By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | November 1, 2007 12:47 PM PST

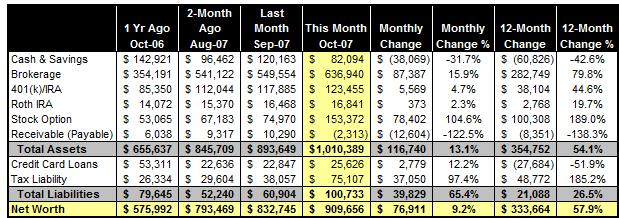

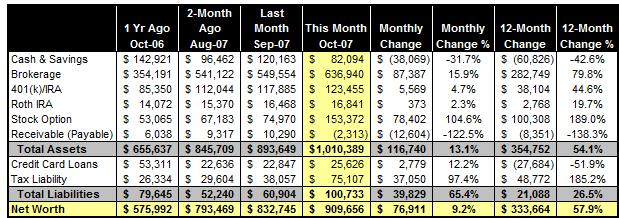

One month after we breached the $800s mark of our quest for net worth accumulation, we are now in the new domain of the $900s. Our bottom-line is happily lifted by a blow-out quarter from my employer and the ensuing multi-year highs of its stock, together with significant gains from my self-managed portfolio.

At $909,656, we have out-delivered our annual net worth growth goal of $230,000 by over $48,000, and we did this two months ahead of time.

While we fully understand that the stock market may turn in opposite directions overnight, we are really happy about where we are and what we accomplished. We look forward to exciting planning process for 2008 to bring our net worth up another notch.

BALANCE SHEET

NOTES

- RECEIVABLE: We received reimbursement for the medical expense we paid in September. Also, we accrued for our upcoming Christmas vacation ... We have booked the hotel and air but these transactions have not hit our credit card yet.

- TAX LIABILITY: There are quite a lot drivers for our tax liability line. First, as usual, we recorded some massive adjustments to properly account for the increased tax exposure of the floating capital gain of our employee stock option and other investment positions. We also (finally) received our 2005 refund check of over $6,000 ... what a long time!

WHAT'S AHEAD

- $12,000 of interest-free debt from Citibank will be due next month. I'm prepared to pay it off by November 20th.

- On the other hand, I have applied for three new cards with attractive 0% APR introductory offers. Time to start another cycle of free money arbitrage.

- I'm working with my tax adviser in KPMG to adjust my payroll tax withholding for the next two months. We expect bigger tax bite in November and December to avoid under-withholding and potential IRS penalty later.

- I'm looking to exercise some of our hard-accumulated employee stock options in the near future. It is probably wise to lock in some gains.

- I'll also perform a year-end check-up of my portfolio to optimize our tax position -- this may mean some loss-reaping sale on the horizon.

- And we will be soon starting our financial planning for 2008. If the sky does not fall tomorrow, we will be looking to add a digit to our net worth some time in the next 12 months.

- The family hasn't had a vacation since June. If we can do things right for the next two months -- we will be happy enough to close the year as we are today -- we will be in remote island in Maldives celebrating the new year! More PFBlog Articles You Might Find Interesting ...

|

MM, congratulations! 77K is a massive increase and really motivates me to focus even more on my career!

So, with FI in eyesight, do you to plan to RE anytime soon?

MM: I hope you never stop blogging, your success and perseverance are really inspirational. Congratulations on another great month of returns. Keep on truckin'! :)

RE is closer but not now. It is probably on my 3-5 year radar. And I can (and will) still do blogging after RE anyway ... it will be a different chapter :-)

Congrats on the big jump this month! At this rate, I expect that you'll hit the big million mark before the end of the year.

I've only found your blog recently and am pretty surprised by the level of detail you provide about yourself and your finances. Of all the personal finance blogs I've read you reveal the most about yourself by far. Do you ever worry about providing so much information to the world? I have thought about starting a PF blog myself and this was an issue for me. It would be a blog on my quest to $20MM liquid net worth which is my "magic number" to retire on. So far I'm only at 1.6MM so I have a long way to go but I am just 30 so have some time. And similar to you most of my worth was made over the last few years (I was in grad school until I was 24 and then worked a couple of years trying to start up a business to no avail). Congratulations on your recent gains, this has been a good time to ride equities, particularly international equities which I see you have a lot of exposure to. Have you considered scaling your exposure back however now that the gains have been pretty good? Some of those international markets can turn on a dime, heck so could the more developed markets, especially at a time like this.

Enjoy Maldives. If the global warming fanatics are correct those islands may not be in existance in the next 30 years.

Congrats on youir success.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:34 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|