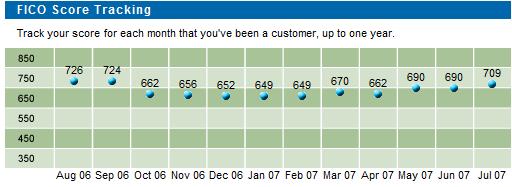

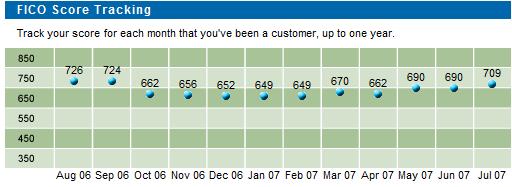

I'm proud that I never had a late payment in my credit history, but that does not mean I have perfect credit score. Back in November, I almost wondered if I was becoming a credit risk after taking a slew of 0% APR balance transfer offers:

The golden days are probably over. Besides these hate mails from Chase, FirstUSA and Amex, my credit score, as reported by the free credit profile in my Providian account, has declined from a consistent 720s in the last 12 months to 662 in October. I can understand these banks' concern -- after all, if one's credit utilization flirts with 50% and the absolute amount of the debt hits $50,000, the chance is the cardholder is on a slippery slope.

Actually, my credit score continued to head south after that report, and finally settled at 649 in January. In today's market, I would have been denied credit everywhere given such a score.

Luckily, now that I have been gradually paying off my credit card debt in the last few months, and reduced my credit card debt from a high of $60,000 in December 2006 to $37,000 at of July end, my credit score, as reported by Providian as part of its complentary service for cardholders, rose steadily in the last six months to 709 now:

So in retrospect, is it worthwhile to take the bullet in the last twelve months for some quick cash (i.e. borrowing at 0% APR from credit card and saving the proceeds at online savings accounts that yields 4% to 5%)?

Absolutely yes for me, given that I have been living in a different continent in the last 20 months and do not have any need to borrow money any time soon. For me, I hope my credit score in the 700s opens the door again for more 0% APR balance transfer deals to come.

However, given the current credit market climate, people should think hard before arbitraging with the next low-APR balance transfer offer. If one will need to apply for a car loan or mortgage in the next six to twelve months, you might not have enough time to recover your credit score, and in today's market, a less-than-perfect credit score will probably cost one more than a few grand.