SUMMARY

SUMMARY

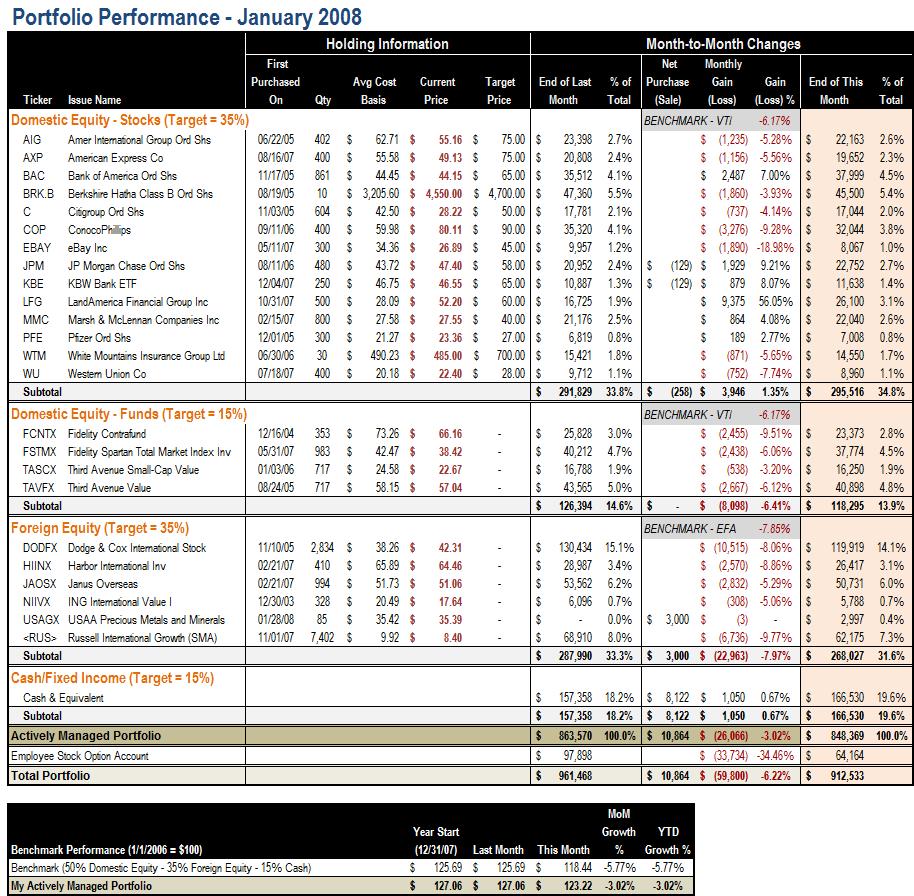

With the S&P 500 dropped more than 6% and the international market performed no better, January sees perhaps the most brutal start of the year in recent memory.

For three months in a row now, my portfolio lost money. This time, for a total of 60 grand in one month, including more than $26,000 in one month in self managed portfolio, and about $34,000 in my employee stock option account.

There is little to celebrate, except that my self-managed portfolio is actually performing better than the general market. My finance-stock-stuffed individual stock portfolio was helped by the aggressive rate slashing of the Fed, and one of my stock pick returned over 50% in this past month. All in all, my portfolio lost 3.02% in the month when my benchmark lost 5.77%.

TRANSACTIONS

I only made one purchase during January on USAGX (USAA Precious Metals and Minerals), in a babystep bid to diversify my portfolio toward commodities.

NEXT STEPS

My day job duty is growing more challenging, with a much larger business to cover and frequent cross-Pacific travels. Still, much needs to be done to reengineer my portfolio to be more diversified than the current two trick pony of domestic equity and international equity.