By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | May 1, 2007 7:31 PM PST

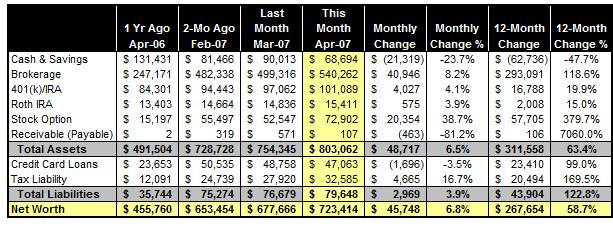

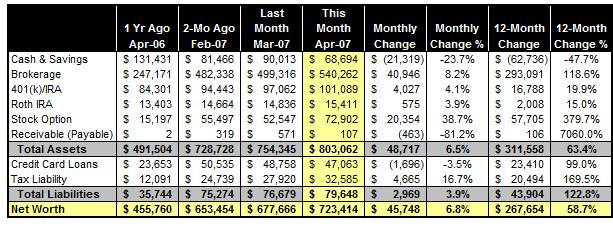

A booming stock market is behind the stellar performance of our household finance in the past month. With over $38,000 in portfolio gains in the month, and continued cash flow generation from my day job and sideline business, our net worth broke into the 700's. The monthly improvement of $45,748 is the second best in record, only behind October 2005 when we sold our house and booked the real estate appreciation.

MONTH-END BALANCE SHEET

HIGHLIGHTS OF THE MONTH

- With the growing asset base, the performance of our portfolio is becoming the No. 1 factor in our net worth growth. This month's gain of $18,000 is the best monthly recording ever thanks to 3-5% gain in major indices.

- After a strong quarter earning release, MSFT is rebounding from $26 in mid-March to $30, where it started the year of 2007 at. Year-to-date appreciate in outstanding options? Next to nil.

- Our side business delivered an above-average month. Our year-to-date booking has exceeded $35,000, or 50% of our annual revenue in 2006.

- We continued to tighten up our expense except for a small celebration of our wedding anniversary.

- Our tangible assets grew to over $800,000 after this fruitful month. We still have $47,000 in credit card balance (in 0% or ultra-low APR balance transfer deals) and $33,000 tax liability should we liquidate all winning positions in taxable accounts.

NEXT STEPS

- KPMG delayed the tax filing for 2006. It also informed me that I can make about $10,000 contribution to SE 401(k) account in tax year 2006 and it will reduce my immediate tax by about $3,300. I will be happy to make the contribution whenever KPMG is ready to file the tax.

The third family trip of the year is booked. Destination: Hawaii. (Gladly my employer picked up the bill for air fare and hotel as part of expatriate's benefit package.)

More PFBlog Articles You Might Find Interesting ...

|

Would you mind sharing how you calculate your tax liability?

Shouldn't you also recognize a tax liability associated with your 401(k) and regular IRA? Since these will be taxable upon eventual distribution, accruing for taxes on your balance sheet would give you a more accurate (and conservative) estimate of your net worth.

Congratulations, great month. Stock investments are your road to riches. When your long term gains start adding to real money, you will see that the accrued taxes will add up, the investment income that these deffered taxes provide free make it difficult to divest and to even diversity. I think you have found your hobby. Bill

Congratulations, great month. Stock investments are your road to riches. When your long term gains start adding to real money, you will see that the accrued taxes will add up, the investment income that these deffered taxes provide free make it difficult to divest and to even diversity. I think you have found your hobby. Bill

Have you ever thought of purchasing any income producing real estate? Just wondering what your thoughts were on this.

-limeade

AWESOME MISSION,I'M IN HAWAII,LET ME KNOW IF I MAY HELP YOU W/ANYTHING FOR YOUR VACATION!=)

I'M MARY WITH EXCEL-NOW.COM & YOUGOALS.COM,

AWESOME JOB ON YOUR MISSION,I'M IN HAWAII,LET ME KNOW IF I MAY HELP YOU W/ANYTHING FOR YOUR VACATION!=)

It's inspiring to hear that you've already planned your 3rd family trip for the year! Job well done on the current gains, well, gained, as well.

All I can say is WOW. I am truly impressed. I just found your blog through MyMoneyBlog (who says you inspired him to start his writings). I just cannot get past your rocket-ride to $800M! Not only that, but the precision in your thinking/analysis is truly impressive. Gongxi ni! I will definitely subscribe and enjoy reading past posts as well.

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:36 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|