By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | June 3, 2008 8:26 PM PST

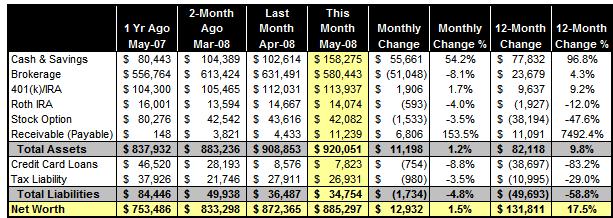

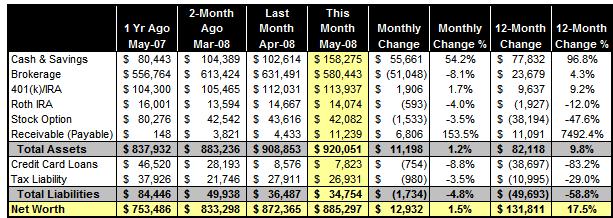

While our portfolio barely made an inch, we continued to save a substantial part of our take-home pay and this ultimately drove home a 1.5% net worth addition in May. While our portfolio barely made an inch, we continued to save a substantial part of our take-home pay and this ultimately drove home a 1.5% net worth addition in May.

Should I feel good that Our net worth winning streak is finally extended to the third months?

For the four full years between 2004 and 2007, there were only three "down" months in between. Now with our net worth changes are mostly governed by the market turbulence, our monthly performance is close to a coin toss lately -- exactly three "down" months and three "up" months in the last six months.

And this means my annual financial goal of $225,000 net worth growth is probably out of reach now -- our net worth actually retreated about 10 grand so far this year compared to where we ended 2007.

Now I actually don't feel too bad. If anything, the market condition and ensuing sea change in our net worth growth trend is a good wake-up call on how important it will be to manage the financial risks after our peak earning years. We are still fortunate that we are able to save more than 50% of our pre-tax income month after month, so we can definitely ride through this hurricane and come out stronger (both financially and mentally).

BALANCE SHEET

NOTES

- The family had a good time in Seattle and LA in our annual U.S. trip.

- My grueling double-duty day job life since January is finally over, for now. I am looking forward to spending more time with the family this coming summer.

NEXT STEPS

- The 2007 tax organizer has been on my to-do list for too long and I am committed to knocking it off this month.

- Now that I can take a breadth from the work, I will look at my portfolio management and take changes as appropriate.

More PFBlog Articles You Might Find Interesting ...

|

So, are you still on track to hit your $1M goal by 36?

Great achievement and you are close to becoming a millionare. One thing which I recently wrote about was having a passive income goal (ie how much are your savings and investment generating for you), as this is really a key barometer in determining when you will be financially free.

Nice to discover this blog as well!

Andy

Well Done. Quite an achievement!

Congratulations! Any change toward the positive is great news. Also wake up calls are nice to get at an early point where you have time to change things around.

I'll keep checking back in!

I just found this blog today. I don't know how long you've been working toward this goal, and how long till you are supposed to reach it. I would love to know what you started with and when you started with this specific goal... but tell me, at nearly 23, with a net worth of nothing because I'm in debt about 30K because of school, do you think I could make it to $1 M in 13 years?

Another Congratulations to you. $1M by age 36 - awesome! ATB.

Very nice, almost to $1mil! You'll reach your goal very quickly as soon as we get past this recession. It's been very entertaining to watch your progress, you provide great detail on all of your portfolio tracking sheets.

Best of Luck!

Odd Lot

Sounds like you are doing very well for a market that has gone done 20% since the October high.

Just found this website. Very interesting. I managed acure 500k in debt by 36, which i found extremely easy.

fakepaycheckstubs.com helping you help yourself!

God speed! Sanity comes in short supply these days.

God speed! Sanity comes in short supply these days.

Hi MM,

If I may ask, which brokerage do you use for your mutual fund investments?

Thanks

Amit

Hi MM,

If I may ask, which brokerage do you use for your mutual fund investments?

Thanks

Amit

Hi MM,

If I may ask, which brokerage do you use for your mutual fund investments?

Thanks

Amit

Sorry about the multiple comments. The post comment page results in an error, so I hit refresh a few times.

Amit

Congrats on your tough savings program. I see from your chart that you're mostly in your 401 and Roth IRA, though. I hope you're holding some metals somewhere too... or some foreign currency. Just a thought. You probably have some metals-related funds in there?

Another down month in the market, another non updated net worth report?

I remember in October getting mocked for saying he was too heavy in financial stocks.

My portfolio is up 63% since then.

Ho hum.

I remember in October getting mocked for saying he was too heavy in financial stocks.

My portfolio is up 63% since then.

Ho hum.

Dave - I remember! You were getting bashed by everyone that supposedly knew better than you... too funny.

If somebody was totally in cash now, what would you suggest they put their money into at this point?

Dave,

Probably true about Financials, however it is worth learning.

Do let us know, if you keep your portfolio in some place public, many including me would be interested.

Amit C

This is great, you are well on your way. Me I am just starting my wealth creation journey and I have the goal to be a millionaire by age 25 (2013).

Check out my personal finance website if you have time www.smarterwealth.net

This is a personal message to you since you didn't post my last comment. I realize it is your blog and you are trying to make some money but don't make it seem like you are so sure of yourself and that you know what you are doing in terms of investing relative to the rest of America because the bottom line is that you DONT KNOW WHAT YOU ARE DOING! You are gambling with your own money and it was an illusion that you were making money the past few years with your portfolio. The fact is most of the monies gained is from your own savings and will not be from investing appreciation because you SUCK. Sorry to be so blunt! Part of learning is to have the fortitude to post negative comments about your lack of investing knowledge so that other readers can be informed of how uneducated you are. Do you honestly think that people are going to follow your investment philosophies? NO. This blog is pure entertainment. The way you are going with your investments, all I see is DOWNHILL!

I will give you credit for posting my comment. However, what were you thinking heavily weighting your portfolio in the financial sector? Insight into your mindset would be enlightening....

I will give you credit for posting my comment. However, what were you thinking heavily weighting your portfolio in the financial sector? Insight into your mindset would be enlightening....

This is also a personal comment to you since you have not posted my prior posts as well. I used to actually enjoy ready your blog, it was one of my favorites. Now it is nothing more than a page of advertisements on which you post something every other month. You don't even post your monthly net worth updates anymore. Very disappointing...I am not taking this page off my list of bookmarks. Good luck to you in the future.

I used to read this blog on a regular basis, but the updates are too infrequent now.

Nice work even with the market downturn. I just discovered your blog here and am going to take a look around. =-)

Nice work even with the market downturn. I just discovered your blog here and am going to take a look around. =-)

Hey, Thanks for this great bit of research !This is such a great post - thanks for thinking of the concept and putting it together.

thanks!

Hey, Thanks for this great bit of research !This is such a great post - thanks for thinking of the concept and putting it together.

thanks!

I have enjoyed watching your progress. You are doing a great service to your readers. It would be interesting to know how many of your readers do their own net worth statement.

I just thought the fall of the market was so foreseeable.

The Asia financial crisis in 1997 - 1999 gave me the experience of questioning my assumptions of market bottom and vitality. In Malaysia, it went down as low as 20% of its peak. A long the down way (for one and a half year), we assumed a layer and a layer of bottoms only to see the index falling further down.

BUT, the recovery is swift and quick. The index went up four times higher than its bottom from Oct 1998 to end of 1999.

Such major fluctuation opens up a window of opportunities. Despair not, be ready for the upturn.

Be ready means, have cash and cash inflow to buy (stocks with good dividend)if the market fell further, BUT also to have stocks holding in hand too if the market went up. You will gain both ways, though not maximizing your return of assets.

It is not about maximizing return, anywhere, it is about balancing risk and return. Such a platitude, but it is solid wisdom. Those who went through asia financial crisis and subprime loan crisis will understand this. ;-)

I just thought the fall of the market was so foreseeable.

The Asia financial crisis in 1997 - 1999 gave me the experience of questioning my assumptions of market bottom and vitality. In Malaysia, it went down as low as 20% of its peak. A long the down way (for one and a half year), we assumed a layer and a layer of bottoms only to see the index falling further down.

BUT, the recovery is swift and quick. The index went up four times higher than its bottom from Oct 1998 to end of 1999.

Such major fluctuation opens up a window of opportunities. Despair not, be ready for the upturn.

Be ready means, have cash and cash inflow to buy (stocks with good dividend)if the market fell further, BUT also to have stocks holding in hand too if the market went up. You will gain both ways, though not maximizing your return of assets.

It is not about maximizing return, anywhere, it is about balancing risk and return. Such a platitude, but it is solid wisdom. Those who went through asia financial crisis and subprime loan crisis will understand this. ;-)

It is so true..... these rough times really remind you to manage risk, especially when you start inching closer to retirement, or to your net worth goal.

WHAT IS UP WITH THIS WEBSITE? IT IS DEAD.

Is this blog officially dead? I agree completely with the poster who commented that this blog has really gone downhill. Not only is new content rarely (almost never) added but all it has become is a page full of advertisements.

But to fl who posted his harsh criticism about MM's investing skills I have to say it isn't deserved. I agree that mm is not a great investor but I don't remember him every suggesting that he was. This is about HIS OWN personal finance. Granted he has lost a lot in his portfolio but so have many many people. I was one of the many posters who criticized him for buying into financials last summer when they first started selling off, in fact I think right now is still the wrong time however if you got in about a month ago I think you're pretty safe (most financials are much higher from their July 15th lows). We may see those lows again and even more but I don't think much more. Same goes for his pretty heavy emerging market exposure.

This is in response to JD...I realize that this blog is about his own personal finance however, if you read through some of his earlier blog posts he comes across with a certain hubris about his investment acumen. That in itself I suppose is also okay as there were many other novice investors who also lost a lot of money in this latest economic downturn however, if you are going to post positives then you should also maintain your blog and post your negatives. Like I've said earlier, since the inception of this blog he's never suffered losses of this magnitude and he's gleefully posted one update after another forecasting how much money he's made and isn't it ironic now that he hasn't posted at all for the last several months when his portfolio continues to crumble around him. He's stated that he's been busy with work but you know what? To maintain credibility in the blogosphere he needs to post when his portfolio tanks also. I mean it doesn't take that much time to post a few sentences once a month. This blog is finished.

I agree with FL, it's a shame MM stops posting when things go south. This ie exactly the kind of economic environment that makes net worth updates informative.

On the other hand; I don't think MM is alone is his ego protective attitude. Millionaire Mommy Next Door, for example, also stopped posting her net worth after the market, and especially her momentum strategy, went south. Combine this with the fact that her husband owns half the assets (you got to love early-retirement.org for being critical to her ego posts) and she isn't actually a millionaire...

MM might make a million by 36, but we won't ever know at this rate.

Back of the napkin calc shows a -$200K year so far from the start of year. So, that might make the goal of $225K this year but to the downside.

For the portfolio alone, another calc shows down -$94k since MAY. This is assuming the portfolio was not sold at the bottom in mid-July & held to today. If everything was sold on July 15th, would have been down $113k. So, recovered somewhat.

The education as I see it is as follows. Hedge your long positions with covered call options or buy some puts. Also, be flexible in selling like in March when market recovered from Jan. selloff. Buy & Hold can crush a portfolio without any hedging esp. one that is overweight a one sector.

Thanks for this great bit of research !Like I've said earlier, since the inception of this blog he's never suffered losses of this magnitude and he's gleefully posted one update after another forecasting how much money he's made and isn't it ironic now that he hasn't posted at all for the last several months when his portfolio continues to crumble around him.

Thanks for this great bit of research !Like I've said earlier, since the inception of this blog he's never suffered losses of this magnitude and he's gleefully posted one update after another forecasting how much money he's made and isn't it ironic now that he hasn't posted at all for the last several months when his portfolio continues to crumble around him.

Thanks for this great bit of research !Like I've said earlier, since the inception of this blog he's never suffered losses of this magnitude and he's gleefully posted one update after another forecasting how much money he's made and isn't it ironic now that he hasn't posted at all for the last several months when his portfolio continues to crumble around him.

fl and pj you make good points. I guess I haven't been following this blog as long as some of you but I have been following for at least over a year and do remember that MM was very quick to post his net worth updates when things were going well, now he's essentially abandoned the blog. And I guess I do see what you mean by that certain "hubris" and "ego" he used to display. I just shrugged it off though as another finance blogger who thought he was some sort of pro stock picker. They are a dime a dozen.

pj its funny you mentioned Millionaire Mommy Next Door. I was actually trying to remember what that blog was called a few weeks ago. I remember finding it around a year ago and reading through it and being hugely turned off by her ego as well as very skeptical about some things. For instance her numbers didn't make sense unless she wasn't paying her taxes or she had some big investment gains which I would ascribe to luck since she didn't know much about the markets. I find it funny to learn that half the money was her husbands, that explains a lot of it. And I'm not surprised she has disappeared just like MM when her portfolio has started heading south. I posted a very critical post back then on her blog and to her credit she did respond to me but she didn't really answer the questions.

As you guys say, they lose any credibility in the PF blogging community when they disappear as soon as their finances go bad.

Very good job ..

Congrats

I'm surprised MM wouldn't hire someone to keep this blog breathing, given that he has over 100,000 readers.

In its heyday, wasn't this thing making MM something like $50,000/yr, as a sideline business? Surely his plethora of advertisers aren't too keen on paying for ads on a site that hasn't been updated in 10 weeks.

Remember when this blog used to be updated? Ah, those were the good old times.

MM - if you want to pay me to write guest posts just let me know. You can contact me at the email address I provided when I posted this comment.

in the trading world, we say "he down size..."

Regardless of what is happening financially, there probably are lots of readers who liked the blog before all of the advertisers. And, there may be points of learning that could be passed on to the readers, which is probably a lot of why they read in the first place. Either way, a blog can't survive without regular updates. Take care.

Is this where the story ends? We gotta hear how you're navigating the current market conditions.

I wonder if he still owns AIG it is now around $12 a share and he onced owned 402 shares at $62

Excellent this site is great watching you get your goals.. What stocks are you looking to buy during this time of bumpy-ness ;)

After the big hit on the financials today, MM definately isnt comng back. who wants to bet?

I shall set up my own financial goal, hopefully it will work out something like yours.

Even though he seems to have abandoned his blog I hope he wasn't ignoring the market and sold out of his AIG position with at least a little something. He bought it at $62 and its now essentially worthless.

Even though he seems to have abandoned his blog I hope he wasn't ignoring the market and sold out of his AIG position with at least a little something. He bought it at $62 and its now essentially worthless.

I made a copy of his portfolio with where it stood in May and since then it has lost about $148,000 from those May prices.

Only down $148k, not bad. Is that down about 20%? The market is down 20-25% for the year so he is in line with where everyone else is.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:33 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|