SUMMARY

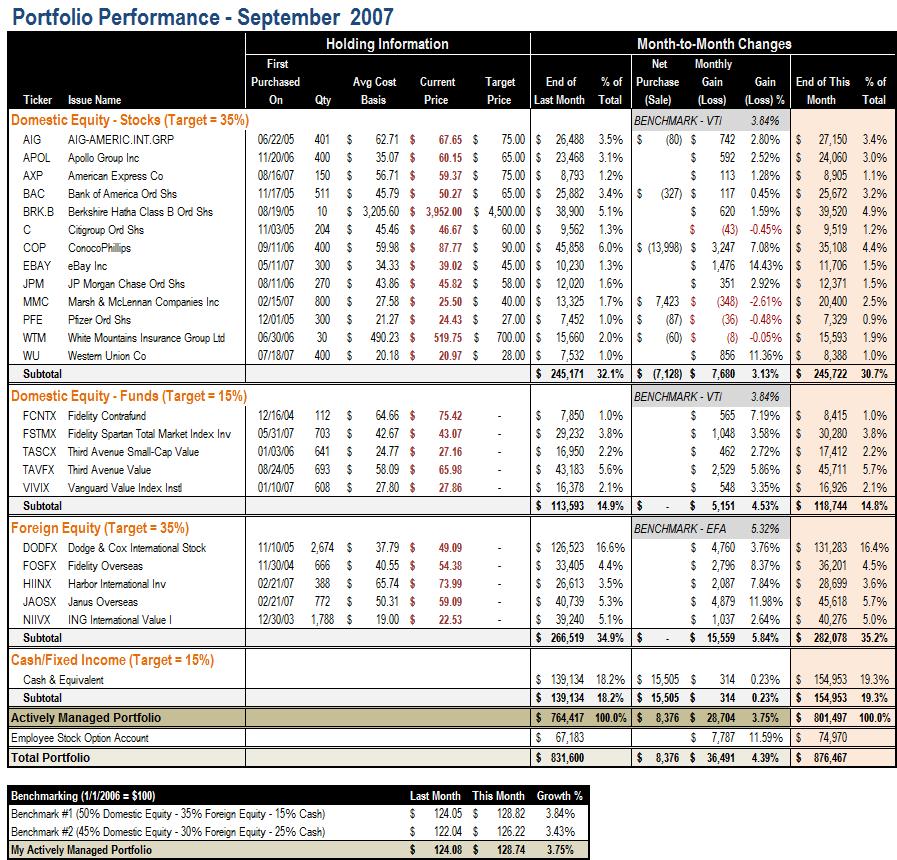

After Fed decisively acted to cut rates, the general market is recovering from the turbulent July and August. This lifts all boats, and helped my portfolio to book a record-beating 3.75% monthly gain. For the first time, my actively managed portfolio (excluding employee stock option account), has more than $800,000 in assets.

My portfolio performance is in line with the benchmark for the month. Year-to-date, my portfolio index has gained 10.1%, compared to 9.6% in 50-35-15 benchmark and 8.9% in 45-30-25 benchmark. Overall, I'm satisfied of the portfolio's performance.

TRANSACTIONS

I completed two transactions this month. First, I sold about a third of my energy holding ConocoPhillips (COP) at $86.05 after it broke my earlier target price of $85. While oil price has been breaking all-time record throughout the month, most of the climb is due to the weakening dollar. Also, I feel I'm a bit over-weighted with this single issue representing more than 6% of my portfolio. New target price is set to $90 for the rest of the shares, though.

On the other hand, I am happy to be able to acquire more shares of the insurance broker Marsh & McLennan Companies Inc (MMC) at $24.71, or 15% discount off my initial purchase price of $29.27 back in February. The stock is obvious weak for the time being, but by reading more analysis reports and its financial filings, I do believe a turnaround story is developing. I have quite some success in the past by betting on recovery of distressed industry heavyweights, including (Cigna, Sears, Altria, R.J. Reynolds and Coca-Cola), and I am expecting the same thing to happen again here. MMC is trading at 14 times forward earnings and bears an impressive 3% dividend.

NEXT STEPS

There are a couple of loose ends I expect to tighten in the next 30 to 60 days. First, domestic equity has been under-represented in my portfolio for quite some time compared to benchmark portfolio, and with more money coming from our tireless savings engine, I need to think hard to deploy them to new opportunities.

Second, I just received notice form our benefits department that one foreign equity fund (namely Fidelity Overseas, FOSFX) will be replaced by a new investment vehicle soon. I need to read the change announcement documents and research my options.