By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | February 9, 2008 2:02 PM PST

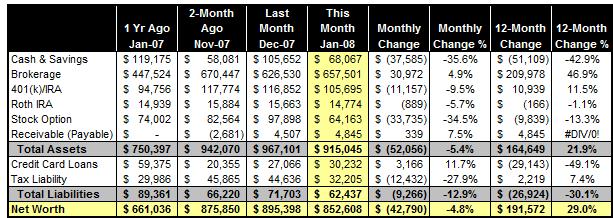

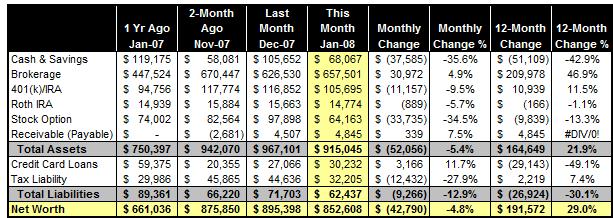

Suffering the biggest-ever loss in our portfolio -- a total of $60,000 -- our net worth took a nosedive again in January. That is, the second month in red in the last three months. For the month, our net worth declined by 4.8%, or over $42,000. I would be lying if I say I don't miss the good old days when we can count on consistent net worth improvement month after month.

On the other hand, it is probably not a bad thing if one takes a long-term perspective. After all, it could be much worse if this happens after I finally bid good-bye to my corporate life -- that extreme early retirement scenario has been in our plan for many years and all we wait for is we hit a certain net worth number. If anything, the recent market turbulence serves as a timely wake-up call in our last stretch toward millionaire club that early retirement is only the means to an end, and risk management is more important than ever in our ride toward financial independence.

Fortunately, our core income streams are still well-oiled machines. My daily job is still generating five-figure monthly cash flow even after paying all taxes and living expenses. Our sideline business also delivered a big surprise in January with monthly net proceeds topping $10,000 again.

All together, our family is little affected by the paper losses (or gains) in our portfolio. Bottomline is, even with the market slide in recent months, we still added more than $190,000 to our net worth in the last 12 months.

BALANCE SHEET

NOTES

- We took another 0% APR fee-free balance transfer offer from Citibank, and this added to our credit card balance. On the other hand, we paid off our Christmas vacation expense before it starts to incur interest. Our $30,000-strong credit card balance is 100% on either 0% APR balance transfer deals or charges in the last 30 days.

- Tax liability is reduced due to shrinking portfolio value and floating capital gains.

WHAT'S AHEAD

- My work/life balance is disrupted when I was called to take over a big business in addition to my current duties in January. While it is professionally fulfilling to take big challenges, it absorbs a lot of my energy and brought the sudden halt to my one-post-one-day streak since December. I won't have more bandwidth until June, but I do, still, intend to spend more time researching and writing on portfolio management.

- I'm starting to collect tax forms for the 2007 tax season. It will be fun to crunch the numbers and maximize tax savings with my tax preparers. More PFBlog Articles You Might Find Interesting ...

|

Yuck...

What you lost in a month is a whole year's wages for a first year teacher in Vancouver...

So, I'll be interested in reading what your conclusions are and/or changes you make because of risk management.

WOW. teachers must get paid well in Vancouver. I need to quit what Im doing and become a teacher over there.

Average home price in Vancouver is 10 times a teacher's wage, good luck, you deserve it.

And also we are comparing after-tax loss with pre-tax income :-) Needless to say I had a huge loss no matter how we cut it.

What is the relevance of Vancouver to this discussion? The stock market went down, hence many people's portfolios went down. No big shocker there.

Even with the dip, the amount added over the last 12 months is very inspiring! Marathon, not a sprint!

That's rough, but to caveat off RacerX's comment... the tortoise and the hare come to mind.

I'm also experiencing decreases in my net worth (on a much smaller scale than you), and it's hard to stay motivated.

I am new here. I don't see any real estate related numbers in your net worth sheet. The biggest net worth for me is my home equity.

eager to see your update on Feb/Mar...

|

Read More ... 139 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:33 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|