By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | October 8, 2007 6:51 PM PST

This is the second installment of the series "Running Household Finance As A Business". My goal in this series is to "examine our household finance under the corporate finance microscope," which, I hope, will bring up some new perspectives in thinking about personal wealth accumulation.

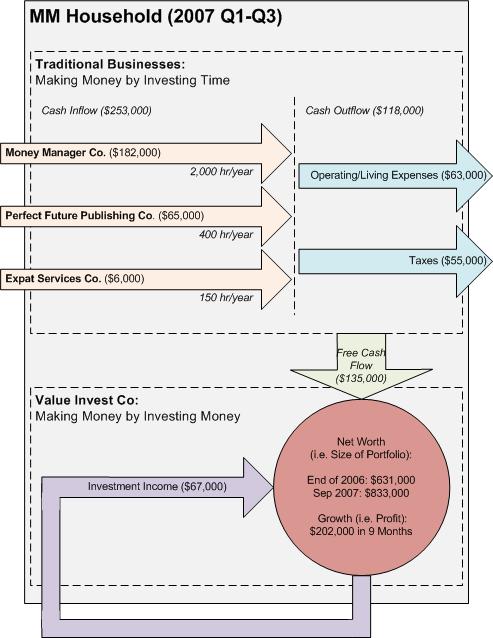

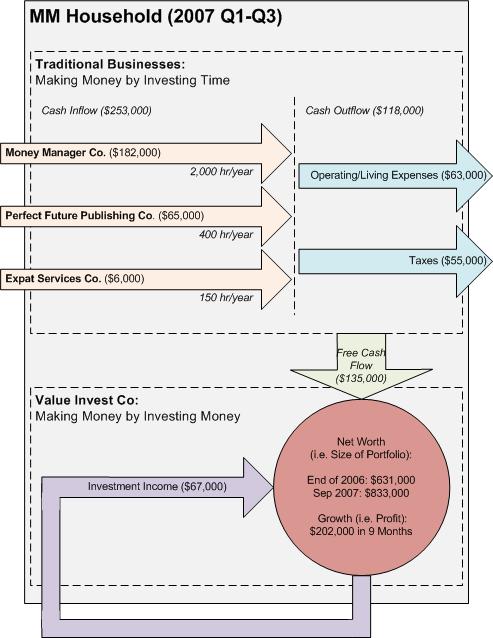

In the first part of this series, I devised some fancy names for our corporate structure, including MM Household as the umbrella holding company, and Money Manager Co., Perfect Future Publishing Co., Expat Services Co. and Value Invest Co. representing our diversified income streams. While I purposefully concealed some details of each entity, it suffices to know that our financial life is really complex, or for the lack of a better term, diversified.

In this chapter, I attempt to show how all these pieces work together as a money-making machine. Let me start by showing you a chart that describes how money flows through MM Household in the first three quarters of 2007.

So how should you read this chart?

First, I generally categorized our business to two parts: our traditional businesses (top half of the chart) are where we earn the "sweat equity" by putting in hard work and time, whilst the Invest Co. (bottom half) is where we circulate the free cash flow generated by the traditional business to our investment portfolio, and derive investment income.

Second, you may notice the dollar figures attached to the arrows that explain the relative size of cash flows. While I do consciously left out some insignificant details (like taxes or potential tax liabilities on investment income), these numbers on the chart are more than enough to show how the machine works.

All in all, I see this chart as a great framework for a company CFO (or household CFO, for whatever it means), to analyze the business and define a profit-maximization strategy for the long run.

I'll keep more commentary to myself for now and let you study the chart a bit more, before I share how I read the chart and how some conclusions drive the way we run this machine. More PFBlog Articles You Might Find Interesting ...

|

I know said it's for profit-maximization, but it actually looks more like a cash-flow chart, which is not really accurate if you're looking to maximize profit.

But anyways, as I see it: you need to see where your labor makes the most profit, that would be your Perfect Future Publishing where you make $162.50/hr. At the same time you need to look at margins of diminishing returns, meaning that just because you'll put in more hours doesn't mean you'll keep getting that $162.50/hr, it will probably go down. So, you want to find a perfect balance where you make the most of your time and that is probably what you're doing here, isn't it? :)

So, Money Manager Co. is your job-related income right? Since you have investment income coming in at the bottom of the chart?

Great concept, keep plugging at it.

Did I read this correctly? The website this year has earned $65K from ads??

Is that right? You are making $182k salary for three quarters? It means $240k a year! You are out of middle-class status already!

Wow, saving 53% of your gross is incredible! Congratulations.

Trudy, I think he has a whole network of sites so it's not just for ads on this one site.

I really enjoy reading this series of your blog. This is an excellent way to look at your personal finances.

Great post. I really like the diagram too.

Perhaps you could include your charitable contributions in a future graph. With $200,000 in net worth growth in 9 months, any significant percentage of that to philanthropic causes each year could make a large impact.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:34 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|