Long-term readers of PFBlog knows I have been taking advantage of credit card companies for years. Especially, I'm very good at 0% APR arbitrage, whereby I sign up for new credit cards with attached introductory 0% APR balance transfer offer, move the entire balance immediately to my bank account, and enjoy the high saving account rates of 5% or more while remitting only the monthly minimal payment back to the credit card company.

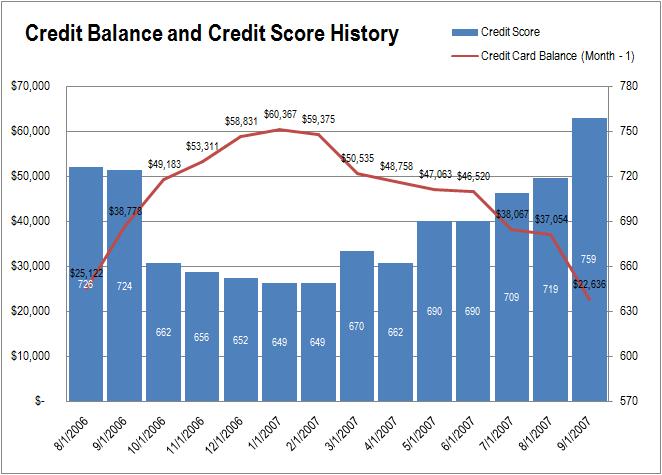

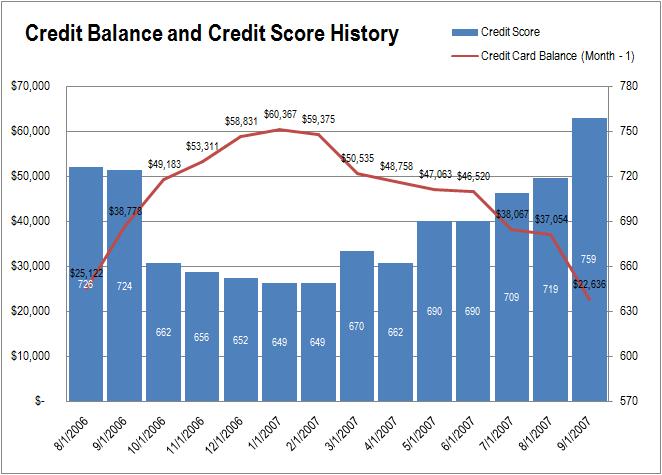

Of course, this strategy will drag down your credit score. Last summer, especially, I applied five cards in two months' time, and my credit score tanked from 720s to 640s, and I was essentially denied new credit application after being seen a credit risk by most banks. But credit score is only of cosmetic value if you don't need credit any time soon. To me, after all, I have no better use of my credit score now that I'm sitting on a portfolio of over $800k and has no plan to buy a property any time soon.

The below chart is a great summary of what happened in the last dozen months:

So what did I get from a full year worth of arbitraging activities?

First, over $3,000 in hard, cold cash. I keep an average balance of $45,000 during the timeframe, and the difference between 5% APR interest received from online savings accounts and zero interest paid to the credit card companies means a net $2,250 additional income. Plus, I also made another quick $1,100 by showing good payment habits to Citibank.

Second, over 30 points of credit score improvement. now that I have brought my credit balance to where it started (~$22,000), my credit score is even better than it was one year ago. Why? Credit score calculation takes into account the average age of one's credit accounts, and recent credit inquiry history. After a year's seasoning, my outstanding accounts are growing beard, which helps my creditworthiness.

So it should be no surprise that armed with a 759 credit score, I'm coming back with more credit card applications. In the last few days, I have been granted over $20,000 credit line by applying to these credit cards. Good beginning for the next round of David vs. Goliath!

• $8,000 from Citi® Home Rebate Platinum Select® MasterCard® (0% APR on balance transfer for 12 months, and no balance transfer fee)

• $7,000 from Citi® Professional(SM) Cash Card (0% APR on balance trasnfer for 12 months, and no balance transfer fee)

• $6,500 from Chase-issued Disney Rewards® Visa® Card (0% APR on balance transfer and purchase for 12 months, and balance transfer fee capped at $50)

If you are in the same camp, take advantage of those offers when you still can! Given how the credit market squeeze is playing out, less and less offers will be on the table.