My portfolio performed quite well in the month of March. The monthly gain of $13,120, or 1.9% of the portfolio size, is almost a full percentage point above the S&P 500 gains. The gain is helped by my sizable foreign equity exposure, and an opportunistic gain in a particular stock position.

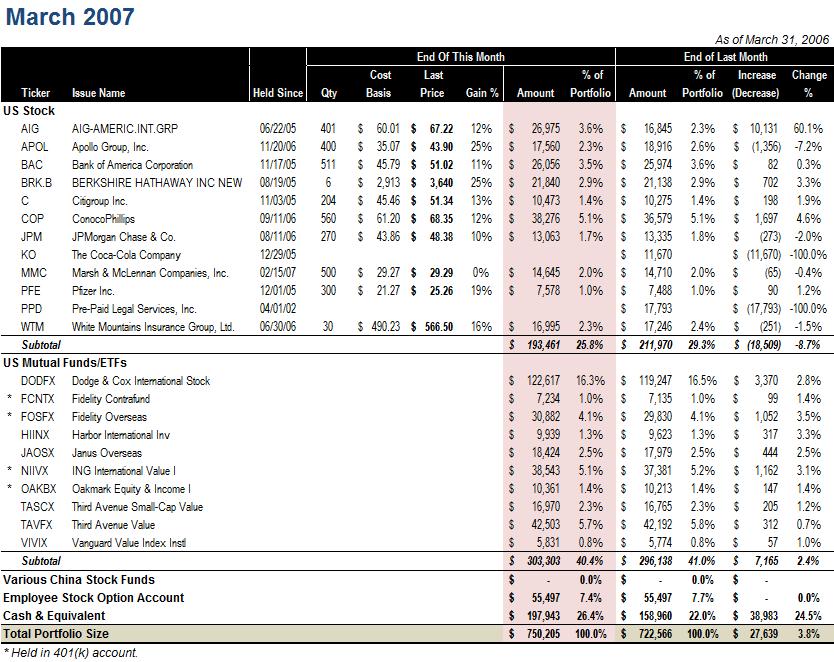

Below is the breakdown of my portfolio at the end of March:

MAJOR TRANSACTIONS

1) I sold all 430 shares of Prepaid Legal Services (PPD) at about $50. I had been very patient holding this stock after my initial purchase at $28 in April 2002. I also added more in August 2002 at $18 and more in August 2006 at $36. Although there is almost no top line growth, this prepaid legal service company is a cash cow and management has been very investor friendly in using buyback and dividend to maximize shareholder returns. The stock is recently helped by an apparent short squeeze that lift the stock by 20% since my last update. I'm selling the stock since it is fully valued at 14x EPS with no top line growth. (Total dollar return: $10,793; Annualized return: 21%)

2) I also sold all shares of The Coca-Cola Company (KO) at $48. Again, there seems to be anemic top line growth and 19x forward looking EPS is too rich a valuation for me. (Total dollar return: $2,175; Annualized Return: 17%)

3) I bought more of American International Group (AIG) at $67, the insurance giant. The company is turning the corner and is quite cheap at 11x forward looking EPS. (Disclosure: I first bought into AIG in June 2005 at $56.)

NEXT STEPS

1) Apparently my problem, again, is too much cash. While my $200,000 cash position is generating a risk-free $10,000 return a year, I will need to be more aggressive if I want to do better.

2) I will start dollar-cost averaging to gradually increase my foreign equity exposure from the current 30% to 35% in the next six months. It will mean a monthly purchase of $10,000.

3) I'm also in the lookout for more stock ideas.