SUMMARY

SUMMARY

The stock market took a nosedive in November after three months of gains. At one point, the market was officially declared "in correction," defined as more than 10% off recent highs.

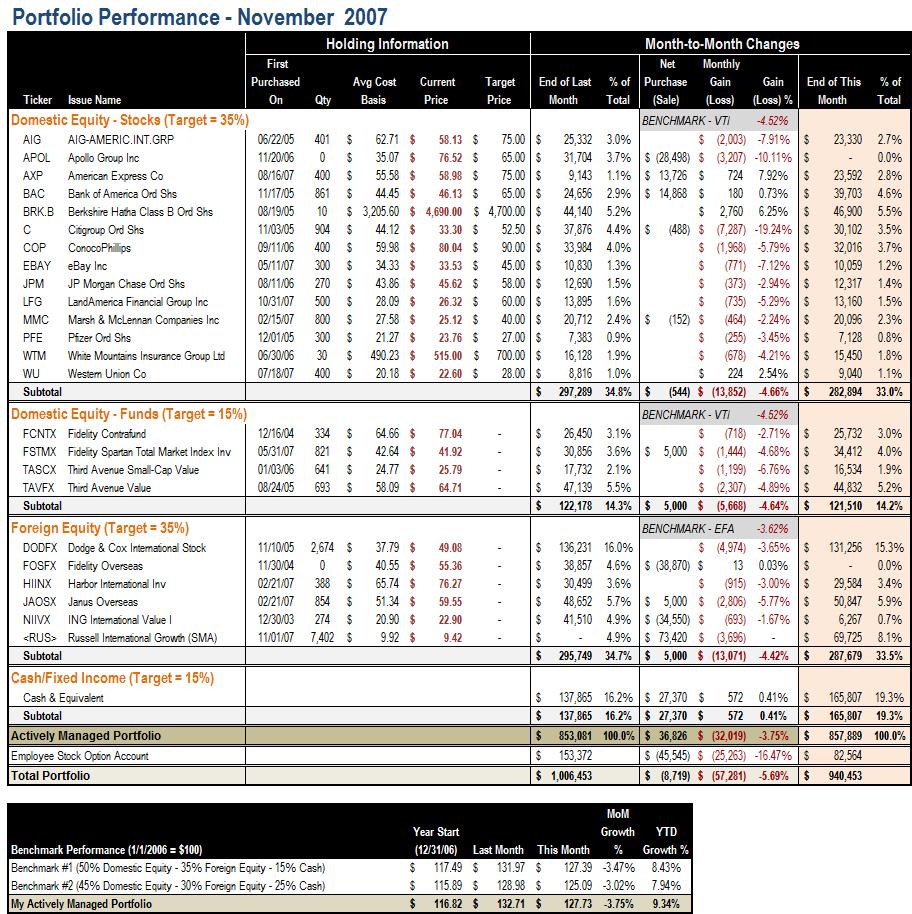

Obviously my finance-stock-stuffed portfolio is not spared from the chaos. It ended the month with a 3.75% loss, even slightly worse than the benchmark loss of 3.47% in the same month. On a year-to-date basis, my portfolio is still up 9.4%, compared to 8.4% gain of the benchmark.

TRANSACTIONS

I'm quite busy in managing my positions in November. Key transactions include:

1) Exercised 1/3 of my vested employee stock option positions (MSFT) at $36.60. Before this month's transaction, I haven't exercised stock option for over 7 years now. The action is prompted first by valuation concerns -- MSFT was bid up to a level that is above my calculation of intrinsic value after a blow-out Q1 release, and second by diversification purposes -- my employee stock option account was representing 17% of our net worth at the end of October and it was obviously too high.

2) I sold all 400 shares of Apollo Group (APOL), the online education titan that is behind University of Phoenix and alike, at $71.21. I bought these stocks back in November 20, 2006 at $35.05 apiece following Morningstar's recommendations, and although I didn't catch the high, I'm comfortable with the double-bagger performance. Also, since I sold after the 20th, all capital gains will be taxed on a long-term gain basis.

3) I snapped on American Express (AXP) and Bank of America (BAC) before the end of the month. Although there are still uncertainties, my firm belief is financial stocks are screaming value now.

NEXT STEPS

- I might need to make one or two loss-taking tax-driven sales. Likely I will sell some Citigroup (C) shares at a loss and (temporarily) replace them with a similar issue.

- With the cash infusion after my stock option exercise, my cash position is higher than I would like to be. I'm looking for opportunities to reduce my cash position to 15% or below in coming months.

PORTFOLIO PERFORMANCE