By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | March 3, 2010 8:38 PM PST

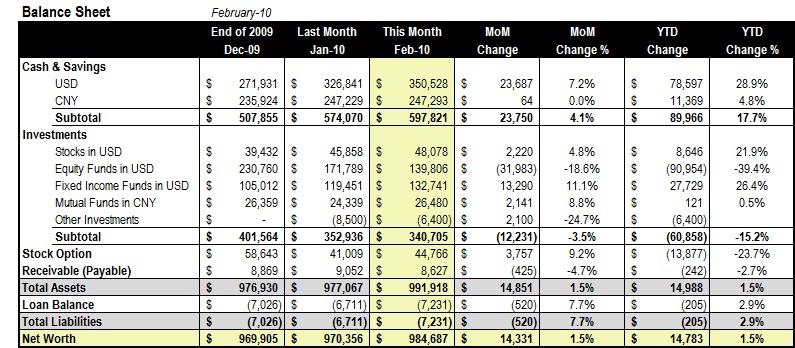

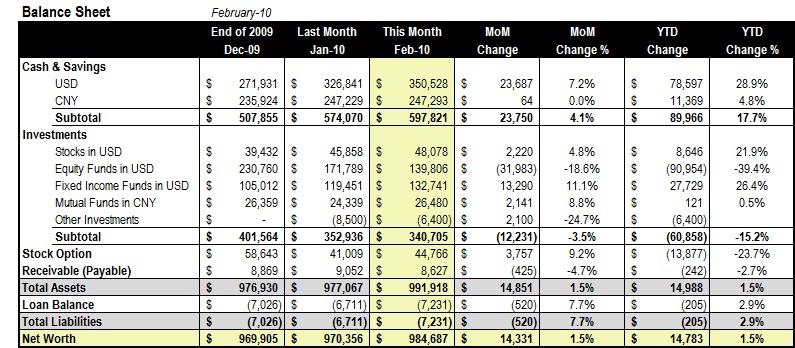

Here comes the monthly tally time again. Our financial life has been uneventful lately. We continue to save about $3,000 a month, and the rest of our fate is governed by the financial market. For this month, the market lifted all boats and my portfolio included, bringing our net worth number much closer to the million dollar figure. Here comes the monthly tally time again. Our financial life has been uneventful lately. We continue to save about $3,000 a month, and the rest of our fate is governed by the financial market. For this month, the market lifted all boats and my portfolio included, bringing our net worth number much closer to the million dollar figure.

I have moved away from the days when I kept streaming quotes on my desktop and spent hours and hours reading individual companies' annual reports. In the last two years, I'm adapting to a lifestyle where I predominantly only invest thru mutual funds (with Berkshire Hathaway as the only stock holding), and only look at my portfolio two or three times a month. (I do still read WSJ every morning to keep myself up-to-date of what's happening in the business world.) If anything, the financial turmoil in the last two years at least helped me to adapt to a much healthier lifestyle, even though it set me back for more than a year financially.

Without further ado, here is the month-end balance sheet:

And notes for this month's report:

1) I made a small modification to the balance sheet by splitting my USD-based fund holdings to equity funds vs. fixed income funds. As the table shows, I continued to liquidate my equity holdings while adding some back to fixed income funds. Of course, this is a personal choice -- the conventional wisdom is about to keep 60-70% of the portfolio in stock for my age, but I simply see no catalyst of the market goes much higher from where we are now.

2) The "Other Investments" row includes the "covered call" option we sold to hedge our employee stock option position.

3) Some asked why I didn't include a real estate line in my net worth calculation. The truth is I don't currently own a property. I sold my house in October 2005 and have being renting since.

On the personal side, February saw the coming of Chinese New Year, and the family enjoyed some good time in Dubai -- the city is a huge collection of man-made wonders and it's so much fun to see the desert, water park, snow park, shopping malls, fanciest hotels and tallest skyscrapers all in one week. Dubai is really a city for everybody. (And of course, if it fails to reorganize its debt, it will become a monument of our go-go days.)

Happy Tiger Year 2010!

More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

I am getting addicted to your updates. I am on a similar quest with the goal of $1M by end of this year. Couple of things I have done is separated 401k (tax free) and other investments. This helps me calculate how much I will have at retirement (with a hypothetical growth rate). With certain assumptions, I figured I will need $4M to 5M at the time of retirement to maintain the lifestyle. I have been following your posts intermitently and that was one of your best posts. Makes it doubly interesting for me that we are on such a similar path. My NW is about the same (I am 34), i have been moving out of equities over the last 24 months, I rent, and have adopted a halthier lifestyle. :-). All the best!

interesting stuff, I'm sure you've hit $1m intra-day and don't even know it..

Although you should probably note that you'll pay taxes for liquidating your holdings.. which will not make you a true millionaire..

but whatever.. you're prolly in the top 1% of wealth for your age.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

Here comes the monthly tally time again. Our financial life has been uneventful lately. We continue to save about $3,000 a month, and the rest of our fate is governed by the financial market. For this month, the market lifted all boats and my portfolio included, bringing our net worth number much closer to the million dollar figure.

Here comes the monthly tally time again. Our financial life has been uneventful lately. We continue to save about $3,000 a month, and the rest of our fate is governed by the financial market. For this month, the market lifted all boats and my portfolio included, bringing our net worth number much closer to the million dollar figure.