I have to give some credit to our benefits department for taking an active role in maintaining a good 401(k) plan. Over the last couple of years, they sacked the ill-performed Fidelity Magellan fund, negotiated a lower expense rate on the money market fund, and introduced a series of Barclays LifePath lifecycle fund. Overall, they provided good service in delivering a reasonably good plan.

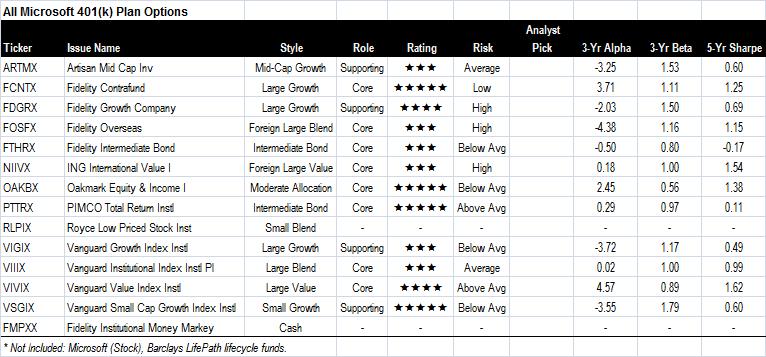

But it is far from saying the investment options provided in the 401(k) plan are all top-notch funds. Below are Morningstar's latest take on the mutual fund options in my 401(k) plan:

Only one third of the funds are given a 5-star rating, and half of the funds are barely keeping up with the average. In addition, a handful of funds are reporting negative alphas (meaning a systematic unfavorable bias in keeping up with index), and some have low Sharpe ratios (meaning not getting enough financial rewards for taking risks). All in all, I really cannot say I am afforded the best investment options.

So, how can I make the most out of the 401(k) plan? After all, the $90,000 we invested in the plan is virtually all our assets in before-tax accounts, and we do hope to grow them quicker than the rest of the portfolio to take full advantage of the preferred tax status. After all, we probably won't touch one dollar of what's currently in the 401(k) accounts before we turn 60.

One option is to only invest in the 5-star funds in the plan, and balance it with the rest of my after-tax portfolio to accomplish fair coverage of all asset classes. This means we will rely on the plan's strength in large-cap and small-cap growth companies, and intermediate bond areas. However, this is not the right mix you can count on to deliver long-term above-par performance in your tax-deferred account.

I actually have one more revolutionary option to turn my money in 401(k) accounts to really good use. That is, to roll over the money to a traditional IRA. The rollover door is open to me because technically I am no longer with my employer's U.S. subsidiary that provides the 401(k) plan, and I'm labeled as an ex-employee in the 401(k) plan.

A complete roll-over brings several benefits:

First, obviously I will have access to the whole range of investment options. I can select mutual funds and stocks as I see fit to accomplish my portfolio goals, instead of trying to fit my aspirations to the limited choices afforded in the 401(k) plan. Will I miss the access to some institutional-class fund options and their lower expense ratio? No, a good fund's positive alpha will more than make up any tiny difference in expense ratio between institutional-class and retail-class.

Second, it will bring me one step closer to a final Roth IRA conversion. While 401(k) or IRA allows for tax-deferred growth, it is still before-tax, and I look forward to the chance to shift the tax-deferred growth to tax-advantaged growth available in Roth IRA, and doing so will allow me to grow the account tax-free for the rest of my life. In the near future, I couldn't do so before our household's income exceeded the IRS threshold. However, Congress passed the law to allow Roth IRA conversion in the year of 2010 with no income limit (read: so the government can tap into some future tax dollars much sooner to mitigate some budget deficit). Furthermore, I will for sure retire in the next 5-10 years, and I will have sufficient opportunities soon to do a Roth IRA conversion when my marginal tax rate is at 10% or 15%.

Third, much less obviously, a traditional IRA provides better estate planning options, like to allow your heirs to extend the required minimum distribution over their expected lifespan by using what's called Inherited IRA.

Therefore, I am pretty much determined to roll over both my wife's and my 401(k) account to a traditional IRA.

Next: Finding the best mutual fund options for my Rollover IRA and my after-tax portfolio.