By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | June 7, 2010 4:34 PM PST

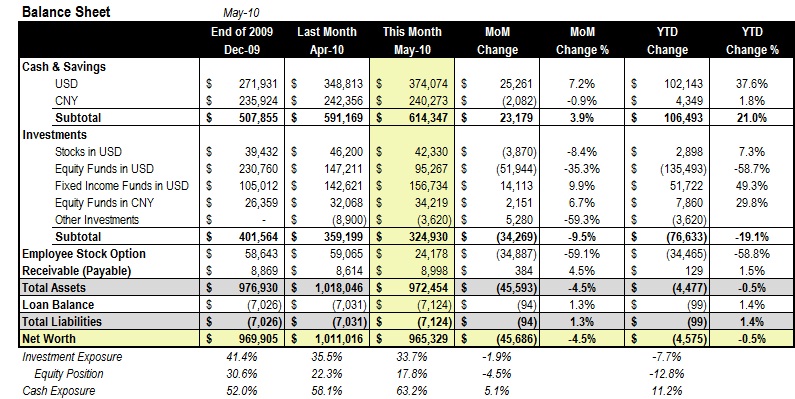

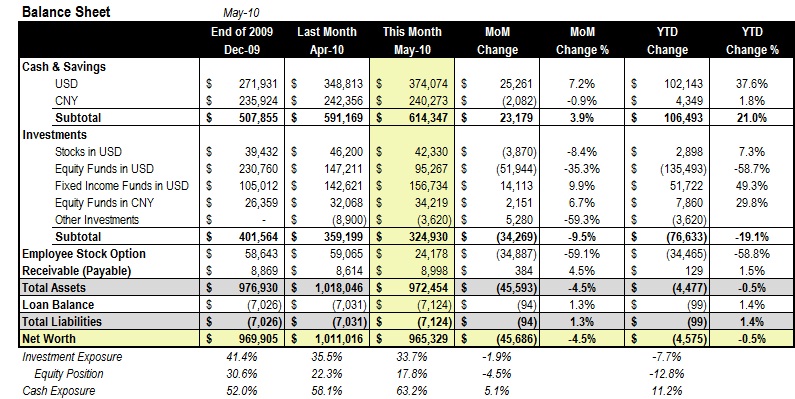

The renewed global economic uncertainty and ensuing stock market "correction" dealt a big blow to our portfolio. Our net worth retreated to 6-figure with a monthly drop of 4.5%. The renewed global economic uncertainty and ensuing stock market "correction" dealt a big blow to our portfolio. Our net worth retreated to 6-figure with a monthly drop of 4.5%.

Most damage was done to our vested employee stock option positions, which behave disproportionately to the change in the underlying company stock. Our partial hedge helped, but not much. On the other hand, our continued "light" exposure in equity positions spared us from more severe damage.

So, how does it feel as a millionaire club drop-out?

Actually, I feel very good. Why? Since the beginning of the year, we chose to be very risk-reverse with the belief that the bull market had grown teeth and politicians cannot solve a debt problem by issuing more debt. During the same period, we have steadily lowered our equity exposure from over 30% to less than 18% at the end of May. With over $600k cash at hand and another $150k+ in low-risk fixed income funds, all we can pray for is for the market to take another skydive and present much more valuation opportunities.

So, it doesn't bother us much that our net worth dropped from 7-figure to 6-figure. With a solidly growing career, our saver's mentality that preserves 50% of our after-tax income, and the void of any debt obligations, whatever the market can do to our net worth now won't affect how we live our lives in the next decade. Yes, we are in it for the long run.

Additional notes:

1) We redeemed about $42k of equity funds in the middle of May amid the global sell-off. We continued to add to our fixed-income holdings, primarily in inflation-protected bonds (thru a Vanguard fund).

2) Our employee stock options will expire between 2011 and 2013. All options with 2011 maturity have been properly hedged.

3) Summer is coming and the family will have vacation in NYC and Orlando in late June and early July. I always enjoy the time to research and arrange the next trip and this time is no exception. Cannot wait to relax after a busy spring. More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

Overall, you are doing well. I looked back to October of 07, the peak before the challenge and you are up from there. I am sure a lot of people can not claim that. MM- I'm curious about your current living situation - are you still living in China or have you returned to the US? Im also wondering if your planning on buying real estate whether your located at. thanks! 2million - thank you for asking. Currently i'm still living in China. Local real estate market is too hot and i'm renting now. Looks like you've got everything planned out. Good for you for being such a great saver. I'm sure you'll be back in that 7 figure in no time. ;) I prefer to rent rather than buy. It is simply cheaper, especially in places like Hongkong. Thanks for the report. Your fixed income funds are performing extremely well amid the downturn. Any chance you can shed some light about your strategy or selections? |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

The renewed global economic uncertainty and ensuing stock market "correction" dealt a big blow to our portfolio. Our net worth retreated to 6-figure with a monthly drop of 4.5%.

The renewed global economic uncertainty and ensuing stock market "correction" dealt a big blow to our portfolio. Our net worth retreated to 6-figure with a monthly drop of 4.5%.