ANALYSIS AND COMMENTATRY

Although market ended within 1% of where it started off the month, market volatility in August is comparable to that of the chaotic July. At one point, the market was 10% lower than its peak in mid-July, certifying this as an official "market correction."

Being a participant of this journey really requires a strong heart. At one point in August, I lamented that my stock holdings at low-teens P/E ratios were declining while the obvious bubble of trading stocks at more than 50 times forward looking earnings were rewarded financially in China. S far, I'm glad that at least six weeks into this drama, I'm still holding onto myself without selling at low.

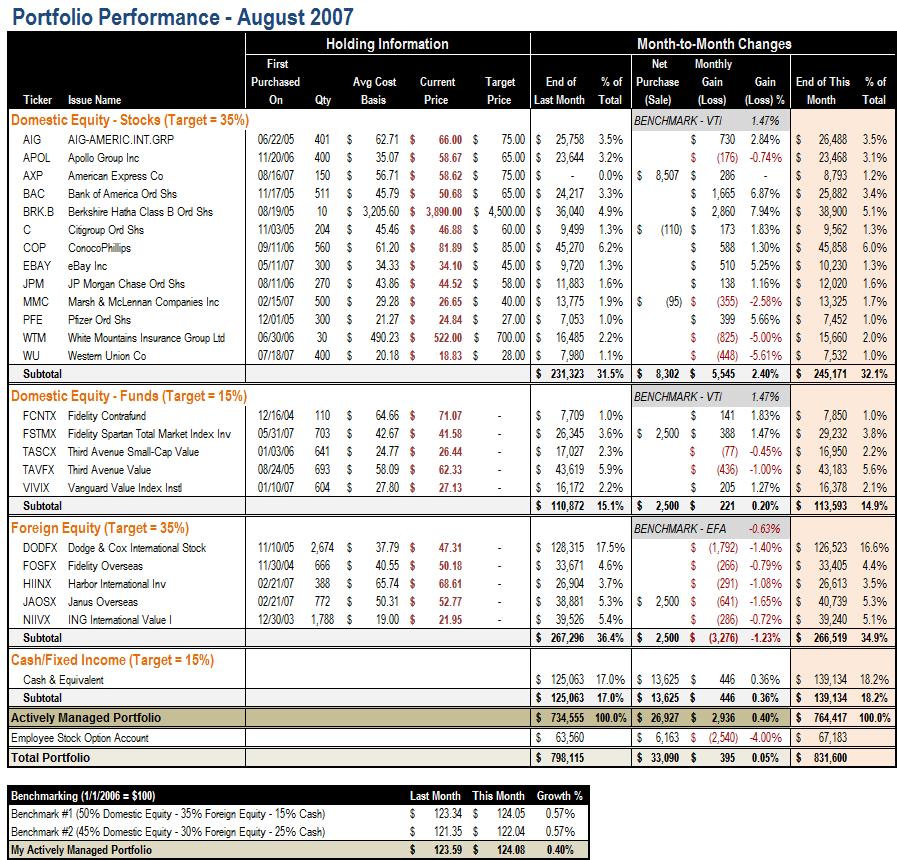

My portfolio gained 0.40% in this month, slightly lagging the benchmark performance of 0.57% appreciation. My individual domestic stock picks continue to beat its benchmark of VTI by almost one percentage point, but the performance of my mutual fund holdings is quite disappointing -- both my domestic equity funds and foreign equity funds failed to match their respective benchmark. That's probably a one-month event -- prior to August, all my funds are beating benchmarks for three straight months.

Apart from adding $2,500 to domestic equity and foreign equity respectively thru regular fund purchase, I opened a new position of American Express Co (AXP) this month. While also a financial stock, American Express should weather the storm and come out even stronger as a premium card issuer, and its mid-teen P/E ratio and high growth (relatively to other financial behemoths) make it an attractive buy at this price level.

NEXT STEPS

Looking ahead, as my multiple earning streams will continue to gush cash in the coming months, I'm looking for good opportunities to dispose my currently larger-than-allocation-target cash positions. I'm in active look-out for undervalued individual stocks, and will, from time to time, add more money to my fund holdings on an dollar-cost-average basis.