Yesterday I shared that I'm working on the financial problem to maximize return on my soon-to-expire employee stock options. An outright sale is an easy path to choose, but does it make the most economic sense?

Yesterday I shared that I'm working on the financial problem to maximize return on my soon-to-expire employee stock options. An outright sale is an easy path to choose, but does it make the most economic sense?

One thing to note about stock option: it does not only bear value when the strike price is lower than the market price (in the case of "call" options, which is the case for all employee stock options), it bears time value too. For example, for stock option of the same strike price, the further the expiration date, the more value the option is.

So, if one determine the market price is right but the employee stock option grant still has some shelf life, one can sell the stock option (instead of exercise the stock option) in the open market. Technically, it means to write (or "sell to open") a call stock option position with strike price and expiration date similar to one's employee stock option grant.

To illustrate this in an example, let's use the same data set in my last post:

Stock Option Strike Price: $26.4375

Quantity: 2,222

Expiration Date: February 12, 2011

Price of Underlying Stock: about $31

As we calculated in the last post, the gross proceeds before tax will be ($31 - $26.4375) x 2,222 = $10,138.

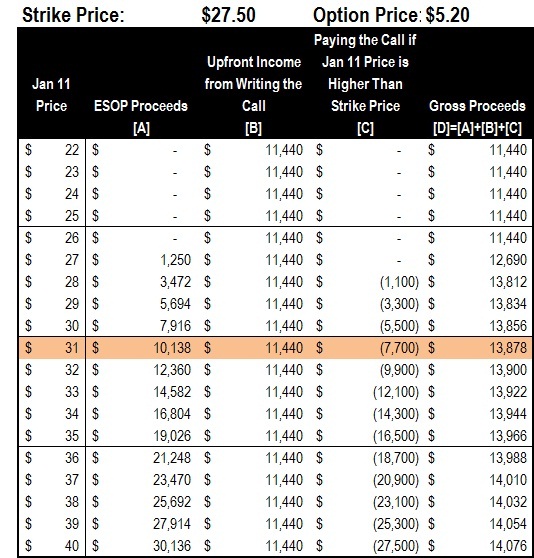

One can look at the option table and find the January 2011 $27.5 Call LEAP option is trading hands at $5.20. (Standardized options are trading at specific intervals, so we take $27.5 as a strike price proxy.)

To implement the strategy, one can write 22 contracts of such option. This transaction means one will receive 2,200 x $5.20 = $11,440 upfront for selling the right to someone else to buy 2,200 shares of the underlying stock at $27.50 from the seller before January 2011.

So what's the difference? Below is the table that shows how this strategy will work.

Let's take the $31 row for a quick walkthrough. One year from now, if the price of the underlying stock is still $31 (as today), our hypothetical investor will receive $10,138 by exercising the employee stock option (column [A]). Also, when he sells the stock option in January 2010 in the open market, he will receive $11,440 upfront (column [B]). Finally, if market price in January 2011 is $31, someone else will choose to buy the underlying stock at $27.50 from him, which will require him to pay out 2,200 x ($31 - $27.5) = $7,700 (column [C]). The sum of all three: $13,878 (column [D]), which is a good 35% improvement over the original $10,138 he will otherwise get if he chooses to exercise the employee stock option upfront.

Actually, by taking the additional hassle to write the call option in the open market, our hypothetical investor will be able to lock the income of at least $11,440 in the worst case even the stock price plummets tomorrow. And he has a fairly good shot at getting $13,800 or more if the stock doesn't fall too much. In other words, he is guaranteed to do (much) better than cashing out the stock option upfront.

One thing to consider is the tax implications. Let's explore this in the next post.