By Topics

Overall:

0. About (10)

1. My Progress (139)

2. Car & Home (107)

3. Credit (138)

4. Banking (33)

5. Saving (49)

6. Investing (308)

7. Taxes (89)

8. Spending (74)

9. Misc (97)

A. Archive (49)

MONTHLY ARCHIVE

Feb 2014 (3)

Jan 2014 (6)

Jan 2012 (1)

Apr 2011 (1)

Mar 2011 (1)

Feb 2011 (1)

Jan 2011 (1)

Dec 2010 (1)

Oct 2010 (1)

Sep 2010 (1)

Aug 2010 (1)

Jul 2010 (1)

Jun 2010 (1)

May 2010 (1)

Apr 2010 (1)

Mar 2010 (6)

Feb 2010 (2)

Jan 2010 (7)

Dec 2009 (3)

Feb 2009 (4)

Jan 2009 (8)

Dec 2008 (1)

Jun 2008 (2)

May 2008 (2)

Apr 2008 (5)

Feb 2008 (3)

Jan 2008 (15)

Dec 2007 (32)

Nov 2007 (6)

Oct 2007 (8)

Sep 2007 (9)

Aug 2007 (24)

Jul 2007 (2)

Jun 2007 (1)

May 2007 (3)

Apr 2007 (4)

Mar 2007 (4)

Feb 2007 (13)

Jan 2007 (6)

Dec 2006 (3)

Nov 2006 (7)

Oct 2006 (7)

Sep 2006 (6)

Aug 2006 (4)

Jul 2006 (10)

Jun 2006 (1)

May 2006 (3)

Apr 2006 (2)

Mar 2006 (6)

Feb 2006 (6)

Jan 2006 (3)

Dec 2005 (1)

Nov 2005 (9)

Oct 2005 (8)

Sep 2005 (13)

Aug 2005 (25)

Jul 2005 (16)

Jun 2005 (17)

May 2005 (19)

Apr 2005 (20)

Mar 2005 (24)

Feb 2005 (23)

Jan 2005 (36)

Dec 2004 (40)

Nov 2004 (34)

Oct 2004 (17)

Sep 2004 (21)

Aug 2004 (59)

Jul 2004 (37)

Jun 2004 (31)

May 2004 (29)

Apr 2004 (52)

Mar 2004 (49)

Feb 2004 (49)

Jan 2004 (31)

Dec 2003 (48)

Nov 2003 (52)

Oct 2003 (29)

Sep 2003 (8)

Aug 2003 (5)

Jul 2003 (2)

Jun 2003 (2)

May 2003 (5)

Apr 2003 (2)

Mar 2003 (2)

Feb 2003 (3)

Jan 2003 (29)

|

|

|

|

Contributed by mm | May 3, 2005 7:49 AM PST

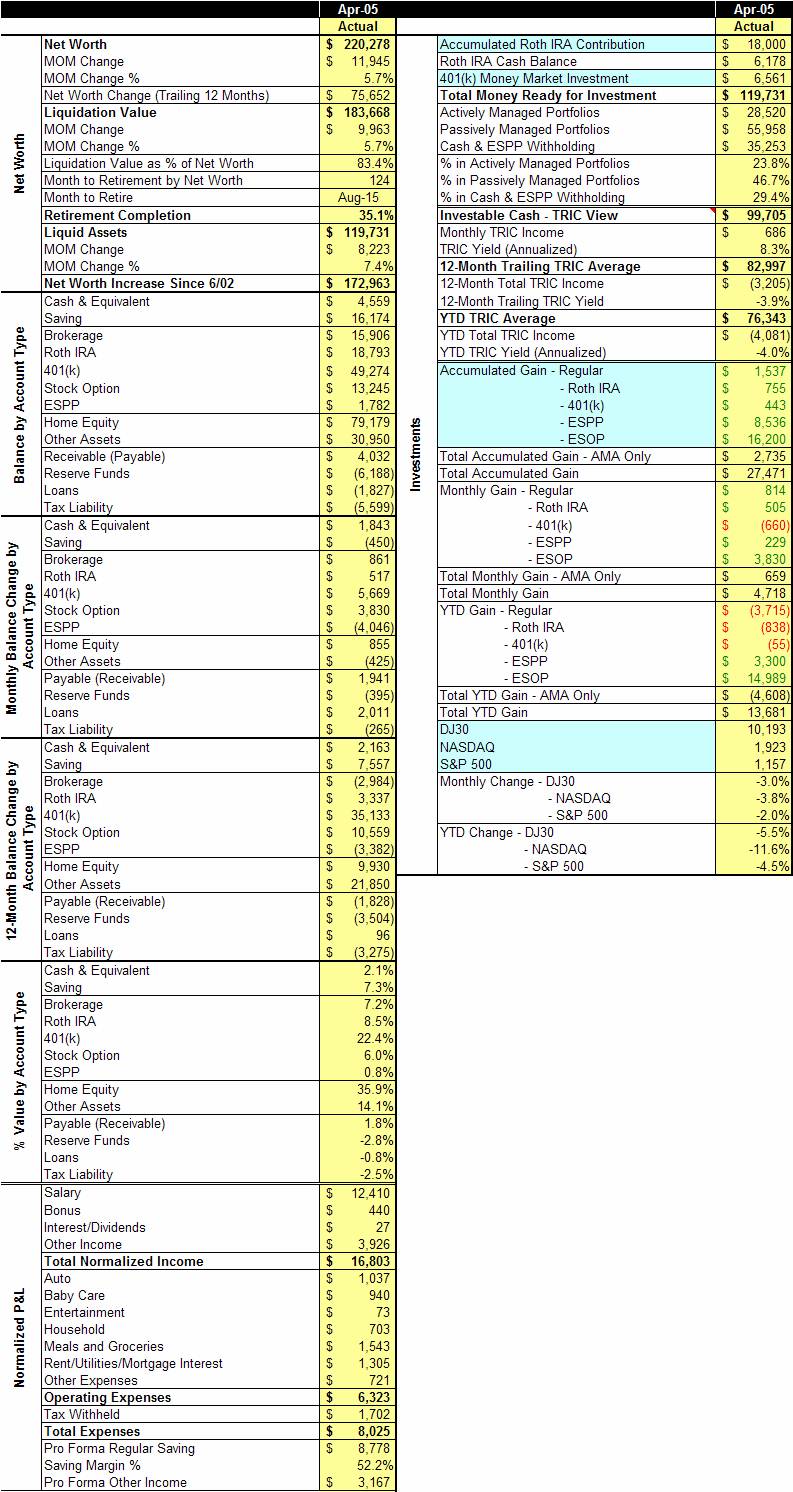

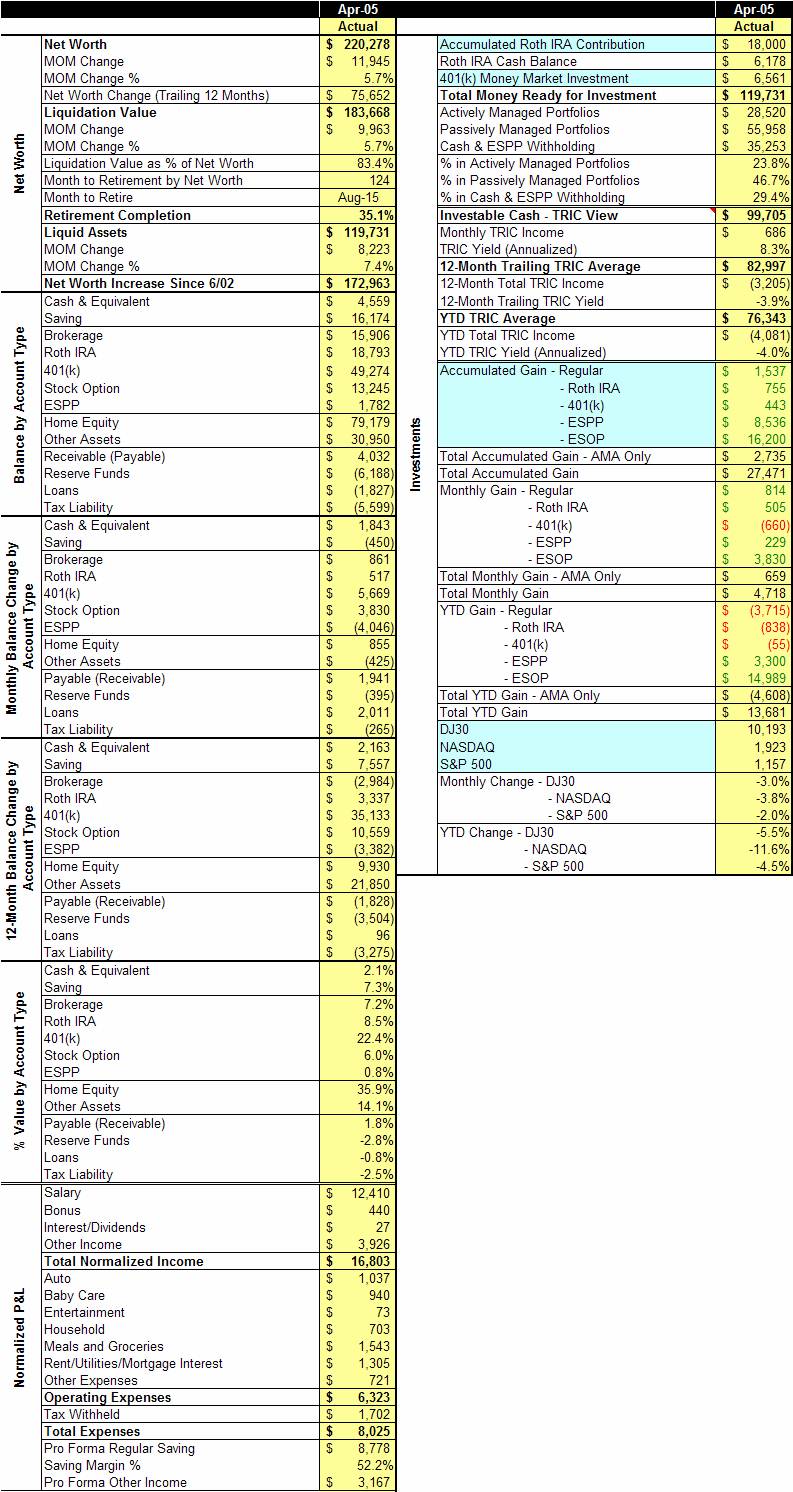

As many of you know, I use Microsoft Money to manage my personal finance -- I believe personal finance software like Microsoft Money and Quicken is essential to family money handling. On the other hand, I also use Microsoft Excel on top of Microsoft Money to produce certain reports/models that are beyond the scope of Microsoft Money. I am not advocating that everyone should try the combo -- it is unnecessary for most people, but I am happy to share my reports from time to time. Today, the disclosure of my monthly snapshot view.

The report is produced to summarize key monthly financial information in a concise manner. It resolved several limitation of a traditional personal finance suite:

1. With Excel, I can have different kinds of data shown in one view. Microsoft Money is incapable of showing both balance sheet and income statement data in one place, not to mention all these % calculation.

2. I have more than 70 accounts set up in my Money file, but when it comes to financial analysis, I really don't need to see the details for every single account ($1 in ING Direct is not different from $1 in VirtualBank -- they are all savings). Excel allows me to do custom grouping and get a view that is truly meaningful. Same way, I leverage my Excel workbook to group expense categories. (Want to produce your own view? Hint: A. you can export a standard Microsoft Money report to Excel by right clicking for "Export to Excel" option. B. Use VLOOKUP function to do customer grouping.)

Final words: this report is provided on an "as is" basis -- I don't intend to share this view in the general public on a monthly basis, nor do I intend to answer any questions. Nevertheless, this view includes new information that I haven't disclosed before. Enjoy!

(The actual report includes every month side by side. The above view is reformatted for illustration purposes.) More PFBlog Articles You Might Find Interesting ...

|

If you could provide the excel file you use for this, and which Money reports you paste in to do it, that would be tremendous! I'm a huge fan of MS Money, but I've really been wanting to produce more detailed reports, exactly like the one above. The "monthly report" in Money is nice, but limited. Thanks a lot!!

Seventy accounts? No offense, but you are seriously pushing it with seventy accounts. The administrative burden alone is not worth the hassle. The multinational corporations I have worked for have hardly had seventy accounts. I would recommend you consolidate some of these. My general problem with your site is that you nickel and dime your finances too much. You sign up for offers to get like $25, you have seventy accounts, you use ridiculously detailed spreadsheets to track your finances... When do you have time to actually live your life?

For most people, your model of tracking your finances would never work. However, for you it is great. The most meaningful way for a person to make money is to increase their potential income.

Sure, tracking your finances is important, but if you are a janitor, no matter how many hours a month you spend planning and budgeting, you're never going to be rich.

For you, all this tracking represents a potential source of income. Maybe you sell ads on your site, or you write a book or something, and you can make something off of it. However, the volume of reports and tracking you do are simply a huge waste of time for the average janitor.

Instead of "making a quick $100 opening a banc of america account," the janitor's time would be better served by taking night classes, or learning a trade, opening his own business etc...

I realize you probably agree with all i've said and i dont mean to mischaracterize you and the intention of your site. You're great at what you do. You aren't promising to make people rich, just share your personal finance experiences.

However, I just want to make sure people are focusing on the right things.

Thanks.

Thank you Damian. Great feedback!

As I pointed out in the post, such level of details are unnecessary for most people, although I don't see it as aburden. It takes me about two hours to build the report, and every month, it only takes me 2 minutes to refresh it. You have to admit it gives me additional insight into my finance. I see it is a spirit of running personal finance as if it were a business.

And I have to agree with you that most of my net worth increase recently is driven by income increase -- fortunately I earn a bit more than a janitor.

I will share details of my 70+ accounts in another post.

I would also appreciate the excel template if possible. Please let me know if we can download it or if you can email it to us.

thanks

Great information. Thanks for posting it. How does the Net Worth statement that Money generates differ from your Excel spreadsheet ? Like you, I would like to track my change in net worth from month to month. However, my financial situation is much simpler. 2 IRAs, 2 401ks, 1 income source, 2 stock portfolio accounts, no mortgage, etc. Will Money Deluxe suit my needs ?

Thanks for not taking my comments the wrong way. Hm... so many people want the spreadsheet that took you 2 hours to develop...maybe they'd be willing to pay ya for it?

And yes i see how you are running personal finances from a business perspective. Its a good framework.

I would pay for it in a heart beat, not even a second thought.

Cheers!

Exporting all of your reports from Money to Excel could be time consuming - thought about using MoneyLink to help with this?

Thanks for sharing the information though

TRIC = Total Return on Investable Cash

Greetings from London. Great model, a 2 minute refresh every month for the level of detail is impressive. Here's an idea though, I use Excel as well (though nowhere as detailed) and I find creating a line chart to be extremely useful with my money decisions. For example; I was seeing that at times I was building up too much cash that needed to be allocated towards investments and at other times I didnt have enough 0% credit card debt (that I put into a 5% savings account). You probably have an Excel chart somewhere though I'll be more than happy to email you a snapshot of mine. Rgds.

I love this level of detail-- I've been using Quicken since 1997 and haven't been able to figure out how to track trends, etc. Please add me to the list of people who would love the template, and who would pay for it. thanks!

|

Read More ... 138 Posts In The Same Category

|

This page was last rebuilt at January 27, 2014 07:40 AM PST.

|

|

RSS FEED

PERSONAL FINANCE BLOGS I READ

Consumerism Commentary

Get Rich Slowly

My Money Blog

All Financial Matters

The Simple Dollar

|