By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | April 8, 2008 5:54 AM PST

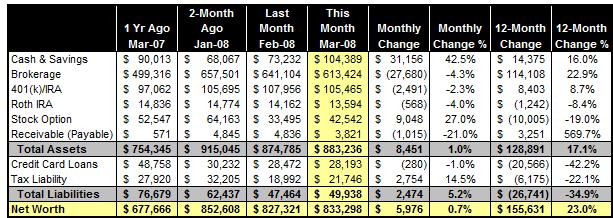

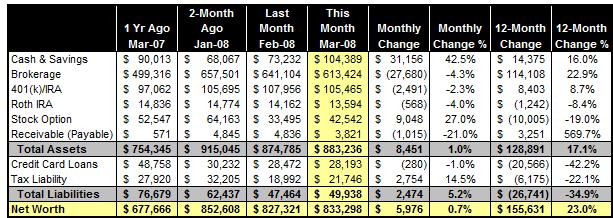

The first month of net worth gain came rather late in 2008. Helped by continued strength in my day job and sideline business, our net worth edged up 0.7% in March. While we are $62,100 off where we started the year, we still increased our wealth by over $150,000 in the last 12 months. The first month of net worth gain came rather late in 2008. Helped by continued strength in my day job and sideline business, our net worth edged up 0.7% in March. While we are $62,100 off where we started the year, we still increased our wealth by over $150,000 in the last 12 months.

Again, the market is testing the patience of every participant and spectator. If anything, I'm getting very good at dealing with market turbulence -- daily five-figure portfolio loss doesn't bother me much these days.

Now I don't think I'm a role model when it comes to investing -- some can easily discount me as market timer by keeping a big cash reserve, or being on the fence between stock picker and fund investor -- but I'm glad I'm true to myself and put my money where my mouth is. There are and will continue to be hits and misses, and it will surely take a long time to get better in the game. I won't mind people giving me more criticism or feedback along the way.

BALANCE SHEET

NOTES

- Our entire credit card balance is either on 0% APR balance transfer deals or charges in the last 30 days that will be paid off before the due date.

- Our tax liability continues to decline due to shrinking unrealized capital gains.

NEXT STEPS

- Our tax preparers at KPMG have filed for automatic extension of our 2007 tax return. While I have collected all forms, I still need some time to put together my organizer and spend time with the firm to complete my tax return.

- The family hasn't vacationed since Christmas, so we are set to go to Seattle and LA in late April/early May. Great to catch up with some friends, bring our kid to another Disney park, and regain some sanity in our busy life. More PFBlog Articles You Might Find Interesting ...

|

Not a bad month all things considered with the market. Are you seeing any negative effects in your side business related to the weakened economy?

Large cash reserve is a good idea. Some markets looking for a return of capital is better than a return on capital.

Speaking as an ex-banker, that is the primary criteria of lending, Return OF the capital, before return ON the capital. One of the first pieces of advice I received in banking was: 1) Laddered Treasuries for the investment portfolio, and 2) make good loans, and the bank will run itself.

Anyway, congrats on returning to the plus side !

I think, the tax liability needs to be increased for 401K / IRA amount, unless that is reported on a tax adjusted basis. Atleast adjust for tax rate of 15% (the way healthcare and social security are going, it will most definitely be higher by the time anyone in his 30's retires) - I like your blog and openness.

Cheers.

After starting my own finance blog a little while ago, I have been inspired by the detail and structure of your blog to make a few changes to my own. Well done and keep it up. Excellent reading.

James.

Indeed, return OF capital is the primary concern, and then the return ON the capital (as Todd stated above).

I hope you had fun on your vacation!

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:33 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|