By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | April 2, 2007 1:45 AM PST

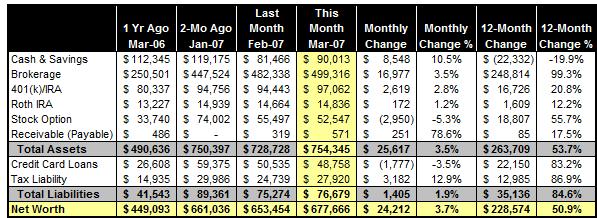

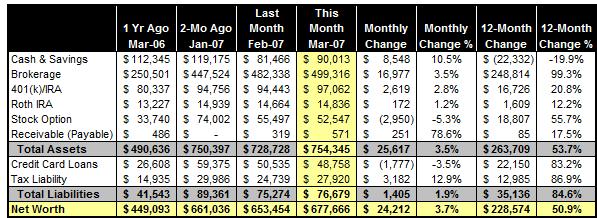

The dip in our net worth in February is, as I correctly predicted in last month's summary, no more than noise in our march toward financial independence. Helped by a rebounding stock market and a surge of business income, our assets grew more than $24,000 in March. This also concludes the first quarter of 2007, in which our net worth improved by over $46,000.

At $677,666, shall we celebrate this minor milestone that we finally amassed two thirds of a million bucks?

MONTH-END BALANCE SHEET

COMMENTARY FOR THE MONTH/1ST QUARTER

- Our investment portfolio gained almost $13,000 in March, and a total of $16,000 for the 1st quarter. Our 2.2% year-to-date return also handily beat the 0.2% increase in S&P 500 index and put us on the right track for our annual goal of 8% before-tax investment return.

- Our sideline business is again celebrating another five figure income for the month. Our Q1 revenue adds up to $28,000, which is way ahead of our annual goal of $80,000. At this rate, we are very likely to achieve six figure annual revenue for the first time in 2007.

- We also controlled our expense very well in March. Our monthly spending of $6,000 is the second lowest in the last 8 months.

NEXT STEPS

- I'm waiting for KPMG to run its scenario analysis on whether I should contribute to my self-employment 401(k) for the tax year 2006.

- My wife's laptop is nearly broken, so we are in the shopping mode for a new one.

- The family is also planning for the third family trip of the year in June or July. We are looking at a few places in the North America this time. More PFBlog Articles You Might Find Interesting ...

|

That's absolutely amazing that your sideline businesses are grossing almost $10k a month. Very few households generate that kind of revenue in total. Would you ever give a revenue breakdown among your two sidelines? I'm still confused, but I'm guessing that Perfect Publishing and Expat Service are the two activities that we could call your sideline businesses.

I'm amazed that the blog is able to generate so much cash, given that you're now only posting original content about four times a month, and one of those posts consists of the net worth analysis.

Can you pls tell me how you update your finance information. Is there any tool to automatically update your bank, credit card etc. info and generate reports like you have here or do u do it manually?

I have seen Microsoft Money, but the reports generated are pretty basic. It's wonderful to have a history of previous year's data to do a comparative evaluation with the current year's performance. Any pointers are well appreciated.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:36 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|