By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | January 1, 2009 3:31 PM PST

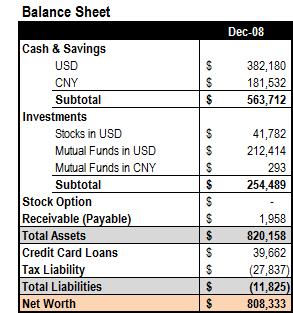

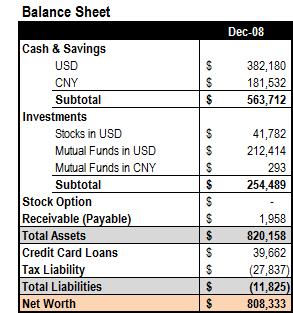

It's time to face the moment of truth. After a lapse of six months (which all of us want to forget), let's pick up again the monthly ritual of reporting my net worth. Here comes our balance sheet at the end of the year: It's time to face the moment of truth. After a lapse of six months (which all of us want to forget), let's pick up again the monthly ritual of reporting my net worth. Here comes our balance sheet at the end of the year:

The worst market performance since 1930s caught us as a victim too. After this carnage, our net worth is 80 grand less than the last time we reported. We also closed 2008 with almost $90k lighter than what we started the year with. What a year!

Several note on this:

1) We are introducing a new balance sheet format. The old format has been around for almost five years and hasn't been very useful now that our net worth and future income will be more dominated by investments (instead of job income and savings). The current view now clearly illustrated how much is at risk (i.e. investments that can lose value) vs. our cash pile.

2) Quite obviously, we have been cutting our investment portfolio since the summer -- back then, we have almost $600k invested in stocks and mutual funds. One important change I made is to drop all my individual stock picks with the exception of Berkshire Hathaway, which behaves more like a mutual fund (considering the diversity of the businesses the Oracle is holding).

3) We took our own share of (substantial) losses throughout the year too. If you recall that Money Manager Co., Perfect Future Publishing Co. and Expat Services Co. (all nicknames for our different income streams) still collectively yield a five-figure monthly net cash flow, it doesn't take a genius to figure out that our loss is much more than the absolute net worth decline of $90k since the beginning of 2008.

4) Our stock option is completely under water now, wiping out our paper gain of $98k at the end of 2007. Who can believe shares of the software behemoth is changing hands at less than $20 a pop?

5) The above losses explains the big tax asset line of $27,837 we have. It will take years for us to fully realize the tax benefit of our capital gain losses -- the tax law, as it stands now, only allows cash-out of a mere 3 grand of capital loss a year. Of course, I will be able to offset that with future gains, or otherwise I will still need to carry over the losses into my 60s :-)

So here we are, after our first-ever annual net worth decline is finally in the book. But 2009 will be a new year and will we have more luck? More PFBlog Articles You Might Find Interesting ...

|

Good to see you back! Good luck in 2009! I hope it brings us all better luck!

Wow - at first glance it seems you did pretty well given the large percentage of your net worth you had in stock investments. Would enjoy a deeper look at how you handled the past several months.

Thank you 2million. Not exactly a performance to be proud of. I'm still off about 20% if you add the $10K+ cash i added to the portfolio every month. Back in May, my portfolio is already heavy on cash compared to benchmark, and i unloaded another 10% during the summer. Still, a good part of my portfolio suffered from the October massacre :-)

BTW, congrats on the upcoming newborn!

MM - I'm glad you're back.

Do you feel that you're overweighting cash? Investment grade debt is yiedling > 6%. Having ~70% of your assets in cash at the age of 33 seems hyper-conservative. I'm glad you sold your individual stocks, though.

Would you explain your decision to abandon the blog for 6 mos? I know you travelled extensively for business, but with 'Perfect Future Publishing' generating such amazing cashflow, I'm surprised you didn't at least hire a ghostwriter to keep it alive. What happened to your advertisers in place when you quit posting?

I don't believe him for one minute. He says that he liquidated all stocks over the summer, which would probably make him the only American to do so. I think he is so battered that he's embarassed to come forward with the actual value of his holdings.

Are you telling the whole truth and nothing but the truth, when "It's time to face the moment of truth"? :-) If so, you are a genius investor.

Glad you're updating again. Truth be told, I took a year hiatus from reading your blog because we had a baby! A boy! But now, I will continue to follow pfblog closely <--my new year's resolution.

MM - why don't you have your customary month-over-month and year-over-year comparison on your balance sheet? Based on rough calculations it looks like you reduced your stock positions by about $610k from 12-31-2007, and increased your cash positions by about $465k in the same time period. Are you worried about missing the upswing when the economy recovers? Based on the 120 - age formula, you should have about 90% in equities, not 30%. With the P/E of the S&P, MSCI EAFE, and MSCI Emerging Markets in the single digits, and nearly 0% returns on cash/Treasurys, I would think you would be strategically moving back into riskier asset classes.

Why don't you provide monthly details during your hiatus? This is really fishy ... Do you expect all of us to believe this?

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:33 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|