By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | August 4, 2007 6:45 PM PST

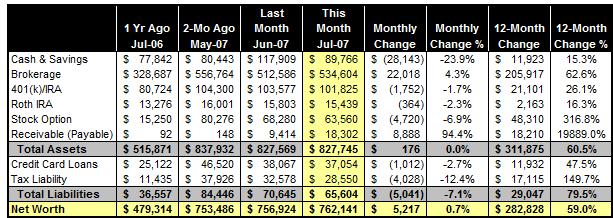

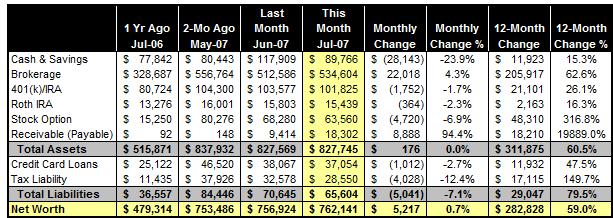

The month of July is quite a drama. For the first 20 days, we were bathed in the best financial sunshine we had in recent memory: I received a couple rounds of unexpected bonus from my employer, and our sideline business was defying the gravity of slow summer seasonality and logged impressive sales. Moreover, with the Dow setting the all time high in July 19, our stock option account and self-managed account were, at one time, worth $30,000 more than they were at the end of June.

But it ended pretty fast too. With the final confirmation of the burst of housing bubble once supported by easy lending practices, and the ensuing credit squeeze and massive asset revaluation in all financial markets, our portfolio suffered massive losses. So, in the end, July was quite a disappointment -- we were only able to add a disappointing $5,217 to our net worth in this chaotic summer month.

Still, I'm positive of our capability to grow our net worth much faster for the rest of the year. For one thing, August and September are when I will see more bonus and the annual vesting of employee stock award shares, so if nothing else, I will expect more cash flowing to our bottom-line.

Also, although our July investment loss of over $13,700 is only dwarfed by a slightly heavier monthly loss back in May 2006, we are still committed to staying in the market. Even with the July loss, our investment gain in the last twelve months is in six figures. If the price is right, we are ready to move a good chunk of our cash positions to equity.

MONTH-END BALANCE SHEET

Notes:

1) Our credit card balance of $37,000 is almost solely from 0% or low APR balance transfers. Long-time readers probably remember I took almost every offer I could get in last summer, and the arbitrage of borrowing at almost no cost and earning interests at about 5% APY is quite profitable in the past year. However, many deals will expire in the next 30 days, and I will of course repay these loans before credit card companies can get a dime of interest from me.

2) Our receivables are piling up but it is not a window dressing. The $18,000 receivable row includes over $10,000 in expected tax refunds for tax year 2005 and 2006 (believe it or not, a technical issue prevents me from receiving 2005 tax refund after I filed the return in early 2007), $4,000 in the after-tax value of the announced but not yet received unexpected bonus (on top of the regular annual bonus in September, which I don't know the amount yet and therefore haven't accrued for it), and some business expense waiting to be reimbursed.

WHAT'S AHEAD

- I still need to mail my check of over $10,000 for 2006 tax year Self Employed 401(k) contribution. I can only file my 2006 tax return after that, and claim my tax refund (and employee tax assistance).

- As mentioned earlier, I will repay about $15,000 in credit card balance that will soon cost me much more than the current 0% APR I have been enjoying for almost a year.

- I anticipate the vesting of one final round of stock option grants and another four rounds of stock award shares (i.e. restricted stock) in the month of August. Also, I'm waiting for a big paycheck in September that includes the annual bonus.

- Last but not least, you probably noticed the massive face-lift of the PFBlog website. It is 90% done now, but apparently I still need a bit more time to complete the work. With the completion of 6 weeks of travel in the last two months, I will have more time to read and write more content (and spend more time with the family). More PFBlog Articles You Might Find Interesting ...

|

slick new site layout, much better

Who do you use/recommend for a Self Employed 401K?

Hats off on your investment return performance -- you seem to have done much better than the market indexes.

Normally a net worth statement includes additional items such as FMV of art, hobbies and collectibles, Funiture and fixtures. jewerly, cash surrender value of life insurance, auto etc. You may be shorting your net worth by as much as 50K. You still are in need of a little spec stock to round out your investments. Do DD on Frpt will double your investment by year

end. Won,t be long till you hit the first million. Enjoy your trip. Bill

Second though. The FMV of your side business is a bona fide asset. Should be included on balance sheet. Your worth more than you think, on a conservative basis. Think about the real value here. Great month . Bill

Its an interesting strategy to use the 0% offers ($37,000!), I might have missed the previous discussions but did you put the money in a CD or in investments?

Brian, I use Fidelity for my SE 401(k) accounts.

William, good point. I actually do not own a car and life insurance other than term life. Yes, I can account for the furnitures and jewelry but it will be too trivial to count them.

"Sharemysite", yes, I put them to online savings account that usually yields 5% or so.

Ok, several rounds of bonus? I don't even know what that means. Anyone who claims their net worth grew in July 2007 is just a liar.

First time visiting here, impressive, I have to say.

Just from curiosity, up to now, how much of your total asset comes from salary/bonus/business (like this site), and how much is from investment?

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:35 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|