By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | February 5, 2011 8:12 PM PST

January 2011 sees the 10 year anniversary of our marriage, and we celebrated this big event with a weekend gateway in a fantastic boutique hotel in Hong Kong, and a 1.4ct diamond ring from Blue Nile. It is a great trip indeed and a memorable beginning of our second decade together. January 2011 sees the 10 year anniversary of our marriage, and we celebrated this big event with a weekend gateway in a fantastic boutique hotel in Hong Kong, and a 1.4ct diamond ring from Blue Nile. It is a great trip indeed and a memorable beginning of our second decade together.

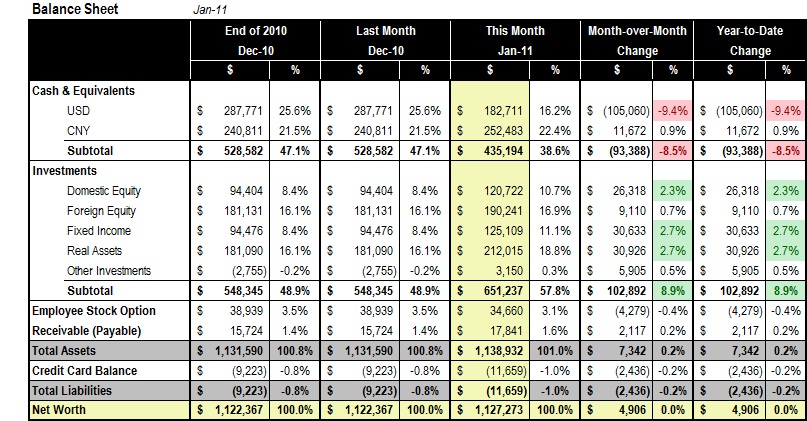

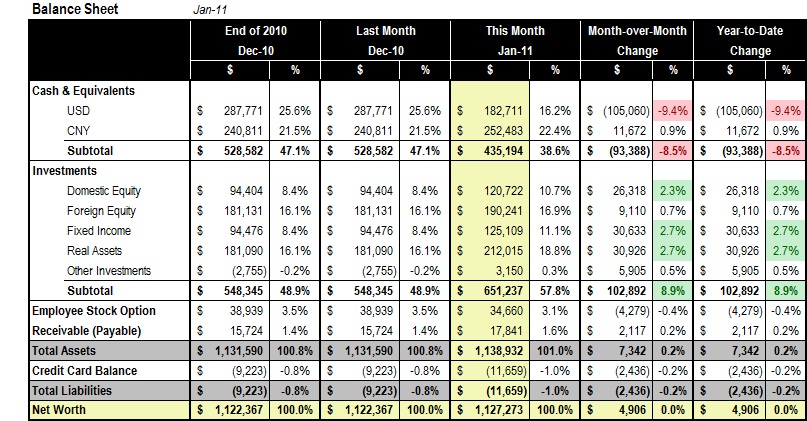

Back to the financials, our net worth inched ahead a modest $5,000 in January, despite the sizable cash outlay for the rock and the anniversary trip. We also put a lot of more cash to work in a variety of investment vehicles.

With the beginning of the new year, we are revising our monthly balance sheet format to better highlight the asset class mix in our investment portfolio. Here is our month-end tally in the new format:

A quick break down of the asset classes listed:

- Domestic Equity: Including stocks traded in the US stock market (BRK.B and JNJ) and mutual funds and ETFs with a focus of domestic equity (SDY, DODGX and FCNTX)

- Foreign Equity: Including various mutual funds targeting foreign equity (DODFX, JAOSX and PRMSX) and a handful of mutual funds in the China stock market.

- Fixed Income: Mutual funds and ETFs on fixed income vehicles. Most of our fixed income holdings are floating rate bonds funds (FFRHX and PPR) and mortgage REIT (NLY). LSBRX and LSGLX provide coverage for regular fixed income issues.

- Real Assets: A variety of funds of different underlying assets, including commodities (VGENX, PRNEX and DJP), gold/mining (USAGX), MLP (AMJ) and TIPS (VIPSX).

- Other Investments: Including some hedging positions.

January marks a slow start toward our 2011 net worth growth goal of $150k. How will the rest of 2011 treat us? More PFBlog Articles You Might Find Interesting ...

|

Be the First to Comment on this Post

Add Your Comments

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:31 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

January 2011 sees the 10 year anniversary of our marriage, and we celebrated this big event with a weekend gateway in a

January 2011 sees the 10 year anniversary of our marriage, and we celebrated this big event with a weekend gateway in a