By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | April 7, 2010 11:49 PM PST

I started PFBlog seven years ago to document the journey toward a publicly-announced net worth goal of $1,000,000. With a starting tally of $47k in 2003, my wife and I were well prepared for a prolonged 13-year fight -- our realistic projection back then envisioned us boasting 7-figure net worth by 2016, or when we will enter our 40s. I started PFBlog seven years ago to document the journey toward a publicly-announced net worth goal of $1,000,000. With a starting tally of $47k in 2003, my wife and I were well prepared for a prolonged 13-year fight -- our realistic projection back then envisioned us boasting 7-figure net worth by 2016, or when we will enter our 40s.

A mix of luck and hard work brought our net worth to half a million bucks by August 2006, and we reset our goal to accumulate the million by 2012, and hence we changed the tagline of this blog to "Personal finance observation, musing and decisions in a journey toward financial independence by 36 with at least $1 million."

Since then, it was quite a drama: a quick ascent in 2006 and most part of 2007 put us within a stone's throw of the million dollar mark, but the following nosedive in 2008 almost wiped out a quarter of our asset base.

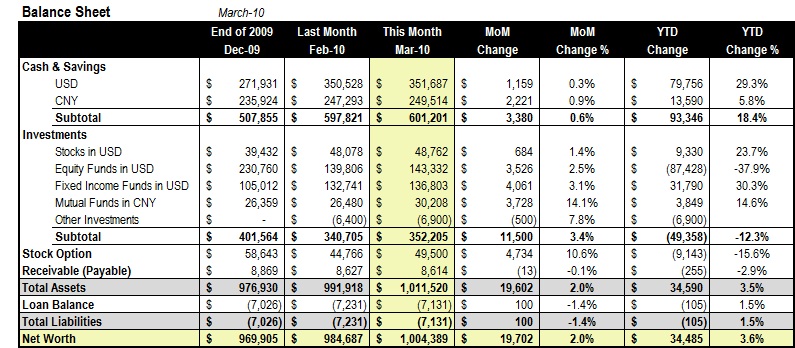

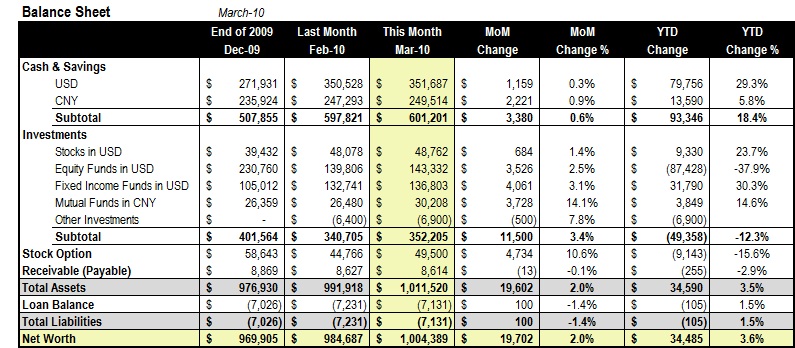

But finally, a few days before my 34th birthday, our personal accounting software finally had to accommodate an additional digit in our net worth report. In the end, we closed the month of March 2010 at $1,004,389!

The Celebration

We two newly anointed millionaires went out in a good Saturday evening planning to celebrate this special occasion at the best restaurant in town. But after running an errand first, we found ourselves stuck in a remote area of the city and couldn't get a taxi. After a failed 30-minute attempt, we caved in to our empty stomachs and walked around trying to find a decent enough food outlet with no success. We finally set our feet in a mom-and-pop noodle house with only three tables, and $5 being the highest price tag on the menu. Our final bill for the celebration meal: $9 including drinks :-)

Back to Our Roots

The $9 dinner at the noodle house was actually beyond our expectations. And it reminded us of our roots when we started the journey.

In the very first post of this blog, I wrote: "I believe this [$1,000,000] goal is achievable with hard work, discipline and smart personal finance management."

Yes, with the past decade barely having rewarded any investors, most of our asset growth from $47k to $1M came from the hard work that paid off in our tripled annual income, and the discipline that drove us to save more than 45% of our post-tax income every year since 2003.

With a seven-figure cash pile, we are financially faring better than probably 95% of the people of same age, but I'm equally glad that we are preserving our roots of living below our means. We are no longer clipping coupons, but living in a megacity, we choose to rent instead of buying, we choose to walk and use public transportation instead of owning and maintaining a car, we shop at outlet malls and online merchants instead of department stores, and we invest hours to do comparison shopping when it comes to big-ticket items.

A Journey That Teaches

The last seven years is a rewarding experience not only financially, but also intellectually. Back to 2003, we just arrived in America, and knew nothing more than the difference of a checking account and a savings account. Along the way, we taught ourselves of savings, investing, tax, real estate, retirement planning, college planning, and other money topics. And our financial life became more complex every year, starting from managing multiple bank and credit card accounts, brokerage accounts, 401(k) and IRA, to handling real estate deals, small business retirement plans and foreign tax planning, not to mention a growing investment portfolio.

In more than one ways, maintaining this personal finance blog is a learning experience too. By writing periodically in a spectrum of topics, I pushed myself to learn new things, be thorough and accurate, and be accountable for my actions and decisions. I would never have imagined that the blog has logged millions of page views, and was mentioned in a number of media outlets like WSJ and MarketWatch, and even featured full-page at Kiplinger's Personal Finance. Plus, the blog itself, thru advertising income, contributed significantly to our financial goal.

It won't be fair not to mention that our seven years' journey cut across the worst financial crisis in decades and its initial recovery. At one point of time, our net worth took a multi-month dive from 900s to the 600s, and it was quite a psychological experience. In a mixed feeling of shock and shame, I also regrettably left the blog idle for a long time between 2008 and 2009.

In retrospect, though, we feel we were quite lucky to experience emotional distress from the financial crisis first-hand when we were still in wealth accumulation mode. We certainly learned many things, especially how to deal with temporary asset reduction emotionally, and how to take a long term view of financial planning. It could have been much worse if the first financial crisis in our life time happens after our retirement.

Having Fun

Household finance management is a marathon, not a sprint. And we learned soon enough into the journey that the winner of the marathon is not decided by the figure on the bank statement at the finish line.

We know we want to build a sizable war chest and have early retirement, but we also know we want to enjoy life along the journey as well.

We know we are truly blessed by me having a well-paid job in a booming industry, so we don't have to choose between saving every dime and building a nest egg. We choose to rent a large apartment, afford private schools, and spend in family hobby -- travel. In the last seven years, we've traveled to over 20 countries and dozens of destinations. These great memories and huge photo albums will be cherished in the family forever.

The Journey Doesn't Stop Here

So, have we achieved "financial independence" as we aspired when we set our 7-figured goal years back? A million dollar in the bank is surely bringing peace of mind. But obviously, one million dollar for a couple in their mid-30s is not enough to count on for an immediate retirement. So, what's next?

I am happy to announce our new goal: $3 million by 2020.

We are setting this new goal for a couple of reasons. First, barring a dollar crash, $3 million is a real fortune that a couple can comfortably retire from. Even with a modest 4% annual return, it will yield 6-figure annual income, much more than what we are spending today.

Second, 2020 is the year our son will enter college, and we will be in our mid-40s. If we truly want to have an "early retirement", then 2020 will be the right timing.

It is both a challenging but attainable goal. It took us seven years to build up our first $1 million, so if we really want to amass another $2 million in ten years, we need to speed up. On the other hand, our first million mostly come from savings, but moving forward, we can count on our portfolio to grow in size and keep giving.

So, are you interested in keep watching how the journey will unfold?

More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

Congrats, I am 35 and am sitting on a pile of about 230,000$ all saved through hard work and wages and clipping coupons and doing surveys and mystery shops and everything in between to make up for any daily expense I might have. I have invested very little of it in mutual funds; I like your story and would love to venture into investing but its so scary! CONGRATULATIONS! thats an awesome achievement. you've done great and nice going on resetting your goals. you always want a goal to aim for. Hi, there! Congratulations! Nice work that you became a millionaire so fast. I would like to be as rich as you in the future. I have my own blog too and also I write about my money same as you.

Bye bye from Poland

ynwestor Technically only one of you is a millionaire. Congrats! That is awesome. And esp. awesome that you are setting another goal! Congratulations!

Welcome to the 10mil club Wow! Congratulations for this amazing achievement and good luck for your new goal! Congratulations

You did a great job. I'm 33 and I just started my financial adventure. I follow your blog as a guideline, thanks for all the advices, most of them are helpful also here.

iwant (an italian PF emulator) Congratulations! I remember when I made my first million, and it was a huge sense of accomplishment. I believe that most millionaires are probably small business owners. But I'm like you, I made my money from aggressive saving and investing. It took me 10 years to make my 1st million, 5 years to make my 2nd million, and I'm about half way toward my 3rd. I just turned 36. So I think your goal of $3M by 2020 is a very doable goal. Just make sure to protect your assets through estate planning and insurance. Good luck! awesome, i'm sure the journey was tough but well worth it. First of all, congratulations!

I don't want to nitpick here, specially in a special moment like this, but aren't you contradicting yourself with this (http://www.pfblog.com/archives/6173_is_1m_still_enough.shtml) post?

After all, I guess now $1M is not enough.

Once again, congrats! I just found your blog through the Carnival this morning. I just wanted to say you are an inspiration to me! I just recently started my blog, with the same goal. I want to see two comma's in my net worth.

It's so great to read your victory, and I'm excited to go back and read all about how you achieved it.

Thank you so much for blogging about it! Very inspiring. Congratulations! Congratulations! Very cool .. I am in a similar situation, but without the due diligence that you have put in your endeavor. Lesson learnt. Will be interesting to follow through 2020 - have all the confidence that you can meet your 3M target. Hopefully, when you fulfill your dreams, you will stay true to your vision that you describe as important to you, as opposed to setting a goal for 10M by 2030, like most other humans! All the very best! Which software do you plan to use after Microsoft discontinues Money next year. I just love Money despite its short comings. I have done a lot of research and have come up empty. Mint ets just is terrible in comparison. Quicken may be my last hope but is portfolio tools seem very poor. Hope you will reply. Congrats for the milestone. I am single, 34 and was able to accumulate about 350K(bank/401k/Vanguard) by saving and earnings from sale of my first house. I also have two homes with equity about 500k total. Can I count the equity as part of my net worth or does the money have to be in a bank first? Congratulations!

We just passed a major milestone this past February in that we are totally debt free (no mortgage either)! Our next milestone is to pass the $1 million dollar marks like your family just did.

It seems soo far away, I hope it goes as quickly as it went with you :)

That is just so awesome and such an inspiration. Especially meeting your goal much earlier than intended. Look forward to reading more of your content to follow. :) Nice post.I’m really impressed with your article, such great information you mentioned here..

mba Fantastic!

Alas, we chose the buying a house much bigger than was needed route. We are a bit behind but just as dedicated to get there. I hope to be there within the next decade though!

More power to you! I too am documenting my path to wealth. Your hard work and accountability is outstanding. Great job!

Dollars Not Debt Nice work! Very impressed with your dedication.

My only suggestion would be NOT to get so down on yourself the next time your portfolio drops 30%. Because, it will drop again! People need the guidance more when the chips are down anyway.

And besides, money comes and goes... all in perspective.

Anyway, nice work! Congratulation. You did what so many failed to do. hi all,

great web site cool article,

i like your article

thanks for view this article.

*******************************

Jeff,

Best Offshore Investment

Good for you!! I think I will follow your lead and do some things I have been avoiding!See you later! Hi, there! Congratulations! Nice work that you became a millionaire so fast. I would like to be as rich as you in the future if i can make success on my website http://www.readoriginal.com Congratulations! such an inspiration for me. I hope i can brag about my savings at age 37 with a $10k debt. But hopefully just like you i can reach that million goal. Wow - I cannot believe I have not seen this huge pf blog before. Congrats on achieving your goal and look forward to checking out your archives Congratulations! Now a word from a friend of mine that may or may not be helpful you see many of us now in our 60's were in your shoes and even beyond when we were 30 somethings and early 40's and then to quote my friend "Good old Uncle Sam get a sneak peak" and one way or another they figure out how to get it from you. So enjoy it while you are young or to quote another friend and a song "go on take the money and run" I had 1.8 I have another friend how had 5.2 at 38 each respectfully now we don't have two nickles all because of a few laws and rules that were changed.

Take notice the young are those who have these types a figures. The elderly do not as yourself the question as to why.

Could be coincidence could be something more as many of my female friends would state they like to give us a feeling like we are accomplishing something but they can't let us keep it. There was a reason that the generation of the depression decided to start stuffing mattresses. Congratulations. I just discovered your blog and your journey to riches. Well done.

Impressive. I hope I can achieve them same. Congratulations also from germany. I like your blog and some episodes on your journey to get rich. ;) i like it once for all, A Million! | From PFBlog: The Unique physical Finance Blog inasmuch i ago 2003 now im your rss reader |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

I started PFBlog

I started PFBlog