By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | December 1, 2007 2:54 PM PST

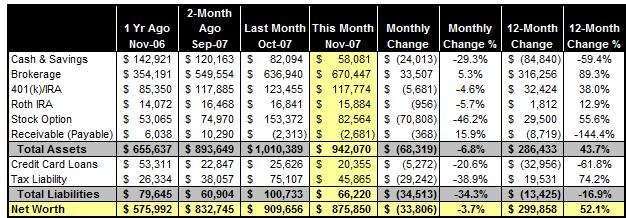

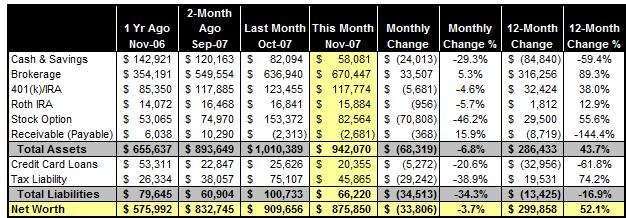

The broad market correction was wielding its powerful force on my portfolio last month, causing a 3.7% hair-cut of our net worth in a month, the highest percentage decline ever in our history of meticulously bookkeeping in the last five years. The broad market correction was wielding its powerful force on my portfolio last month, causing a 3.7% hair-cut of our net worth in a month, the highest percentage decline ever in our history of meticulously bookkeeping in the last five years.

Although I don't feel for the increased volatility in the market this year, I'm getting used to the rollercoaster ride now. To take it positively, we are only giving back some of the enormous gain we recorded in the prior month. In the last two months combined, we still grew our wealth by more than $43,000. And we are still already ahead of our annual growth goal by a five-figure margin, one month earlier.

BALANCE SHEET

NOTES

- Massive stock option account value reduction, caused by me exercising about a third of my vested options in early November (luckily at the market high), and the declining value of the remaining options in the month.

- The total balance on zero-APR credit card arbitrage continued its fall, due to a payoff of $12,000 balance in the Citi Professional Card I opened last year, partially offset by a new 6-month 0% APR balance transfer done in the new Miles by Discover card I received this month.

- Tax liability shrinks due to pay tax on the stock option exercise in cash (the brokerage firm withheld the tax) and evaporation of some of the unrealized earnings during the month. A small part of the tax liability decline is also caused by me instructing our payroll department to withhold more federal income tax before the end of the year.

WHAT'S AHEAD

- I received two more Citi cards with 12-month 0% APR introductory offers so likely I can build up a higher balance to continue my mini-carry trade exercise.

- I need to perform a year-end portfolio checkup to optimize the tax position.

- The annual financial planning exercise is on the agenda. We are eager to plan the new year ahead and prepare for the new challenges we will be facing.

- And then there is Maldives at the end of the year! More PFBlog Articles You Might Find Interesting ...

|

I am still working on the numbers but it looks like the market correction had a negative effect on my net worth for November also.

"I'm getting used to the rollercoaster ride now"

I would love to see a follow-up post on this one. Your general risk averseness, its evolution and the factors for it, your afterthoughts on your 85% equity allocation, etcetera.

Enjoy the Maldives!

Don't worry, we'll be seeing a minor rally in December I think. The way the month ended it looks like the rally will continue through the year. If it weren't for those last few days your portfolio would have been down A LOT more, maybe close to double what you lost. Why don't you hold any small caps though? My small caps have done the best this year, returning an average of over 40%. Next was my int'l equity portfolio which I've slowly been paring down.

Have you ever thought about indexing the 1 million target. A million does not buy what it did 5 years ago. Not a bad month in this market.

JD: I think end of the year rally will be possible only if the Fed will cut the interest rate by 50bps, otherwise, it will tank. But there is a good chance of Fed doing that, so rally is probably to be expected.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:34 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

The broad market correction was wielding its powerful force on my portfolio last month, causing a 3.7% hair-cut of our net worth in a month, the highest percentage decline ever in our history of meticulously bookkeeping in the last five years.

The broad market correction was wielding its powerful force on my portfolio last month, causing a 3.7% hair-cut of our net worth in a month, the highest percentage decline ever in our history of meticulously bookkeeping in the last five years.