By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | January 2, 2007 7:29 PM PST

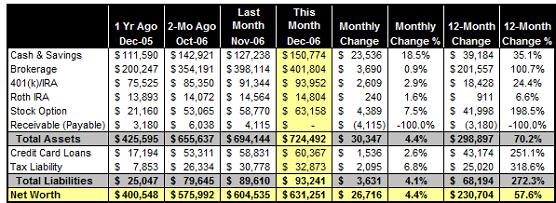

December is another strong month in which we benefitted, again, from robust portfolio performance, stable job income and business income. With $26,716 increase in our balance sheet, December marked the seventh consecutive month of five-figure monthly net worth growth.

We are really glad 2006 is finally behind us! For the full year, we increased our net worth by over $230k or 57.6%. This spectacular performance is beyond our wildest guess when we set our financial plan earlier this year. We hope 2007 will be as good.

MONTH-END BALANCE SHEET

HIGHLIGHTS OF THE MONTH

• Portfolio: Our $700,000-strong portfolio returned almost 2% for the month. Our heavy exposure to international equity market, and our core positions in ConocoPhilllips and Citigroup continued to shine.

• A took a week-long do-nothing break during the Christmas week. This helped me to think about what I will do once I have financial independence. Unfortunately but not surprisingly, I found I have no idea how I can consumer my time meaningfully once I get my 8-hour-a-day in the job back. This is of course not a personal finance topic, but I might need to figure it out in the next couple of years.

NEXT STEPS

• I will be more methodological in managing our growing portfolio in 2007. I'm considering setting up monthly cycle to review my portfolio regularly and consistently.

• We have a couple of family vacations lined up. We will have a short trip to Hong Kong so my 5-year old will meet his cartoon friends in the Disneyland. We are also planning a trip to Bali, Indonesia in late February. Should be fun! More PFBlog Articles You Might Find Interesting ...

|

MM, I noticed that your 401k/IRA advanced 24.4%. Did you add any money to your 401k/IRA during 2006 or was the 24.4% increase due solely to investment gains?

Sharp eye! I made a $3,000 contribution in November to my Self Employed 401(k) account with Fidelity. Everything else is investment gain.

You have a "Self Employed 401(k) account with Fidelity" and stock options?

MM, would you be willing to shed light on which funds you chose for your 401k. You did great in picking the right stocks for your individual investments, i'm wondering how well you're fairing for the 401k mutual funds.How often do you alter your 401k distribution? and out of curiousity, What % of your income do you contribute to your 401k program. Great job on the blog, keep it up.

MM,

Good luck iwth the investing. This is very motivating for other investors and savers.

Do you think you could separate out the savings from investment returns?

It would be more helpful to understand what's happening.

Also, in your pledge to be more systematic - do you think you'll move toward a formal asset allocation plan or remain an active value investor?

Regards,

makingourway

I should start investing. Very insightful blog! I'm just not sure where to start.

Where exactly have you parked your cash and savings to return over 18%?

Thanks

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:36 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|