By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | October 1, 2007 2:33 AM PST

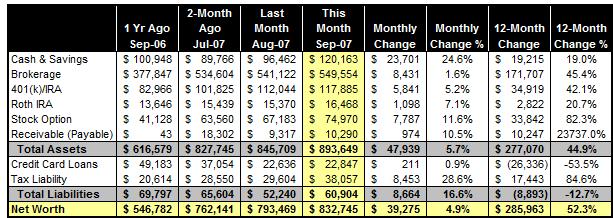

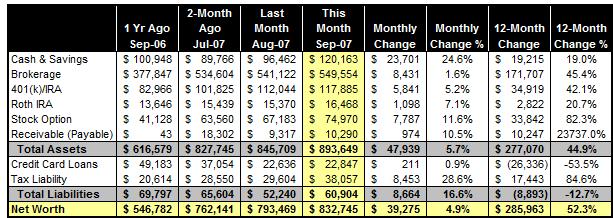

September is an exciting month to say the least. After the stagnating performance of the general stock market in the last three months, it finally rallied in the month and helped our portfolio to book a monthly gain of 3.7%, a record in itself throughout our systematic tracking of portfolio performance in the last two years.

The result: almost $40,000 addition to our net worth tally, boosting our month-end net worth to $832,745.

It is fair to say that we are now in the 8th inning of our multi-year quest for a seven-figure nest egg since the inception of this blog. After we broke the $400,000 mark at the end of 2005, it took us 8 months to gather the 5th $100,000, 3 months for the 6th, and 5 months each for the 7th and 8th. In other words, we more than doubled our wealth accumulations from our first 30 years of life in two years. If we follow the historical pattern, we will likely be able to finish the game with $1,000,000 in our bag in less than 12 months' time from today.

MONTH-END BALANCE SHEET

NOTES

- STOCK OPTION: Helped by the recovery of the general market and the successful Halo 3 launch, MSFT recovered a bit from August lows.

- RECEIVEABLE: We received the tax refund for 2006. However, we are still waiting for the $6,000+ tax refund for the tax year 2005. Other receivables include some medical and business travel expense yet to be reimbursed.

- TAX LIABILITY: Our tax liability increase is mostly due to the appreciation of our investment portfolio. We do take account of future capital gain tax exposure when we calculate our net worth.

WHAT'S AHEAD

- Another 0% APR balance transfer offer is about to expire in November. We are ready to repay the $12,000 balance back. Should I restart another round of credit card applications?

- With only one quarter left for the year, I need to assess our federal tax withholding status, and decide whether I should request to have more tax deducted from my payroll to avoid any inadequate withholding penalty.

- With the tax year of our C corporation ended in September, we are ready to file our corporate tax return. Actually it will be almost a blank sheet. We have no income (and only some small expenses) associated with the corporate entity now (we currently accept all income streams as individuals for now since it does not make a difference in tax consequences. Shall we keep the corporate shell alive? More PFBlog Articles You Might Find Interesting ...

|

Wow, what a month for ya! I think you might reach your goal by the end of January '08 at least in part because of the stock rally that is expected to last until the end of 2007. Your portfolio should benefit from that.

If I were you, I'd probably keep the corporate shell just in case: 1) You might have additional business ideas; 2) Longer "corporate history" is always beneficial if one day you will need to apply for a business loan, etc. Even if the corporation hasn't done much, such "history" can be helpful and you can always say "Established in 200*" even if it was dormant for most of that time.

Good luck!

So, now the $64 million dollar question is, "do you have the same buying power as you did a month ago?"

Being Canadian I couldn't help but notice the 6% decline in the US currency relative to the Canadian currency in the past month...

Wow - another awesome month.

I've been following your blog for a few months now, and I'd just like to say congratulations! $1,000,000 is certainly within reach. With the US dollar decreasing sharply in value over the past couple of weeks in particular and the last few years in general, have you thought about spreading your currency risks somewhat? Maybe worth thinking about going into Canadian Dollars, Euros or gold.

Deborah & Credit Risk: Good questions. Yes, obviously dollar will only be weaker for the next decade.

On my side, between the direct foreign equity exposure and overseas interest of the blue chip stocks I own, my portfolio has about 50% in foreign currencies. I found this to be a reasonable level for now. You two are absolutely right that one needs to consider the FX impact as part of the deal.

MM: I have to disagree with you about the U.S. dollar's weakness. Dollar's value depends in large part on the interest rate and it is likely to increase over the next decade. The rate cut a few weeks back was the first cut by Fed in the past 5-6 years. He might do another small cut if need be for market stabilization over the next 6 months, but overall he will keep on increasing the rate since it is certainly in the low range right now, historically speaking. As the interest rate will keep on increasing more investors, bank, and governments will flock here and buy U.S. currency, which in return raise dollar's valuation (supply and demand). So, in a nutshell, I believe the dollar will rise back over the next 3-7 years.

I find the currency comments interesting.

Having lived my adult life through a 20 year period where Canada was addressing its level of debt, a weak Canadian dollar and especially weak economy in British Columbia, well, I just tend to think weakness and larger debt in a much larger country is going to be a lot more challenging in the economy than people think.

Because BC had a strong resource based economy it did get hit hard, but its size is only 1% of the US.

A big country with an economy currently weakening and already not able to keep a cap on government debt, an aging population which increases government payouts and reduced the ratio of those working to those collecting social programs, which will make debt increase even more out of control...

I personally do not see how the US dollar gets stronger. If you look at what killed the value of all country's whose currency devalued it was because of debt.

In 10 years only about 1/3rd of the baby boomers will have retired and the burden of that increasing level of retirement is going to be felt for the next 25 years.

Canada has really worked on reducing debt and structuring tax policies to better respond to the aging population, but I suspect that our progress on dramatically debt will reverse without changes to our fiscal policy. And, we have much of our economy mixed with the US economy.

I should edit better before posting...

Fourth paragraph is just plain old badly written...

Last paragraph, dramatically reducing debt, Canada has reduced debt and for 2006 we paid down debt by $13.2 billion. When you are paying back debt you have a surplus budget.

With 7 figures inevitable at this point and presumably reaching that goal much faster than you had initially estimated, do you believe that you'll actually slow down your attention and resources towards wealth building or do you think the opposite will happen and you'll end up increasing your efforts?

Does 8 figures become a much more considered goal for you now this close to 7, especially when you aren't even in your 40s?

Wow - all I can say is you're an inspiration. You can't do a whole lot when your net worth is piddly like mine but, I guess once you have some breathing room - and a focused goal - you can speed up the process of wealth building.

If you get a chance to respond- Do you think you would base your success more on passive income & income streams or personal promotions and career growth? I think I know the answer but, I thought I'd ask anyway.

Creative Investor/Deborah: Thank you for the good discussion on currency valuation. I am a long-term dollar bear and unless the deficit is controlled, I see no reason dollar wil be stronger five years from now. Government is simply printing too much money to make the value each dollar in our pocket sustainable.

Reggie: In a grand schema of things, I consider trying different things and personal fulfillment as success, so money is only the vehicle toward some (unprofitable) things I can try, and career growth is only one source of personal fulfillment.

Sam Jones: I definitely won't think about 8 figure as a goal ... for the reason above. As long as I have a financial safety net to do things I like, I don't consider a particularly large number as a motivation.

MM, now that there has been some currency rates discussion above, may I ask you if you ever considered forex trading with a retail broker or otherwise, in order to diversify your investments and/or achieve some speculative gains?

Vic: currency trading is definitely out of my expertise. I don't think I can outsmart the "smart money" out in the market.

Also, Buffett once noted that holding foreign equity is a better investment than foreign currency, since you can benefit from both the exchange rate and the underlying business growth. This is exactly what I am doing here.

MM, I like how you have extreme savings habits and don't get lost in the numbers game. I think (fear) I would have a hard time slowing down in your situation.

Was slowing down after reaching certain goals (e.g. financial indepence) always part of you, or did you have to learn to limit (or broaden)ambitions? If so, what did help you the most in these changes? Wealth effects of your portfolio?

Just to know, as I fear I might end up accumulating wealth till I drop.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:35 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|