By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | December 30, 2009 10:36 PM PST

It's an awful long hiatus since I last updated my monthly net worth tracker. Admittedly, I fell prey of the psychological denial when the market crashed in 2008. For quite some time, I avoided reading my brokerage account statement and refused to watch CNBC. It's an awful long hiatus since I last updated my monthly net worth tracker. Admittedly, I fell prey of the psychological denial when the market crashed in 2008. For quite some time, I avoided reading my brokerage account statement and refused to watch CNBC.

So I hunkered down. I wasn't in a very good mood to spend time refreshing this blog. And with the first-ever massive layoff announced by my employer, I also put significant more time to my job -- luckily it has been secure all the time and still yielding handsome cash flow.

Like many others, it's a great relief to me to see the gradual market recovery since this spring. While my confidence hasn’t been fully recovered, it is probably good time to recognize I made mistakes and re-embrace the responsibility to manage our money forward.

Fortunately, during the long lapse, I still keep track of all financial matters in Microsoft Money. So it's good time to take a look at what happened in the last three years:

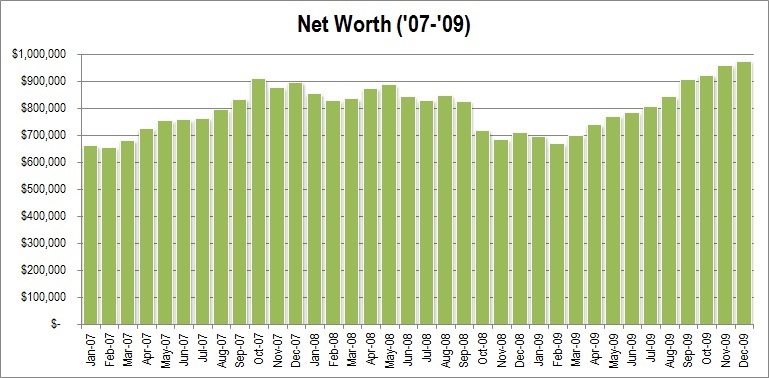

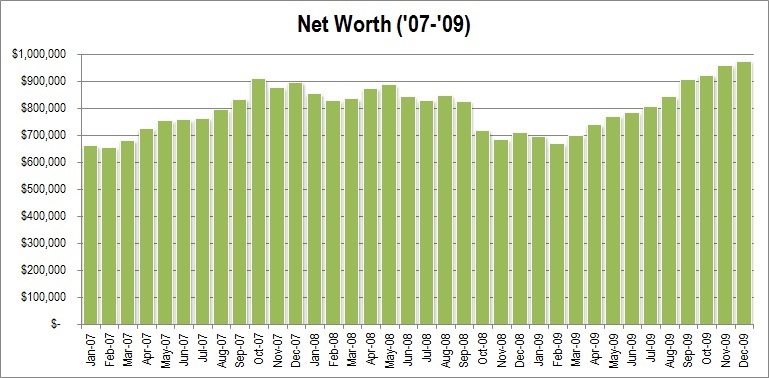

A quick reply: after touching the 900s in October 2007, our net worth went through a choppy downward ride for almost year and a half, until climbed all the way back to the high 900s as of today.

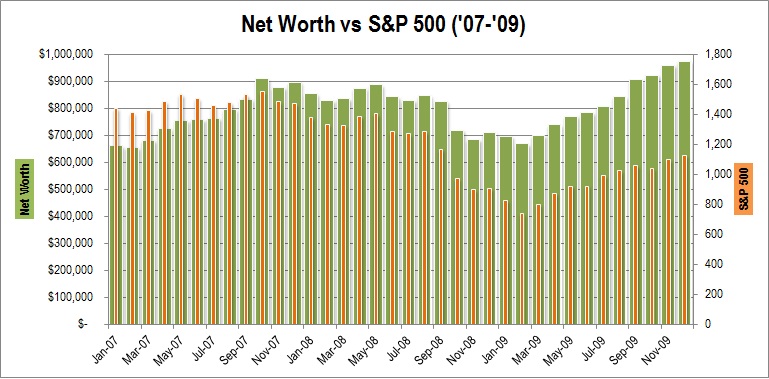

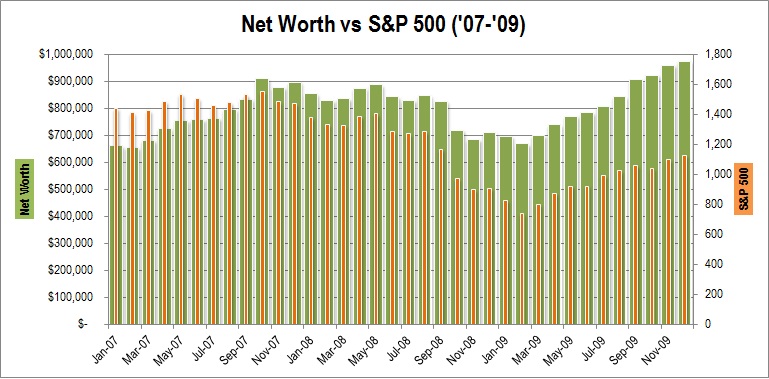

A more revealing view with the net worth chart compared to S&P 500 trend:

Obviously, with a large portfolio, it is the random walk in the stock market that decides our month-to-month net worth moves. On the other hand, with the index returned to where it started the decade, our long-term net worth growth is more explained by our savings habits.

In retrospect, I feel blessed that this financial tidal wave happened to us when we were still in our 30s. I certainly learned a thing or two. And if the same thing happens again in our later years, I probably have some memories to refer to. After all, personal finance management is a life long sport, and we are just at the first quarter of the game. More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

Thanks for giving the update so quickly! I hope not but I think the stock market will prevent you from reaching 1 million in 2010. Welcome back!! Been a long time, but it looks like you have been doing pretty well - I assume well get updates about location - back to US? Did you purchase real estate? I think it is a false recovery based on government spending. It seems to be that around the world governments have put taxpayers so much more deeply in debt, if it was turned around today, it would take a generation to fix. I am surprised that governements have be able to continue to borrow at the rate they borrow at. But, debt is "spending" tomorrow's jobs today and has huge consequences for future generations.

I got out of the market in Nov 2007 and I do not see any kind of foundation to encourage me back in at this point.

But, good luck with your recovery. Welcome back! How are you changing your strategy going forward? Who do you trust and what is your plan this year to recover? Would be great to learn some of that. Our net worth has tracked very much the same way as yours. While we watched our investments shrink dramatically, we withstood the urges to bail and, in fact, bought more as it went down. We are now feeling pretty rewarded by our commitment and are seeing our net worth number come back nicely. The one area we are getting hurt most is in real estate. Owning two houses has proven to be a bit of a black eye on our net worth. The good news is, like you mention, it's a lifelong sport and we'll be reacting to this by investing even more heavily in the market (via mostly low cost index funds in the various sectors).

Hazzard |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

It's an awful long hiatus since I last updated my monthly net worth tracker. Admittedly, I fell prey of the psychological denial when the market crashed in 2008. For quite some time, I avoided reading my brokerage account statement and refused to watch CNBC.

It's an awful long hiatus since I last updated my monthly net worth tracker. Admittedly, I fell prey of the psychological denial when the market crashed in 2008. For quite some time, I avoided reading my brokerage account statement and refused to watch CNBC.