Ever read about how those successful money managers at Harvard and Yale turn their respective endowments into double-digit gains year in year out? As a matter of fact, Harvard's endowment earned 15% per annum in the last 10 years, and Yale's boasted an annualized return of 17.2% during the same timeframe. Ever think about how your portfolio can match such a starring performance?

Ever read about how those successful money managers at Harvard and Yale turn their respective endowments into double-digit gains year in year out? As a matter of fact, Harvard's endowment earned 15% per annum in the last 10 years, and Yale's boasted an annualized return of 17.2% during the same timeframe. Ever think about how your portfolio can match such a starring performance?

SmartMoney's recent article "A League of Their Own" shed some light on how these returns were achieved. Yes, by having tens of billions of dollars you can have asset to the best money management service out in the world, but these consistent performance boils down to one important decision: asset allocation.

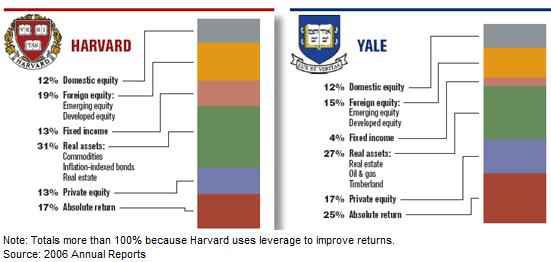

We as individual investors are regularly taught that asset allocation is about finding the right risk/return balance by picking from asset classes like domestic equity, foreign equity, fixed income and cash, but those working at Harvard and Yale are maintaining a portfolio that is radically different:

As you can see, both universities only have less than 50% of their portfolio in those "traditional" asset classes. Instead, they invest heavily in real assets (commodities, real estate, etc.), private equity and absolute return investments (i.e. hedge funds and alike).

Why did they adopt such an unusual and sophisticated approach? According to SmartMoney's article:

As might be expected at big research universities, this aggressive move away from traditional assets was rooted in academic research suggesting that investors can earn a higher long-term rate of return with less risk by diversifying beyond the traditional mix of stocks and bonds. Economists James Tobin and Harry Markowitz each won a Nobel Prize for work they did on this topic while at Yale. Meyer, who ran Harvard's endowment for 15 years before leaving in 2005, and Yale's Swensen put those theories into practice.

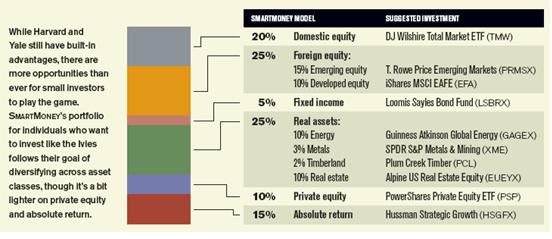

The article went further to suggest that with the growing innovation in investment vehicles, retail investors have a shot to construct a similar portfolio using mutual funds and ETFs open to the general public. A model portfolio is given as follows:

This article is definitely the one that makes me think the most in the last several months. Am I confining myself too much in picking asset classes for my portfolio? While I don't see myself having a portfolio with more than half exposed to those "alternative" investments, it is probably in my best interest to add more flavors to my portfolio.