I'm back to PFBlog! I know it has been a long hiatus since the last time I posted, but the last couple of months hasn't been easy. I was asked to take over a billion dollar P&L that had been poorly run and turn it around. While PFBlog is always an important source I find the meaning of life from, in this circumstance, I have to answer to the call to devote 100% of my bandwidth on this important career-lifting opportunity.

Anyway, after 6 weeks on the road traveling around the world in the last three months and countless hours of overtime poured into the work, I'm finally getting some work/life balance. This doesn't mean the hard work has been completed in my day job, but I'm satisfied that solid foundation has been built to put the business back to the right track.

So, I'm back to the blogging, and I'm starting by putting together some long-overdue monthly updates:

SUMMARY

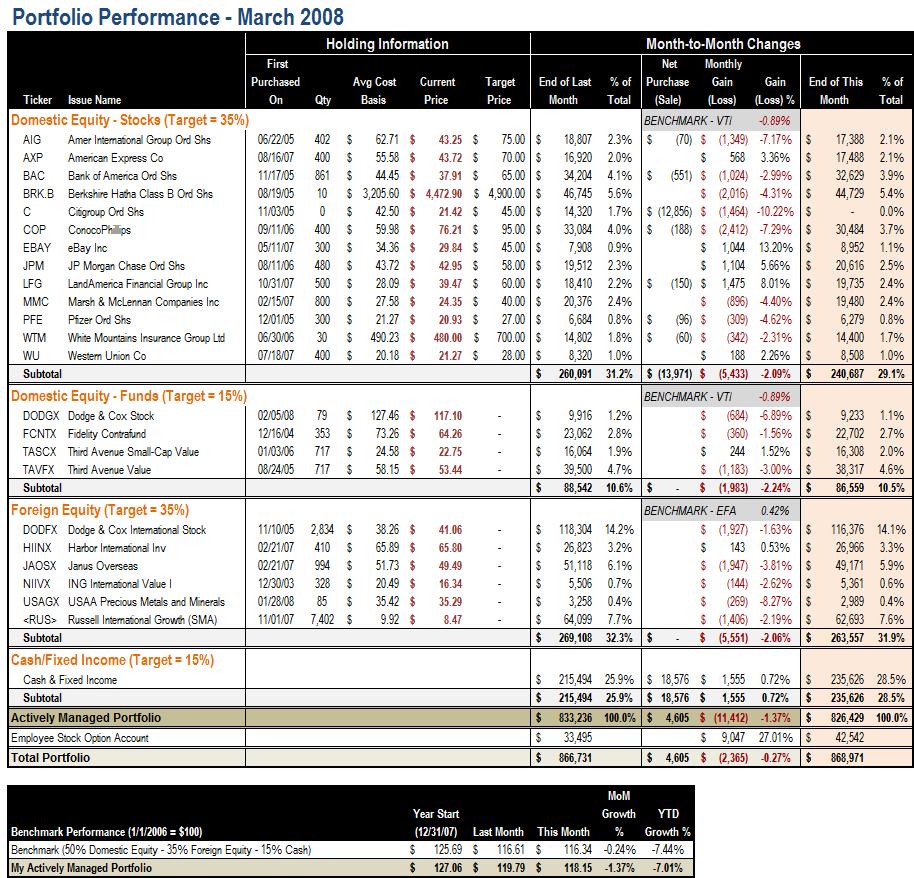

Though the daily price change still suggested a lot of volatility in the market, the market almost ended the month where it started. My portfolio hasn't been that lucky: the heavy exposure on financial stocks still dragged the overall performance of my portfolio. It ended the month with a 1.37% haircut, versus the benchmark performance of minus 0.24%.

It is worth noting that March marks the fifth back-to-back month of portfolio decline, not something easy to swallow. During the five months' timeframe, my portfolio lost 8.36% while my benchmark index retreated 10.46%.

On a year-to-date basis, my portfolio bested benchmark by 1.70%. Still, not exactly something to brag about since I still lost dearly in the market.

TRANSACTIONS

I sold my last batch of Citigroup (C) shares in a bid to fly to safety. While Citigroup is "too big to fall," with the collapse of Bear Stearns as a reminder, it is probably prudent to avoid the bank with the most SIV assets and obscure P&L.

NEXT STEPS

Starting from April, our 401(k) plan will allow participants to freely pick stocks and mutual fund investments via Fidelity's BrokerageLink program. I'll seize the opportunity to review my asset allocation and shuffle some funds.

Of course, 28.8% cash position is not sustainable for long-term portfolio management. But while the market recovered a lot in the first week of April, my bet will still be that we haven't seen the worst yet. I'm more than happy to hold onto the cash (and park them in money market funds in China that is essentially earning 10%+ in dollar terms risk-free) and wait for the best time to come.