By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | February 1, 2007 11:20 PM PST

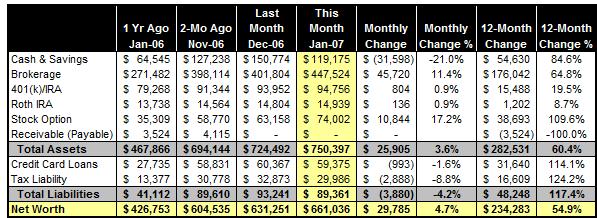

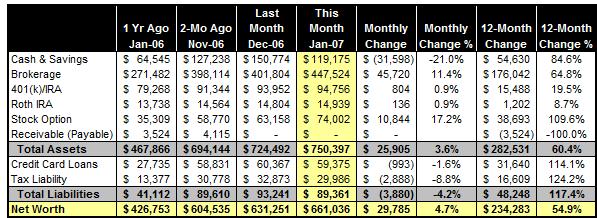

We broke the ground of 2007 with an inspiring monthly net worth growth of almost $30,000 -- a great start toward our goal of $230,000 net worth improvement in 2007. Behind the number, though, is the combination of record business income and record expense, making January a very eventful month.

MONTH-END BALANCE SHEET

HIGHLIGHTS OF THE MONTH

• We had a record-breaking (and jaw-breaking) month at our sideline business, with monthly revenue topping 150% of our previous monthly record, and delivering more than 15% of our annual business revenue target. While this monthly spike is driven by the concurrence of several big quarterly and annual contract renewals, and therefore is surely not sustainable in February, the mere fact that January is the first month during which our sideline income exceeded my salary from the daytime job will make this month an important milestone of our pursuit of financial independence in retrospect.

• Our expense also shot up substantially, driven by nearly $5,000 vacation expenses for prepayment of next month's Bali trip and incidental charges in our recent family visit to Hong Kong. At about $11,000, January is so far our highest spending month -- the last time we spent more than $10,000 was in November 2005 when we relocated to Asia. After next month's vacation, I do expect our monthly expense will stabilize at $6,000-$6,500 until we will vacation again in late summer.

• The performance of my self-managed portfolio is lukewarm at best. While my mutual fund holdings followed the general market optimism, the value my stock holdings actually declined by $2,000, leading by sharp decline of my largest holding of COP (ConocoPhillips) thanks to the softness of crude oil price.

• On the other hand, my employee stock option plan (ESOP) account continued to shine by a monthly increase of over $10,000 (which is partially helped by the vesting of a new batch of 2002 option grants. Since the nadir of May 2006, the ESOP account has consistently deliver sizable returns every single month in the last eight months for a total of $67,000 improvement (including $6,000 from newly vested options). While Microsoft is certainly in the honeymoon again with Wall Street analysts, this monthly income source will dry up one day.

• As disclosed in late January, I'm booking a tax refund of $6,000 for tax year 2005. I haven't received the refund yet, so the effect of the tax refund on my balance sheet is to reduce my Tax Liability bucket (which would otherwise grow by about $3,000 to account for tax liabilities associated with portfolio appreciation).

NEXT STEPS

• About $9,000 of my 0% APR promotional balance transfer will expire next month, so I will make the payoff next week.

• My portfolio grew to almost $750,000 now ... time to spend some quality time on portfolio management.

• Time to collect the tax records and prepare the 2006 tax organizer.

• The family is looking forward to the Bali trip! More PFBlog Articles You Might Find Interesting ...

|

MM - that's a great month. Also, I'm glad that you're able to enjoy life a bit while also working and saving so hard.

Also, can you shed more light onto your side business? Specifically, readers might like to know how you balance the time requirements of moonlighting, and how you make sure your masters at MSFT don't have a problem with it.

I've been reading this blog for a while. It's clear the author will NEVER post his sideline business. It's a safe bet it's probably the banner ads. It's best to keep that a secret I suppose.

I'm sure the advertising is a substantial amount of the sideline, but I think I remember MM mentioning something else, like his wife having a home-based business?

Let's say most of the sideline income comes from this blogging experience, although guess of generating this kind of income from banner ads is quite offbase.

I think the income comes from his affiliated sites such as "term life insurance" etc... these are seo destination sites that can command higher ad revenue as well as referal fees.

regards, makingourway

I think I remember MM saying that he had a online boutique.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:36 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|