By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | July 9, 2010 4:21 PM PST

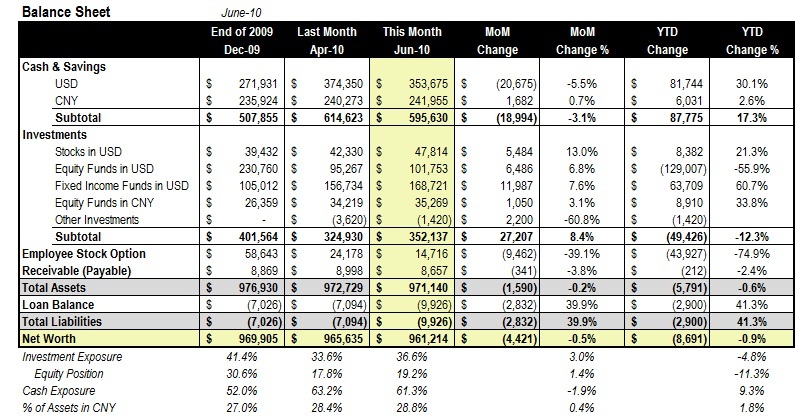

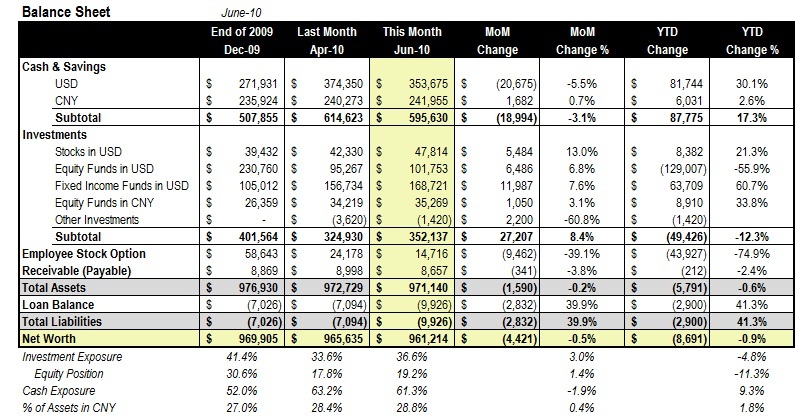

Our net worth retreated $4,421, or 0.5% in the month of June. In particular, our employee stock option account extended its distressed journey -- it has lost 75% of its value since the beginning of the year. Conversely, our investment overall fared well, led by a 13% surge in Berkshire Hathaway stock price and fixed income fund gains. Our net worth retreated $4,421, or 0.5% in the month of June. In particular, our employee stock option account extended its distressed journey -- it has lost 75% of its value since the beginning of the year. Conversely, our investment overall fared well, led by a 13% surge in Berkshire Hathaway stock price and fixed income fund gains.

With 2010 half way through, our wealth tally ended the first half a tad below where it started. And after briefly claiming millionaire club membership for a couple of months, we have been back to the $900s for three months now.

It could have been much worse -- the overall market lost about 10% in the last six months, yet we still preserved most of our capital. Chances are, if more investment opportunities present themselves, we are in a very cash-rich position to take advantage of that.

Footnotes:

• We currently have automatic purchase orders enabled for these funds:

• VGENX (energy stock) - $1,000/week

• VIPSX (inflation-protected bonds) = $1,000/week

• LSBRX (multi-sector bonds) - $1,000/week

• Various China equity funds - $700/week

• China lifted its unofficial peg on USD in June and so far Chinese Yuan (CNY) has appreciated about 1%. We expect about 5% further appreciation in the next 12 months. We have about 29% of our assets nominated in CNY and it will likely increase over time, but we don't expect to dramatically shift money from USD to CNY.

• We are actively looking at ways to deploy our cash. We still have a mild bearish view of the equity market. Some ideas we are exploring:

• AMJ (higher yields from Master Limited Partnership but with interest rate risk and credit risk with ECN structure),

• Way-out-of-money put on TLT (insurance against bond market flop),

• CYB (hedge against CNY appreciation).

• We are expecting a big payday in August and September when our annual bonus will be distributed and a lot of stock awards will be vested. For whatever it is worth, hopefully we can reclaim our millionaire status by the end of Q3.

• The family just finished a two-week vacation in Northeast and Florida. Highlights of the journey include Niagara Falls, Harvard University and Epcot. More PFBlog Articles You Might Find Interesting ...

|

Add Your Comments

Congrats on hitting your 7 figure milestone much early than you thought. Now I guess it's all about more leverage. what do you use for fixed income funds in the US? I notice you have a $12k appreciation in 1 month • VGENX - bad choice. No peak oil issue in sight

• VIPSX - very bad choice. The only thing in sight: deflation. |

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:32 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|

Our net worth retreated $4,421, or 0.5% in the month of June. In particular, our employee stock option account extended its distressed journey -- it has lost 75% of its value since the beginning of the year. Conversely, our investment overall fared well, led by a 13% surge in Berkshire Hathaway stock price and fixed income fund gains.

Our net worth retreated $4,421, or 0.5% in the month of June. In particular, our employee stock option account extended its distressed journey -- it has lost 75% of its value since the beginning of the year. Conversely, our investment overall fared well, led by a 13% surge in Berkshire Hathaway stock price and fixed income fund gains.