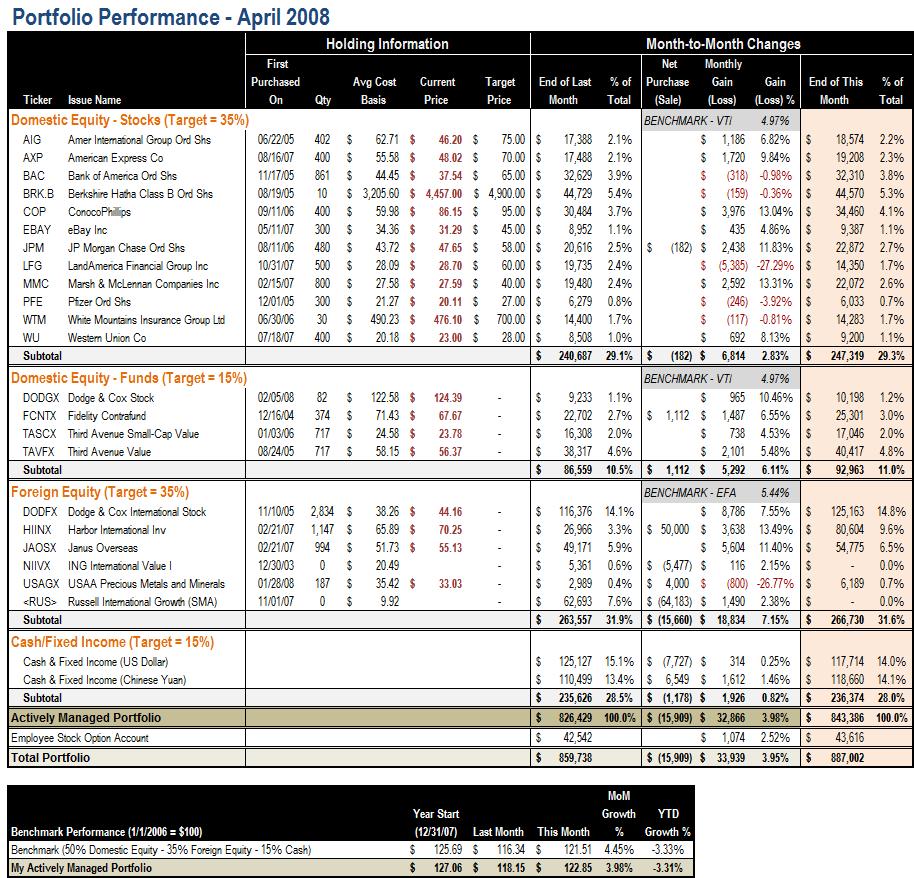

The market finally recovered some ground after five back-to-back monthly losses, and my portfolio benefitted from the market's sudden enthusiasm too with a nice gain of 3.98%, the largest monthly gain in a while. Since my portfolio is decidedly under-exposed compared to my benchmark, my monthly gain is dwarfed by the benchmark's 4.45% expansion. On a year-to-date basis, both my portfolio and the benchmark lost about 3.30%.

TRANSACTIONS

I made some shuffling in my mutual fund positions to embrace the newly available option of BrokerageLink -- a 401(k) plan feature that allows participants to expand investment options to almost all stocks and mutual funds. As such, I dropped Russell International Growth and ING International Value (NIIVX), bought more of Harbor International (HIINX) and USAA Precious Metals and Minerals (USAGX).

In addition, I moved more U.S. dollars to Chinese Yuan on my "carry trade" experiment. By the end of the month, I have about one seventh of my portfolio in Chinese Yuan, yielding handsomely from gradual, predictable appreciation of the currency. (Starting from this month, I'm breaking our my Chinese Yuan positions from the "Cash/Fixed Income" category.)

Also, I had to pull some money out of my portfolio to repay some 0% APR credit card debt that is coming due. This, of course, reduced the leverage of my portfolio.

NEXT STEPS

I'm still somewhat pessimistic of the market: while we are enjoying a relatively long window of non-event (or, in other words, market expectation is so low that it is taking any not-too-bad news as good news), but there will be more mortgage interest rating coming up in the next two years, and the housing market is still sinking.

So in general, I'm looking to fly to safety. It doesn't mean I won't add more to stocks or mutual funds, but I'm not feeling too bad of my 28% cash position now (which dragged the portfolio performance in a month like April). I also plan to move more money to the other side of the Pacific for some assured gain in this turbulent market.