By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | October 5, 2010 8:07 PM PST

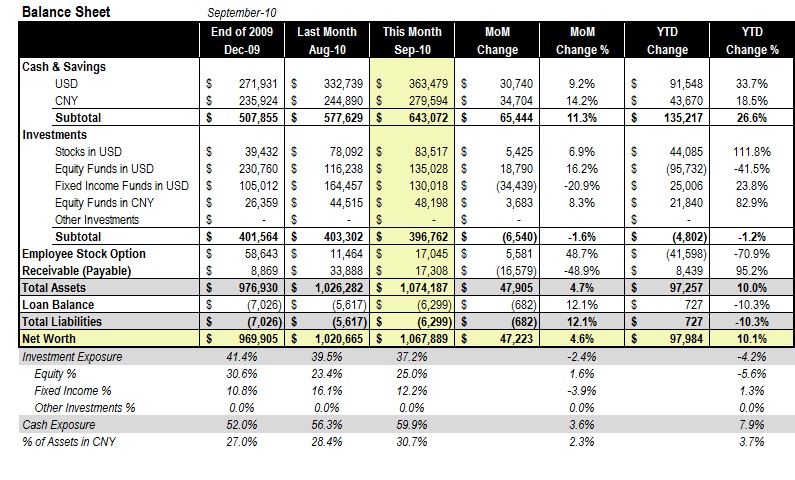

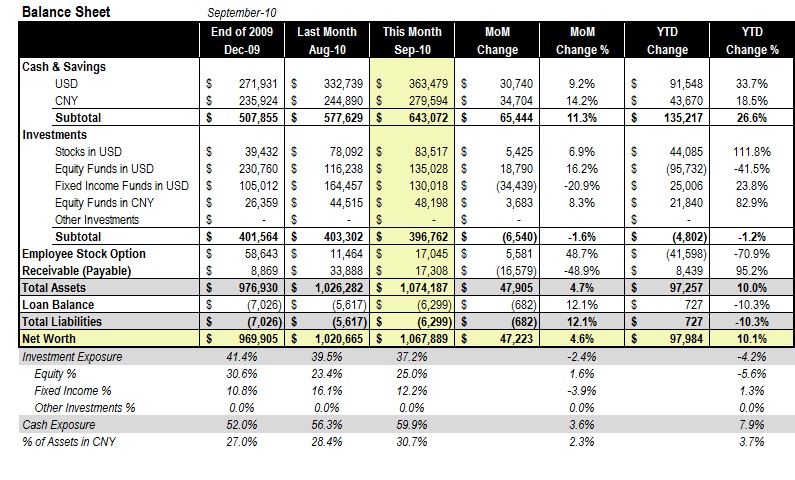

Our net worth took a great leap forward in September, thanks to the bull run in the stock market and a lower-than-expected tax on my annual cash bonus. With the September monthly gain of over $47k, the largest in three years, we have grown our assets by almost $100,000 since the beginning of the year. Our net worth took a great leap forward in September, thanks to the bull run in the stock market and a lower-than-expected tax on my annual cash bonus. With the September monthly gain of over $47k, the largest in three years, we have grown our assets by almost $100,000 since the beginning of the year.

We are maintaining a cautious stance in managing our investments, parking almost 60% of our portfolio in safest money market accounts or alike that yield between 1% and 2%. Of course, this is not an offensive strategy, and certainly means some missed opportunity in the recent bullish market environment, but it also gives us many good nights of sleep. With so many clouds over the world economic, we are not seeing a clear risk worth taking at the moment.

After all, we probably didn't miss a lot -- the stock market ended the September at the level where it started the year, but those with a committed stock holding probably had a rollercoaster ride so far.

Notes:

1) With the declined yield in intermediate and long-term bonds, we are seeing a deteriorating risk/reward profile for fixed income investment. Hence, we sold a large chunk of our TIPS holding at VIPSX in September, hence the decline in USD fixed income category and the increase in USD-denominated cash.

2) I have received the annual cash bonus. Even though we accrued the after-tax amount of the bonus in the "Receivable" line last month, the actual after-tax payout is higher than we expected, resulted in an imbalanced decrease in Receivable line and increase in the CNY cash line.

3) I'm getting extremely busy with my day-time job lately, as I'm taking an ownership to launch a new brand in a larger market in November. I cannot wait for it to pass and enjoy our scheduled Christmas vacation in Guam.

More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

I have followed your post even since it had been mentioned in "businessweek"???.

You did a very good job at such a young age. However, i noted you has never meniotned your thoughts on the real estate market. If you bought a house in shanghai couple years ago, the number would be much better. 4,6 % M/M change... it is really, really good profit. Congrats! I am always curious as to what portion of your reported gain is from an increase in contribution vs. true investment gain. Would be great if that were presented or tracked. If the bulk of your YTD gain are infact from your savings - that is great but it might be reflecting an underlying performance issue on your earning assets. After all your goal is to be able to have your money work for you and not the only the way. I agree with Jay. For example, if you take out bonus and income out of August, what was the actual performance (since the market was mostly down in that month). Good question. My YTD investment gain is about $36k. Not market beating for sure, but still reasonable considering my conservative stance. Hi

I've been following your progress for a couple of years now on and off. One thing I want to know is why you have FX exposure to the USD and CNY? Seems a odd combination (unless you work there are a Chinese national).

Thanks UHNW, yes, I'm a U.S. permanent resident current working in China. This makes the financial planning double the pain and double the fun :-) |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:31 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

Our net worth took a great leap forward in September, thanks to the bull run in the stock market and a lower-than-expected tax on my annual cash bonus. With the September monthly gain of over $47k, the largest in three years, we have grown our assets by almost $100,000 since the beginning of the year.

Our net worth took a great leap forward in September, thanks to the bull run in the stock market and a lower-than-expected tax on my annual cash bonus. With the September monthly gain of over $47k, the largest in three years, we have grown our assets by almost $100,000 since the beginning of the year.