SUMMARY

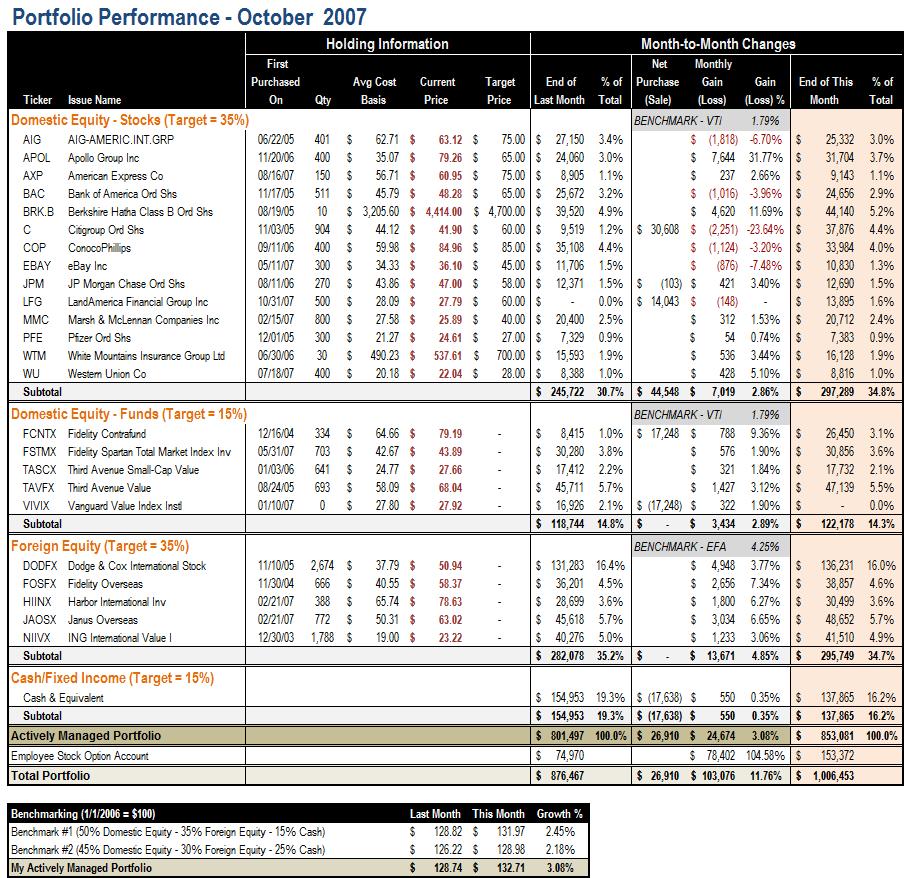

October is another winning month for my portfolio. My portfolio appreciated another 3.08%, which handsomely beat my benchmark by over 60 basis points. The result is attributable to a couple of winning stock positions (APOL and BRK.B especially) and better mutual fund performance vs benchmark, slightly offset by the loss in my financial stock plays.

So far this year, our portfolio returned 13.7%, compared to 12.3% return from our 50-35-15 benchmark and 11.3% return from the 45-30-25 benchmark.

Outside of the self-managed portion of my portfolio, it is worth mentioning that the value of my employee stock option account more than doubled in October, thanks to terrific quarterly results and upbeat guidance. Including the stock option account, my portfolio is worth over a million dollars for the first time!

TRANSACTIONS

While financial stocks are widely deemed as 2nd class citizens in today's market, I am still optimistic about their long term outlook, and bought another $30,000 worth of Citigroup's (C)shares -- this makes Citigroup my second largest individual positions only after Berkshire Hathaway. After all, can we really imagine a time without Citigroup, BofA and JP Morgan?

Now I'm not oblivious to the risk, but still, the three big banks only represent less than 9% of my total portfolio, and the worst-case 20% hair-cut from here will not be really material to my portfolio's overall performance. I will be happy to be opportunistic to add my exposure on big banks by another 2 or 3 percentage points.

I also bought a new stock LandAmerica Financial Group Inc. (LFG) on the last day of the month. LFG is a title insurer and has been hit really hard on concerns over its profitability prospect in the aftermath of housing bubble. I, too, do think we will see too much black in the near future, but I do believe in management's capability to resize the cost structure to the revenue, and like the investor friendly approach to massively buy back stocks. More importantly, LFG is trading well below its tangible book value, and paying $30 or below for its shares can be a showcase example of cigarette-butt investing (to be proven, though).

Elsewhere, I exchanged my mutual fund shares in Vanguard Value Index Instl (VIVIX) for Fidelity Contrafund (FCNTX) after tolerating the former's subpar performance for several months. My flight to FCNTX may be performance chasing but the resultant 3.1% representation in my portfolio is not excessive for a top-tier fund.

NEXT STEPS

- On my selling radar: APOL and COP for valuation reasons, and PFE for portfolio-streamlining purposes (I have 14 individual stock positions and they are a bit cumbersome to manage now).

- The Administrators of our 401(k) plan want to be a pioneer again, and they choose to dump Fidelity Overseas (FOSFX), the best performing fund so far this year in our 401(k) menu, for a “separately managed account” (SMA) that is customized for Microsoft employees. The selling point? "This change increases potential returns on your money by reducing the associated mutual fund costs you incur today with Fidelity Overseas." Now I need to review the announced change and respond accordingly.

- In the next few weeks, I will assess my portfolio and decide if I should take some tax loss to alleviate my tax burden -- this will largely be done thru selling a losing position to capture the loss, and buying a similar (but not materially similar) position at the same time.

- It has been a while since I took a systematic look of my portfolio management. As the year-end is approaching, I'm going to reflect on what I learned this year, and decide if I need to make any changes to the way I manage my portfolio lately.

PORTFOLIO PERFORMANCE