By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | January 5, 2008 3:56 AM PST

When it comes to the cycle of setting up financial goals and achieving them, oftentimes a good post-mortem analysis gives more insight than mere celebration of another mission accomplished. When it comes to the cycle of setting up financial goals and achieving them, oftentimes a good post-mortem analysis gives more insight than mere celebration of another mission accomplished.

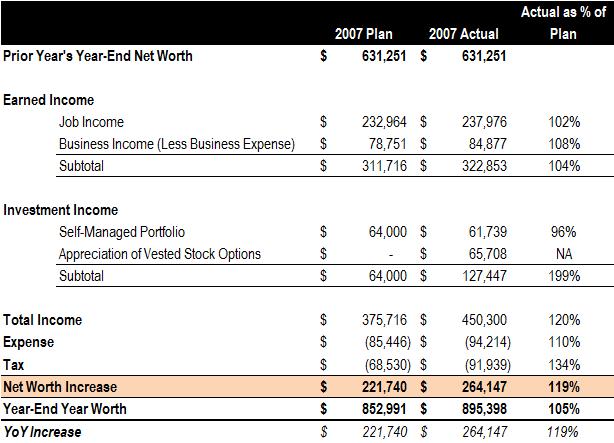

As we are quickly bidding farewell to 2007, I took some time to revisit my 2007 plan -- I did a fairly sophisticated model a year ago to set a net worth growth goal of $230,000 -- and I overachieved it by about $34,000. But what really happened?

In order to complete the exercise, I took the original numbers from my 2007 planning financial model (which I did in December 2006), and compared them against actual results in 2007 in the income statement format I introduced lately. Here is the comparison:

First as a note: the plan column shows an expected annual net worth growth of $221,740, and for goal-setting purposes, I upped it a bit to declare the $230,000 as the "official" growth goal.

Now one can read many things from the table, but key take-aways are:

1) Our earned income beat the target by a small margin, but it is worthwhile to note the 8% upside of our business income does not come easily from a big base, challenged bandwidth (from day job) and some industry headwinds near the end of the year.

2) However, virtually all upside of earned income increase (from an after-tax basis) was consumed by spending overrun, caused by 1) wealth-indulged increased consumption, and 2) increased level of charitable donations that went to a children computer education center and an elementary school in rural China -- hundreds are benefitting.

3) Speaking of self-managed portfolio, our total return is a bit shy of plan, but our annualized rate of return of 8.77% still exceeded our stated goal of 8% and trumped our benchmark by a big margin. (In retrospect, I assumed we will have an average portfolio base of $800,000 and 8% annual return to achieve the $64,000 gain, but we our portfolio size didn't break $800,000 until September).

4) The appreciation of vested stock options is certainly unexpected -- I considered the stock to be fully valued one year ago (and I still do so now, albeit at a higher price level).

5) The tax line increase is almost purely attributable to the stock option appreciation. The net impact of stock option appreciation, on an after-tax basis, is approximately $42,000.

So all in all, while apparently we were doing great in 2007 for blasting our net worth growth target by a mile, in reality we are just being lucky by staying put on our stock option.

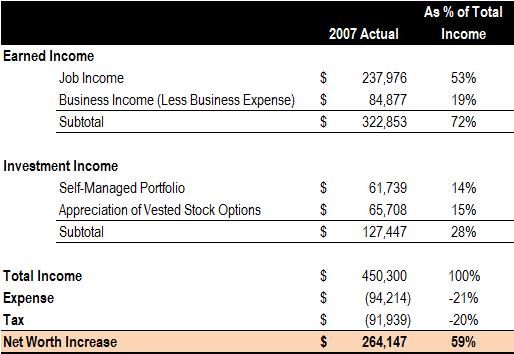

One last interesting view from our 2007 data in what is usually called a percentage analysis:

Now our execution is not that bad with 59% of our total income falling to the bottom line. Only if we can keep that level of efficiency forever! More PFBlog Articles You Might Find Interesting ...

|

Nice to see that you attribute some success to luck and that you are not "Fooled by Randomness".

i think that it is important to note that the investment portfolio, probably due the fs stocs that mm holds, did not meet the goals. while it was picked up by msft stock options.. should definitely recognize the shortfall. not to say that the actual result wasn't good... but it is data to get to 2008 plan.

drchunger, i think the investment portfolio exceeded the goal ... excluding stock options, it beat the benchmark by almost 2 points. it's only fair i call it a small success :-)

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:33 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|