By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | July 7, 2007 1:47 PM PST

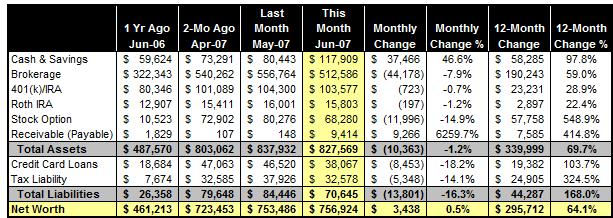

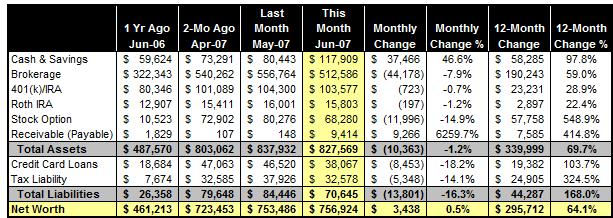

With hardly any investment income from my self-managed portfolio, I feel quite lucky that I can still post a modest positive net worth growth of $3,438 in June -- several extra sources of income more than offset the bleeding in stock option value. This also wrapped up the bumpy but still fruitful ride of 1st half, which put us in a good position in achieving our stated annual financial goals:

1) We achieved a net worth growth of $125K in the last six months, or more than half of our annual growth goal of $230,000. With a sizable bonus and more vesting of stock option and stock awards coming in September, we should be able to overshoot our year-end goal of $850,000 in net worth.

2) My investment also performed well with benchmark-beating year-to-date return of 7.7%. This is only a bit shy of our annual absolute return goal of 8%.

3) On the self-income side, we recorded a total of $47K income in H1, compared to our 2007 annual goal of $80,000 and 2006 whole-year booking of $70k.

MONTH-END BALANCE SHEET

HIGHLIGHTS OF THE MONTH

Our life was very busy in June, making this month's financial reporting a very eventful one:

1) As mentioned earlier, we will send our son to elementary school starting this fall. We paid out approximately $5,000 in June for the tuition of the fall semester.

2) We also moved to a more spacious apartment (and surprisingly, we found an ideal suite in the same building). We paid out another $4,000 as deposit (only cash flow impact but no net worth impact) and $2,000 as the first-month rent for July. We have yet to receive the deposit back from our old apartment though.

3) The family also took a vacation in Hawaii (3 days in Oahu and 4 days in Maui). It is such a nice relaxation after a super-busy spring. Of course, even with company footing most of the bill, that is four-figure "incidental" charges.

4) On the income side, I was granted a couple of cash awards in June for outstanding performance and service to the company. Although, I will receive the true cash in my paystub for July or August.

5) KPMG also finished my 2006 tax return, and I'm due for a refund of about $800 and additional one-time tax assistance of $3,500 from my employer for the material tax change to expatriates in early 2006.

WHAT'S AHEAD

- I have yet made the $10,000 contribution to SE 401(k) account for tax year 2006.

- More portfolio reengineering to do; I hope I can gradually reach my allocation goal by the end of Q3 without taking too much risk catching a market inflection point (read: buying massively just before a market downturn).

- My wife's laptop is literally breaking apart now. Time for shopping a new one now.

- July won't be an easy month too -- I already have three weeks of business trips planned for the month. More PFBlog Articles You Might Find Interesting ...

|

Looks like you are making some great progress.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:35 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|