By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | February 5, 2010 5:54 PM PST

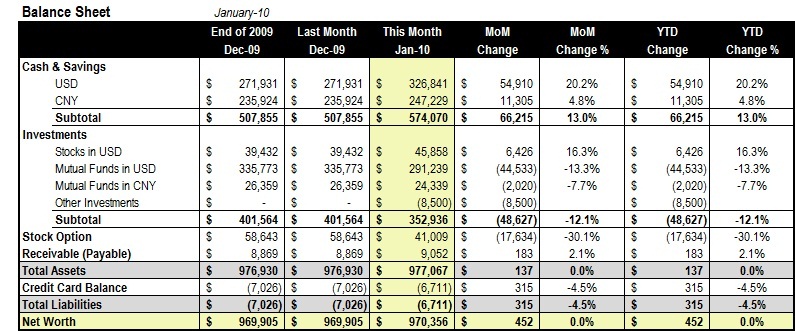

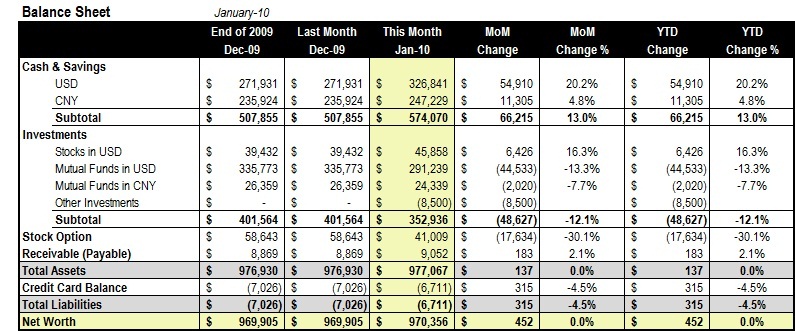

If I can only add less than $500 to our net worth tally every month, it will take us another five years to reach the 7-figure milestone. On the other hand, the tiny improvement in January is not exactly bad, considering the brutal market condition. If I can only add less than $500 to our net worth tally every month, it will take us another five years to reach the 7-figure milestone. On the other hand, the tiny improvement in January is not exactly bad, considering the brutal market condition.

On the income side, we started the year with a positive note. Aside from our regular income, many long-term business relationships are again generating cash results, which helped our cash stockpiling. We continue to save about 40% of our regular income.

The result from the investment side is cloudy at best. After suffering some loss, we continued our flight to safety which gradually lowered our risk-taking positions. The employee stock option lost 30% of its value at the end of 2009, although we hedged some of the loss. We will have a portfolio report later with more details.

So, welcome to my net worth report for a while:

More notes:

- We continue to be very defensive in our asset allocation, keeping almost 60% in cash and a sizable fixed income position in our mutual fund holdings. I am still the believer that we haven't seen the end of the financial crisis yet.

- The "Other Investments" line includes the accounting value of the "covered call" we sold to hedge our employee stock option position. (Detailed discussion is here, here and here.)

- Our receivable primarily includes our rental deposit as well as some expected tax refund.

So, we are still within a stone's throw of our seven-figure ambition. Of course, in this economy, one can never retire on a million dollar nest egg, especially we are still in our mid-thirties. What's the next milestone we should set? $2 million? Or $3 million?

More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

have you thought about the income you will need to retire? is it 80% of your current income? 1 million is a great goal, but to last you 40-50 years it is not near enough. additionally have you decided on what type of portfolio you can have in your later years to generate income? a few thoughts:

1.) you failed to see the financial crisis coming. What makes you think you will be able to accuarately anticipate when it will be "over"?

2.) "In this economy, one can never retire on a million dollar nest egg." Are you kidding?? What a foolish statement. Totally depends on your cost of living. Plenty of people need much less, and plenty need much more. As JMT pointed out, without deciding what your number is, you're pursuing arbitrary goals. To the comments above, I highly doubt he has any intentions of retiring once he hits the million dollar mark. It is simply a mildstone. You gotta set small goals and adjust those goals as you progress. What's wrong with that. Of course 1 million is certainly not a small goal but it is all relative. I recently have been setting our goals in 50k intervals. Obviously the seems to fit the definition of small goals a little closer, but nevertheless. I would shot for 2 then go from there.

I think 1 million bucks is a good goal. its easy to be critical of others goals when it doesn't math our own. I think that once it is attained a new goal can be set, and reaching it will be much easier. My husband and I planned on retiring five years from now in Florida but housing prices are so low there, we’re thinking it might be worth it to make the leap now, and maybe even work part-time. Our lender Intercontinental Capital Group could give us a rate below 5, which is lower than anything we’ve ever had before. Do you think prices and rates will be like this in five years?

Very inspiring. Any reason you don't have real estate (e.g. house) included in your calculations? Go for at least 3 million. If you really want to retire comfortably nowadays, and not work AT ALL, then 3 million seems very safe to me. It's easy to calculate how much you will need for retirement - It's the present value of all the future withdrawals from retirement to death; at the time of retirement. I have seen recommendations that suggest you will need 70-85% of your income after retirement. Don't forget to include inflation in your calculations Man! You really need to improve your investment side. Otherwise your hard earned $$$ will be eaten by inflation. If you have time, you can read Jeremy Siegel, Jeremy Grantham, and David Swensen's books. You will know your current high cash portfolio is "Defensive" in short term but disastrous in long term.

China Barrons Hi, I´m following your blog for quite a long time and love it. I have a similiar target, but its tougher: i want to get 1 Million dollars by playing online poker within one year. Since had some bad luck with stocks in the past, I want to try it this way and i think it´s really feasible... I´m blogging too about my target, if you´re interessted just look at www.poker-diary.net - maybe I´m gonna get to 1 Million before you do :) Some financial institutions offer online-only savings accounts. These usually pay higher interest rates and sometimes carry higher security restrictions.

it's good site

Thanks

=============================== |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

If I can only add less than $500 to our net worth tally every month, it will take us another five years to reach the 7-figure milestone. On the other hand, the tiny improvement in January is not exactly bad, considering the brutal market condition.

If I can only add less than $500 to our net worth tally every month, it will take us another five years to reach the 7-figure milestone. On the other hand, the tiny improvement in January is not exactly bad, considering the brutal market condition.