By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | December 30, 2007 5:51 AM PST

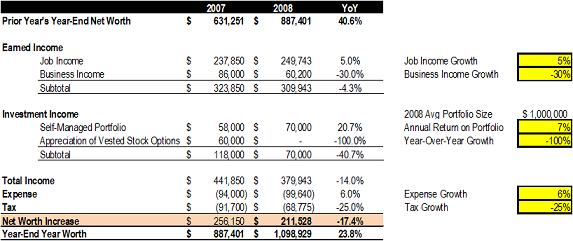

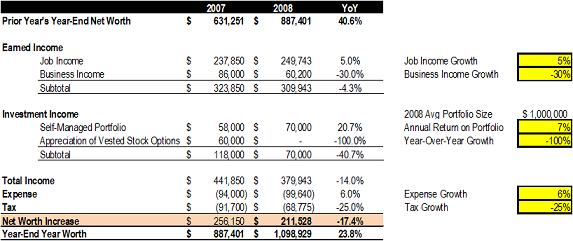

So far I have spent three posts in our Financial Plan 2008 series to elaborate the key driving forces of our financials in 2008 (part 1, part 2 and part 3). It is time to put everything together. So far I have spent three posts in our Financial Plan 2008 series to elaborate the key driving forces of our financials in 2008 (part 1, part 2 and part 3). It is time to put everything together.

In summary, we are looking at $212K net worth increase in 2008, which will likely drive our total wealth to about $1.1M by the end of the coming year. The speed of the growth, however, will be slower than that of 2007, due to a number of headwinds, including:

1) Slower growth of job income, primarily due to change of stock compensation program at my employer;

2) 30% less business income, due to changing industry environment;

3) Unlikely further appreciation of vested employee stock option grants;

4) Higher expense expressed in USD when expensed in Chinese Yuan.

Partially offsetting the unfavorable changes will be a couple of favorable developments:

1) Likely higher income from our self-managed portfolio, mainly due to expanding portfolio size;

2) Reduced tax bill, thanks to more tax gross-up on certain benefits and less tax for employee stock option grants.

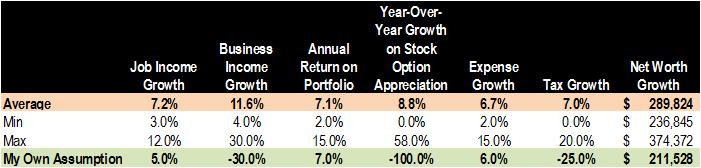

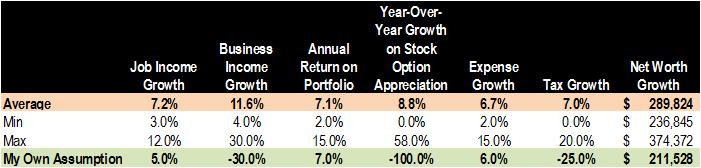

The key assumptions and the resulting annual financial planning model are included below. (2007 year-end figure is estimate. Final result will be available in a week.)

Recognizing that setting a slightly stretching goal is a virtue, I'm hereby announcing that for next year, we will be shooting for the goal of:

Net Worth Growth of $220,000

I will announce the extra absolute net worth dollar goal we will target once we close 2007 results.

P.S. I'm also happy to announce pj as the "Closest to the Pin" winner of our "Producing My 2008 Financial Plan" contest. His conservative estimate won him a $50 Amazon gift certificate. (A notification email has been sent out to his email address on record.)

P.P.S. Group wisdom vs my own on our 2008 financial plan. Nevertheless, thank you again for those who participated.

More PFBlog Articles You Might Find Interesting ...

|

Good Luck with your 2008 financial goals. Achieving your goal will put you in the Millionaire Club!!

Aren't US taxes on US expats rising next year? I keep reading about it in the media.

MM,

does your wife's business/consulting fall into your job income or business income category?

Thanks for the Amazon gift card!

(I will probably use it to buy a the Harvard MBA casebook on private equity and venture capital, so I can prepare for the corp fin practice of the consulting firm I will start working for next year.)

And being able to call a 220K net worth increase conservative in your early 30s is, well, wow! I hope to be there too in 10 years.

damn it, pj.. you beat me ever so slightly.

you 235,845

me 244,929

looks like i was the next one... any runner up prize?

congrats...

drchunger, i couldn't offer more prize or I will have to revise my annual goal to $219,950 :-)

But you deserve an honorable mention ... you asked a couple of good questions in the comments.

2million, the Expact Services Co. is included in the business income bucket. We had a good year in 2007 -- already at the right mix between the money earned and my wife's optimal work/life balance to keep family commitments -- we expect 2008 to be marginally better.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:33 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

So far I have spent three posts in our Financial Plan 2008 series to elaborate the key driving forces of our financials in 2008 (

So far I have spent three posts in our Financial Plan 2008 series to elaborate the key driving forces of our financials in 2008 (