By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

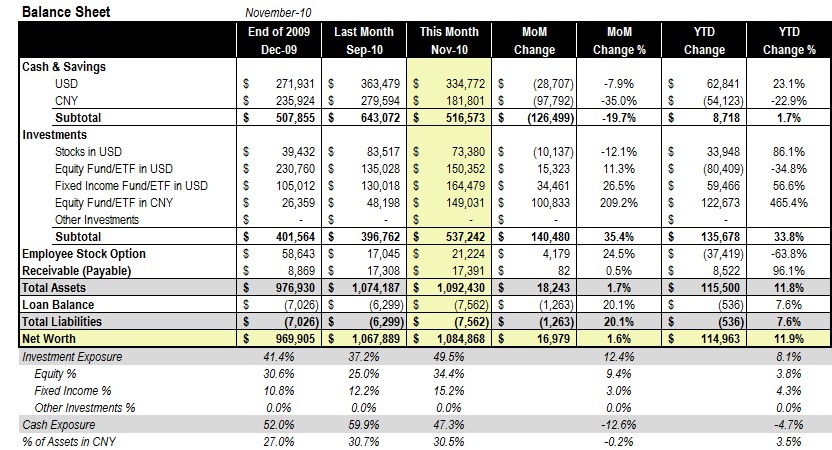

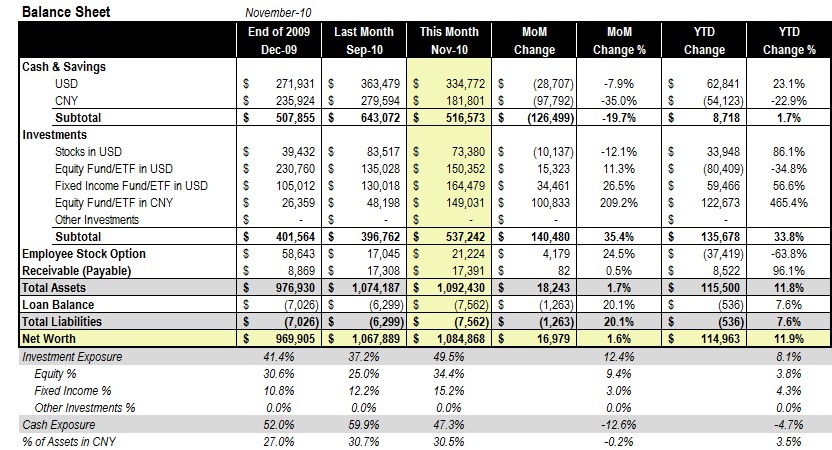

Contributed by mm | December 3, 2010 3:47 PM PST

(This is a bi-monthly update covering October and November of 2010.) (This is a bi-monthly update covering October and November of 2010.)

Our net worth continues to build up after it breaks the million-dollar mark in August. In the last two months, we have grown our asset base by $17,000, largely thanks to savings from job income and healthy investment returns during the period.

On the income side, it is worth calling out that my wife's freelancing job business is growing rapidly, and her income in 2010 already exceeded the full year proceeds in 2009 by over 70%. The steady income from that business is providing another meaningful leg to our financial house now.

On the investment side, we've substantially increased our exposure in the China market now that the market is hitting a new nadir after a recent dive. Other than that, we are adding some positions to some floating rate fixed income holdings but still park 47% of our asset in cash or cash-like vehicles. If anything, it seems the global economy will get worse before it gets better.

The holiday season is around the corner now and overall, we are happy of what we've achieved in 2010 both personally and financially. Some activities on the horizon:

1) Vacation: The family will relax in a beach-front resort in Guam during Christmas. Despite the craziness of life and the world, the family has expanded its footprint to more frontiers, including Dubai, Abu Dhabi, Niagara Falls, Boston and Epcot.

2) Personal Finance Software: With Microsoft finally cutting off the online data feed by the start of 2011, it is time for me to bid goodbye to the software that we have been using to track our financials since 2000. It'll be a painful switch to Quicken. Hopefully I can find time during the vacation to make a smooth switch.

3) Annual Planning: And with every new year, I will devote time for the annual financial planning. This year will be special as we are expanding our horizon to target a build-up of $3M asset base by 2020. How can we make 2011 a successful first year in our next 10-year plan? More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

Well done! I'm sure you'll get $3M as you plan! What's the liability? It's small relative to cash holdings. Can you just pay it off? Congrats on being $17,000 richer! |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:31 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

(This is a bi-monthly update covering October and November of 2010.)

(This is a bi-monthly update covering October and November of 2010.)