By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | September 7, 2007 3:59 AM PST

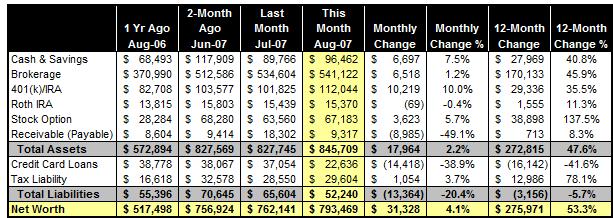

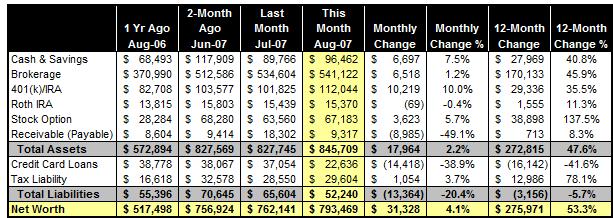

After two months of lukewarm net worth growth during the summer, our household finance is back to the fast lane. The $31,000 monthly increases makes August the second best month of this year so far.

I have to admit it is partially driven by seasonality -- every August, a few batches of stock option and stock award grants will vest in my account, and even after some hefty tax (up to 46%), it represents some handsome income. Also, the annual bonus payout didn't disappoint me. On the other hand, although the global stock market was quite a ride in August, my portfolio ended up literally at where it started in August. My $3,000 gain was cancelled almost fully by the loss in vested stock options.

During the two thirds of 2007 that is now behind us, we have added over $160,000 to our net worth figure. This includes about $130,000 from savings of multiple income streams and $40,000 from investment income, offset by $10,000 loss in stock option value. Therefore, we are slightly ahead of the game in our annual pursuit of $230,000 net worth increase.

MONTHLY BALANCE SHEET

A few footnotes:

- We made a $10,000 contribution to my Self-Employment 401(k) account for tax year 2006, hence the substantial increase in our 401(k)/IRA bucket.

- We also finally filed our federal tax return for tax year 2006, and received about $4,000 from my employer to make up for the difference in tax law changes in 2006.

- We paid off more than $14,000 of credit card balance from 0% APR balance transfers completed in the prior year since the introductory period is coming to an end. (Out of the remaining $22,000 balance, another $12,000 will be due in November, and the rest is in 1.9% APR life-time deals which I don't plan to pay off in this decade.) More PFBlog Articles You Might Find Interesting ...

|

Nice increase! Those stock options are a big benefit, too.

August was a wild ride, until today things seemed to have stabilized. That is the problem with these markets - just when it looks like you can relax Mr. Market comes with an uppercut to the jaw - good thing for a risk adjusted portfolio.

Jeremy

Wow, It must feel pretty good as you inch closer to the goal and in the very near future the 800K mark - I am amazed at your hard work and maybe, with any luck you'll have reached the main goal by the end (or the middle) of next year. Keep up the excellent work.

Question: Why do you decide not to put real estate into your net worth calculation? Do you rent or are you against considering home equity as part of your net worth?

Mich -- I don't own real estate in the first place. I sold my house in late 2005 and am renting now.

What exactly do you consider Receivable (payable), I'm confused by the wording?

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:35 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|