By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | February 1, 2009 12:30 AM PST

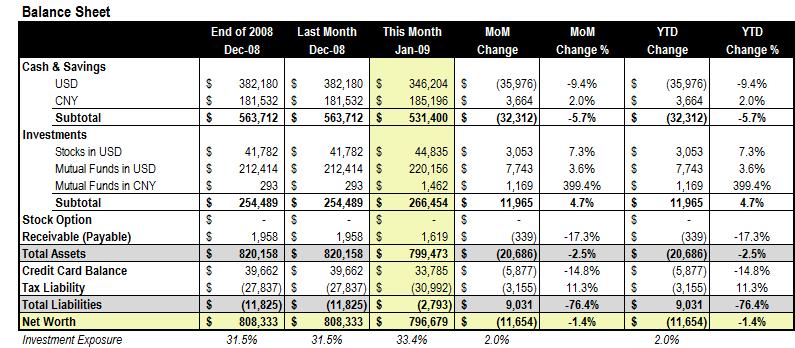

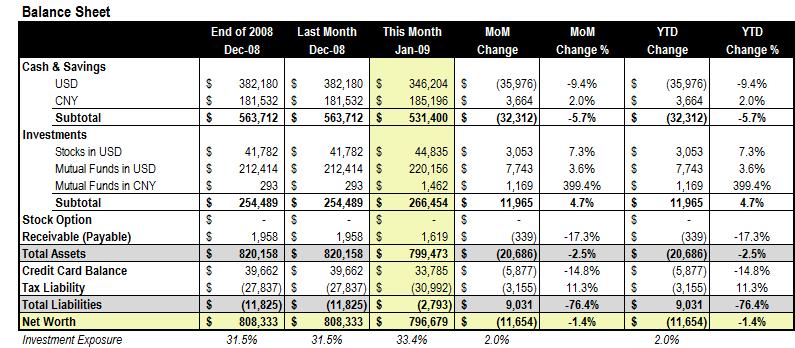

We continued to live below our means and save a huge portion of our income. But even though our portfolio is only mildly exposed to equity investments, we still took a hit from worst market performance in any January since 1928. As a result, our net worth retreated 1.4% and dipped below the $800k mark. We continued to live below our means and save a huge portion of our income. But even though our portfolio is only mildly exposed to equity investments, we still took a hit from worst market performance in any January since 1928. As a result, our net worth retreated 1.4% and dipped below the $800k mark.

On the other hand, our mutual fund automatic investment plan is in its full throttle. $23,000 net purchase was made in the month, bringing our total investment exposure as a percentage of net worth by two points to 33.4%.

BALANCE SHEET

NOTES

- The entire credit card balance is in 0% APR balance transfer deals or spending in the last 30 days.

- Tax liability grows as a result of incremental investment losses.

- Life still goes on … the MM family is celebrating Chinese New Year in a beach vacation in Hawaii. We are off to see the volcano! More PFBlog Articles You Might Find Interesting ...

|

MM - Do you perform any budgeting and projections at the beginning of each year? What are these looking like for 2009?

Completely off topic here, but with the economy and all ...

Does it make sense to pay down on my mortgage by making extra payments if I plan t sell the house in 5 years or less?

Michelle, the short answer will be: if you will still have a good cash cushion for unexpected emergency, and you cannot find better use of your cash (say credit card repayment, or any other higher interest rate loans, or taking risks in stocks, etc.), it doesn't hurt to hasten some mortgage payments for predictable gain.

THANKS MM I really appreciate it, I'm trying to learn ways on how to leverage my money so that i can have more disposable income...any ideas?

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|