By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | May 9, 2010 11:03 PM PST

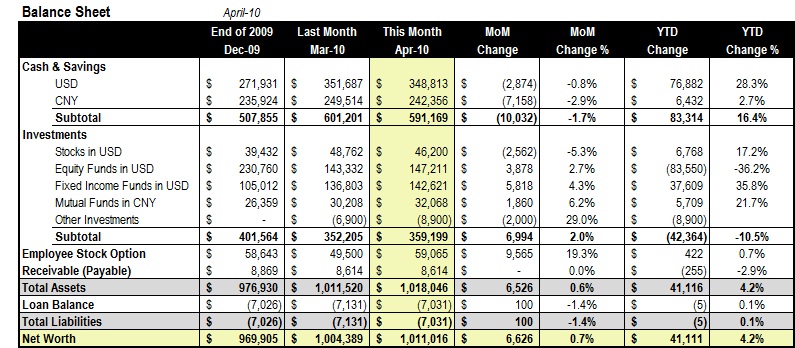

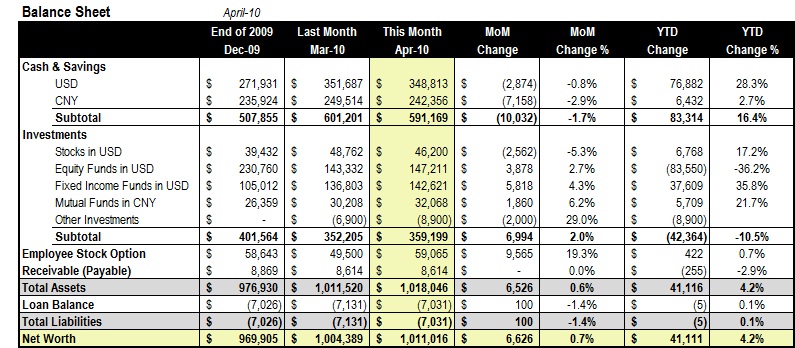

Thank you for all the nice words in response to my last post. Life is as usual even though our net worth is in 7 digits, but certainly the sense of achievement tastes good. Thank you for all the nice words in response to my last post. Life is as usual even though our net worth is in 7 digits, but certainly the sense of achievement tastes good.

As this uneventful month unfolds, our investment grew a bit and my employee stock option rose impressively thanks to a good quarterly earning release. On the other side, we chose to take advantage of a 5% discount by prepaying my son's private school tuition of $12,000 for the next year. All in all, we are still happy to report a net worth growth of 0.7%, or $6,626.

As a few of you have pointed out, we execute a very conservative asset allocation plan with only a third of our assets in investments with market exposure. Here is a quick run down:

1. Cash & Savings: In online savings accounts and laddered CDs, yielding anywhere between 1% to 2%.

2. Stocks in USD: Our only stock holding is 600 shares of Berkshire Hathaway Class B.

3. Equity Funds in USD: A handful of domestic and international equity funds from Dodge & Cox, Artisan, Vanguard, Oakmark, T. Rowe Price and alike. (Fund list: ARTIX, DODFX, DODGX, JAOSX, OAKMX, PRMSX, PRNEX, TAVFX, USAGX and VGENX.)

4. Fixed Income Funds in USD: A few fixed income funds with an emphasis on TIPS. I have an outstanding order to buy $1,000 of VIPSX every week. (Fund list: VIPSX, PTTRX, DODIX and RYJUX.)

5. Mutual Funds in CNY: A few equity funds investing in the China market. I have automatic investment plan of $350 per week.

6. Other Investments: Currently, it only includes a PUT option I sold to hedge my employee stock options holdings.

Compared to where we were at the turn of the year, we cut about a third of our USD equity fund holdings over the course of Q1. Obviously we missed out a lot of the bull market since last March, but we have better sleeps at night now. Still, given the right market opportunity, we might need to find good ways to deploy our growing cash pile. More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

wow, i dont think ive ever seen a spreadsheet with that much cash assets. is there a reason besides fear of loss that is limiting your exposure to the market to 30%? Looking at your spreadsheet is a kind of porn for me. I will never look that good on paper (although poverty has had the upshot of getting me looking good in the real world -- all that bike riding and less opportunity to snack).

Must be nice. Ever since my career hit the skids, I have no chance of ever even having a positive net worth. It's nice to know someone is prospering in this turdbowl of an economy. As this uneventful month unfolds, our investment grew a bit and my employee stock option rose impressively thanks to a good quarterly earning release. Looking at your spreadsheet is a kind of porn for me. I will never look that good on paper (although poverty has had the upshot of getting me looking good in the real world. Must be nice. Ever since my career hit the skids, I have no chance of ever even having a positive net worth. It's nice to know someone is prospering in this turdbowl of an economy.

_________________

Peterscott |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

Thank you for all the nice words in response to

Thank you for all the nice words in response to