Compared to my portfolio at the end of 2006, I made very limited changes -- I was too busy in work and hadn't started working on my new year resolution to set up a clearer strategy for my portfolio. I did completed three transactions:

- I sold my newly acquired MSFT shares from the Q4 ESPP program involvement. This has been my regular practice since 2002 -- I always sell them soon after they are purchased since I already have enough exposure from my employee stock option holdings.

- I converted all my 401(k) balance in money market funds to Vanguard Value Index Institution (for whatever reasons I exchanged some of my international equity funds for 5% guaranteed return on money market funds in October 2006).

- I downsized my holdings on China stock funds from about $6,000 at December end to about $2,500, and added some exposure to local fixed income funds.

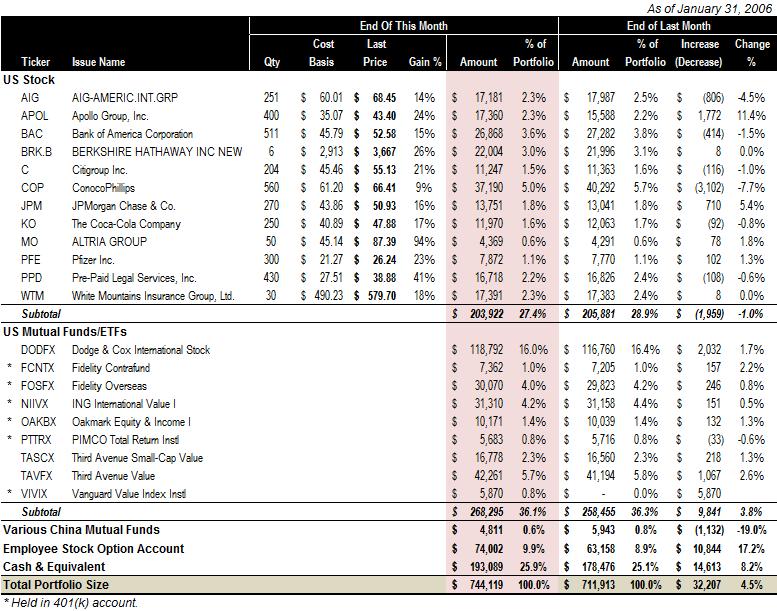

PORTFOLIO AT MONTH END

QUICK TAKES

- The size of my portfolio is growing rapidly every month, and I have to find some time to thoroughly review my options and clean up the portfolio.

- Apparently because of my lack of attention to regular portfolio review, I have excessive amount of cash. I probably will consider to take more exposure in international stocks. (Although the $190,000 cash balance is yielding over $800 in interest risk free every month when I park them in high yield money market funds, so it is not too bad.)

- Will I act on the high MSFT stock price and sell (some of) my vested stock options?