The beginning of a year can be a good time to perform a 401(k) check-up. And before that, a timely reading will be this recent feature from USA Today on a study of how American employees invest their retirement fund in 401(k) accounts.

The beginning of a year can be a good time to perform a 401(k) check-up. And before that, a timely reading will be this recent feature from USA Today on a study of how American employees invest their retirement fund in 401(k) accounts.

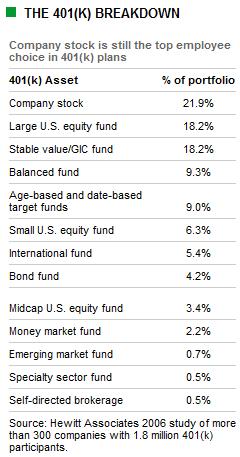

The biggest finding from the survey of 1.8 million 401(k) account holder is: 21.9% of 401(k) balance is invested in company stock. Considering that the Enron debacle that wiped out the lifetime savings of thousands is still in recent memory, it is surprising to see many people are still committing a good portion of their retirement fund to their employers' fate.

Other than that, the breakdown of 401(k) assets in the study does not offer much value on the typical asset allocation of an 401(k) account. One couldn't blame that 401(k) participants are holding over 20% of assets in cash-like funds (money market fund or stable value fund) -- some of them are near or already in retirement age.

Two other things that are worth mentioning:

1) Target funds are becoming mainstream with 9% of assets in such age-based or date-based funds.

2) Self-directed brokerage is still a newbie with only 0.5% of total 401(k)assets. (I'm glad that my employer is about to allow this option in several months.)