By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | September 18, 2007 4:35 AM PST

If there were a longevity award for personal new worth tracking, I probably could get an honorable mention at least. By the end of last month, I have been tallying my net worth religiously at every month end for more than five years, including four full years at this blog.

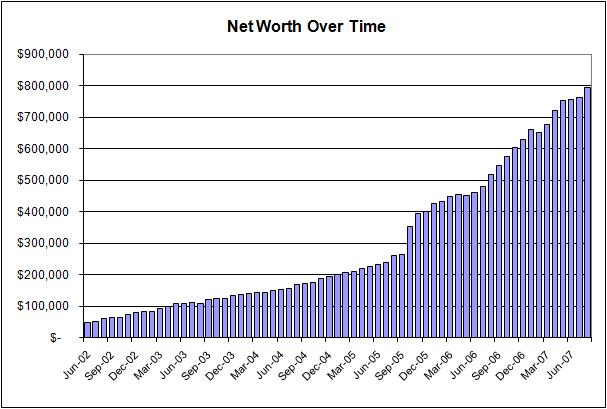

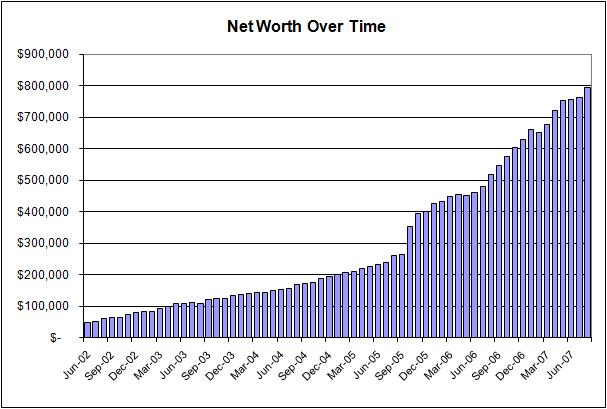

It is quite a ride by itself. As shown in the bar chart below, our saver's mentality did most of the tricks in the first three years, consistently adding about $5,000 a month. Then, we booked a six-figure gain in the fall of 2005 during when we sold our house and relocated to Asia. Thereafter, we started to have a more balanced portfolio of income streams. Our three income pillars, namely day job income, business income and investment income, are collectively delivering $20,000 a month on average since 2006.

When we started the journey, I estimated that it will take us until 2016 to break the million dollar mark. Obviously things went much smoother than we could ever imagine -- we are likely to cross $800,000 in two weeks, and knock out $1,000,000 no later than the end of 2008, a full eight years ahead of schedule.

Will $1 million gives us the necessary financial independence? Over time, we have drawn the following conclusions:

1) One million dollars alone is no guarantee of decent life forever for a couple in their early 30s.

2) But, given the fact that we have put efforts to establish reliable alternative income stream from our sideline businesses (Perfect Future Publishing Co. and Expat Service Co.), taking a break from my 9-to-5 life is not that much a financial stretch.

3) At the same time, we also realize that our safety margin is thin by definition if I choose to quit my highly-paid job, especially with another 50 years or more ahead of us.

So, by the time we arrive at our million-dollar milestone, we might need to choose between a few more working years to increase the margin of safety for our semi-retirement plan, or immediate relief from the corporate world but taking some risks afterwards.

That thing aside, a more fundamental question is: what should we do after we hit the magical seven-figure number in 2008? Will we find more interesting things to do to live a full life?

I learned more and more about myself as I grow up. I know I can quickly excel in areas that interest me -- over the years I have been successful in many different disciplines, including math, computer programming, customer service, corporate finance, people management, personal finance and creative writing/blogging. It also means I lack long-term dedication to any of them -- I cannot imagine I will work in the same line of business for more than five years. Equally important though, I realize the importance of family and relationships, and am living and expect to continue a balanced lifestyle.

Likewise, my wife is taking the same attitude about work/life balance. She has been very supportive of my career so far, moving with me over the years. She is also getting used to the stay-at-home mom role, while also getting a lot of fulfillment from her part-time job as a trainer and her involvement in some non-profit organizations.

Back to the question of our plan after 2008, honestly we don't have an answer yet. In the last few months, my wife and I have been discussing several choices after our financial independence, including a part-time consulting practice/professional training firm, a more formal online business, or more charitable efforts. Gladly, we still have a year or more to figure it out as this journey is et to unfold in a different dimension. More PFBlog Articles You Might Find Interesting ...

|

Hi,

congrats that everything went so quickly for you! It's a real pleasure to follow your blog.

You're mentioning that you are making about 20.000 USD both from your job and your two sideline businesses. How much is added to this by the sideline businesses alone?

That is awesome. Congratulations on 5 great years.

Congrats!!! In general, though, I would say that a couple in their 30's should do nothing more than have a nice celebratory dinner/vacation upon passing the million dollar mark.

By the time you're 60 it'll take $2.5 million to equal the purchasing power of $1 million today (assuming inflation stays low and steady at 3%). So you definitly can't afford to start living off that million. But you certainly don't have to beat yourself down saving either. If you don't touch your pot, it'll grow to be over $7.5MM by your 60's (assuming 7% growth). Which will be worth several million in today's dollars.

So if you have enough income from your side business to live off of, then go ahead and quit your job or do whatever you want. But I wouldn't start dipping into any savings anytime soon if I were you.

Congrats that is very impressive.

Volker, $20,000 is after expense and tax so I would't attribute a portion of it to a certain income stream.

That said, sideline businss income is now representing 25% of our income (including investment income) so far this year, and that's from 20% in 2006, 15% in 2005, and less than 1% in 2004.

Meg, you are definitely right. If I want to outlive the million, I couldn't touch my savings pot until at least 50s.

When I see your financial numbers, I shake my head in amazement and awe. Makes me want to re-read your past posts to see how you truly did it. Remarkable!

Not to brag, but I have you beat. I started tracking my net worth back in mid 1999, so I'm going on about 7+ years. Wish I started a blog to write about it back then! :-)

Congratulations - you've inspired many people, as anyone can tell by reading any comment on any of your posts. That is more impressive than tracking your net worth. I count myself among those you've inspired to track and plan. Congratulations again!

http://digaditch.blogspot.com/

Congradulations! It's my first time on your blog and i feel like just reading the whole of it piece by piece. You are so inspiring. I'm still in my early twenties and just got married and i think following in your footsteps won't be a bad idea. Thanks MM.

I have been trying to follow in the footsteps and it has been profitable for me. I am constantly learning from this blog.

I agree with ka-investor, I'm pretty much in the same position. Have been perusing your blog for about a week now and can't get enough of it! Keep the steady stream of updates coming, its definitely very encouraging.

Incredible indeed. If you don't mind, would you share your experiences on how you reached that goal? I know you mentioned the three legs of your income (formal job, sideline business and investment), but would you share some details for those who did not read the whole story for the last 5 years? Your story has been very inspiring indeed!

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:35 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|